The latest news reports suggest Apple intends to source US phone supply in India to reduce tariff effects.1 Naturally, this news has attracted negative analyst coverage. The most bearish says it probably won’t work well and reduced his stock price target to the lowest of all analysts. Is he right, or missing the big picture?

“We don’t really look at the stock, you know? Because for us, it’s about the long term. And so we’re very much focused on long-term shareholder value but not the short-term kind of stuff.”

Tim Cook

In the fast-moving world of tech, where supply chains differentiate a company, Apple’s decision to shift iPhone assembly to India stands out as a bold, strategic masterstroke. Yet, it’s met with grumbling from analysts like Craig Moffett, who pick apart the move with a short-term lens, fixating on immediate hurdles like tariffs and Chinese components.2

Moffett’s critique, that this shift won’t entirely dodge trade war woes or boost demand, misses the forest for the trees.

Apple isn’t chasing quarterly wins; it’s building a resilient future. Here’s why ignoring short-sighted naysayers like Moffett is precisely why Apple thrives, and why good companies falter when they don’t.

The Analyst’s Short-Term Trap

I have written before about the Apple Tariffs: The iPhone Tariff Problem: Why It’s Time for a Smarter Approach and also about the difficulty Analysts have interpreting and understanding facts: Why Are Facts Irrelevant To Online Analysts?

Moffett is a respected voice in telecom analysis. He has consulting experience, leading Boston Consulting Group’s global Telecommunications practice in the ‘90s. Today, he is a co-leader of a firm that provides independent research for big investors. Moffett is most bearish about Apple’s prospects, having the lowest projected price estimate of $141 among analysts and a rare sell rating.3

Moffett has a point: moving assembly to India doesn’t erase every tariff headache. “You have a tremendous menu of problems created by tariffs, and moving to India doesn’t solve all the problems,” he said on CNBC.

He’s right, iPhone parts continue to be supplied from China, and trade tensions could dent demand there. But his take stops at the surface. The shift is far more significant than he thinks, and the risks are far lower.

Apple is not playing whack-a-mole with today’s costs; it’s rewriting the rules for tomorrow. Short-term thinking like this, obsessing over the next earnings call, keeps companies tethered to the status quo, afraid to make the big moves that define industry leaders.

A Long-Term Vision Worth Betting On

Apple’s shift to India is less about dodging today’s tariffs and more about outmaneuvering tomorrow’s chaos. Under Tim Cook, a supply chain savant who turned Apple into a logistics juggernaut, this isn’t a knee-jerk reaction, it’s a calculated leap. Here’s why it’s brilliant:

Breaking the China Dependency

Relying on China for production is like keeping all your eggs in one fragile basket. Although Tim Cook has been adept at sidestepping many historical risks of sole sourcing in China, Trade wars, political crackdowns, and pandemic risks are growing and could derail everything.

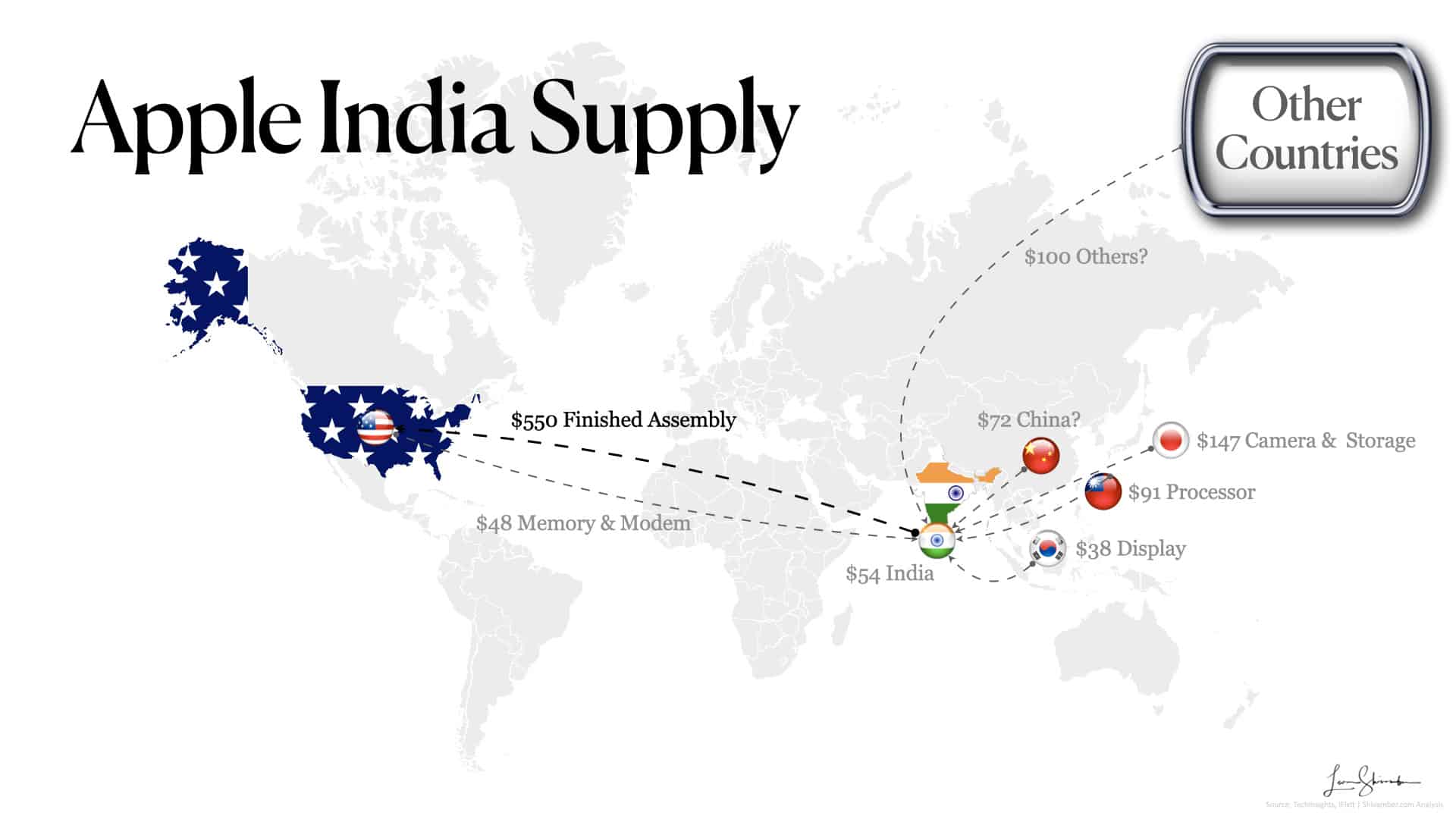

By planting roots in India, Apple diversifies its supply chain, slashing exposure to these risks. Sure, components will flow from China, but that’s a shrinking piece. Moffet overestimates the content of China and loses the plot when the content shifts to India.

As I have shown in my review of the Apple iPhone Tariff problem, China’s content is estimated to be approximately 23% of the landed cost in the USA when sourced from China. Simply moving production of that product to China shrinks China’s content to 13% (due to labor and overhead shifts). Over time, Apple’s clout can pull suppliers along, cutting Chinese reliance further because none of the Chinese content is proprietary. Moffett sees a lingering flaw; Apple considers it a work in progress.

Tapping India’s Goldmine

India isn’t simply a factory, it’s a massive market. With 1.4 billion people and a smartphone boom underway, producing locally lets Apple slash costs, dodge import duties, and win over consumers. Moffett frets about demand risks in China, but Apple’s already countering that by courting India’s growing middle class. It’s not a fix for it’s China’s woes, it’s a new frontier. Short-term skeptics miss this dual play: resilience and growth.

Overstating China’s Domestic Reaction

The Chinese have always resisted Apple moving production from China. Many of the moves have been warnings with limited effects, such as when they announced Apple products would not be allowed for government use domestically. Many analysts missed the subtlety and screamed about Apple’s imminent peril due to this move.4 However, a proper examination would have discovered that foreign telecommunication devices were rare in the government to begin with, and never anticipated as a market for Apple. The move is similar to the US government’s policies to keep foreign technology from its operations. It had little impact on Apple’s demand in China. Ultimately, Apple convinced Chinese leadership that Indian production would be needed to penetrate India, a market unlikely to embrace China’s supply. Now Apple is convincing China to move US production for similar reasons. Consider the conundrum of China’s leadership regarding its response to Apple. China is unlikely to squeeze domestic Apple demand as the supply for those, and many other markets remain in China. Should China suppress demand for Apple, it merely accelerates the departure of Apple and its still significant 60+% supply outside the USA. It’s in China’s interest to find a common ground with the USA.

Trade Balance Red Herring

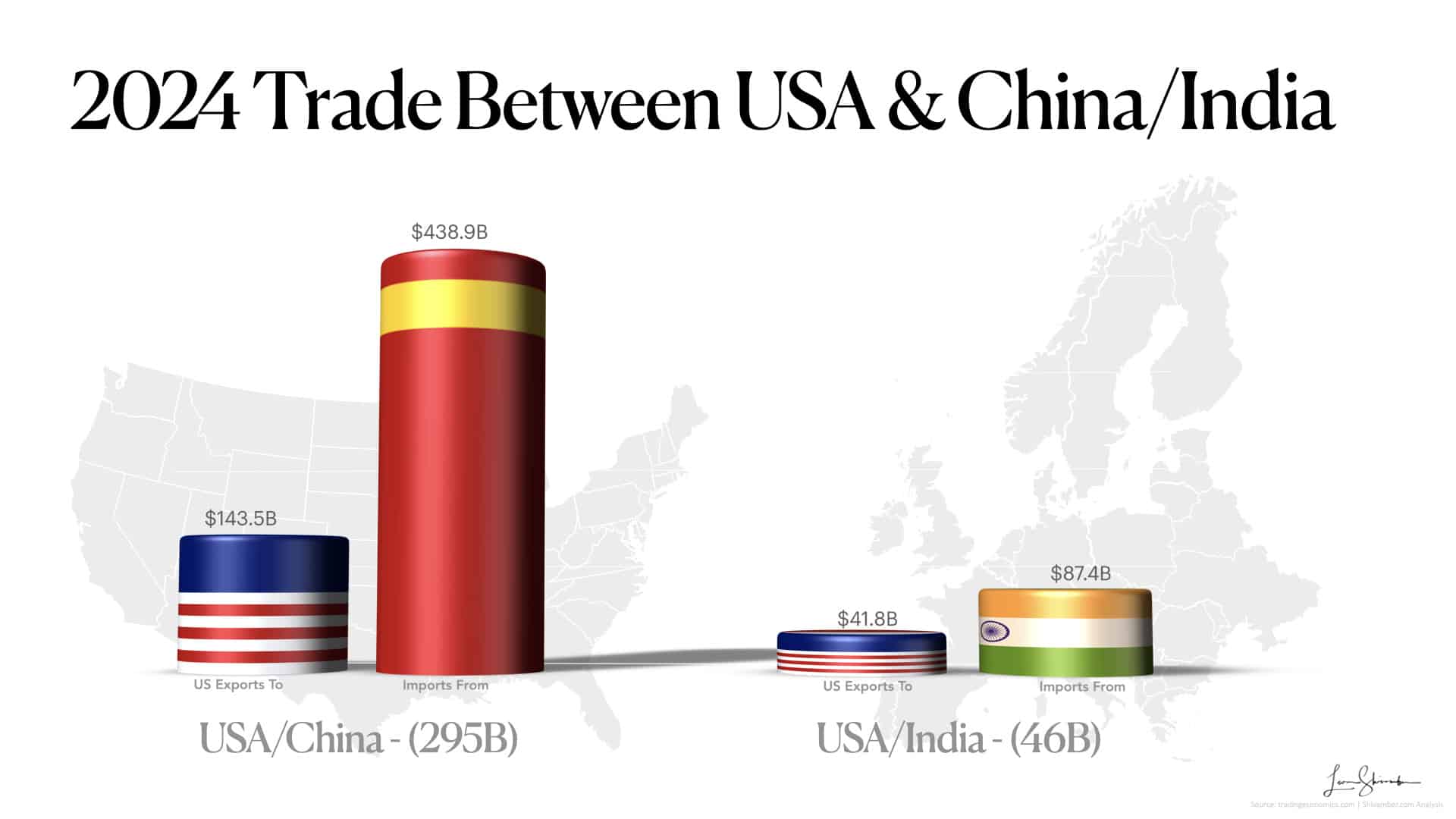

Moffett argues tariffs sting because of Chinese parts. Moffett does not understand trade. Assembling in India trims the Chinese content, and it’s more likely that India tariffs will be reduced more rapidly to below China rates. Yes, the shift to India does not reduce overall trade imbalances. Indeed, it shifts a Chinese trade surplus to India.

Assuming that the trade value of $30B (60m iPhones) has moved from China, we would see the trade imbalance go from $295B to $265B between the USA and China. At the same time, the trade surplus will grow from $46B to $76B in India. Strategically, the USA prefers a trade imbalance with India rather than with China. Further, India and the USA have already agreed to a framework for increasing multilateral trade to $500B by 2030, which benefits both countries.

Resilience Over Reaction

Does Moffett think staying in India and maintaining its single-country supply risk is in the best interest of Apple for the long term?

Short-term thinkers like Moffett balk at the upfront costs, new factories, training, logistics. But Apple’s history screams long-term payoff. Remember when Cook slashed inventory in the ‘90s, making Apple leaner than its rivals? Or when it bets big on custom silicon? India’s the same playbook: invest now, dominate later. Companies that flinch at these pivots get stuck reacting, not leading.

Why Short-Term Thinking Kills Good Companies

Moffett’s skepticism isn’t unique. It’s epidemic. Wall Street’s obsession with quarterly results has tanked plenty of firms that could’ve been great.

I have worked with several CEOs who fought against star analysts who misunderstood the business to such an extent that they, like Moffett, put out annual bearish reports, misleading investors about the company’s prospects. We beat them in every instance with great strategies and continued year-over-year operational outperformance that eventually shut them up. But, for extended periods, they held these companies’ stock prices and growth prospects lower than they deserved.

Apple cannot stay cozy in China, raking in today’s margins while ignoring tomorrow’s cliffs. Instead, it’s betting on India and reducing US tariff costs. These moves don’t imperil Apple. They reduce risks.

Great companies don’t merely survive disruptions; they shape them.

Cook’s Chessboard

Tim Cook isn’t guessing, he’s playing chess while analysts tally pawns.

India’s no panacea; it’s a foundation. Prices might tick up if carriers balk at tariffs, as Moffett warns, but Apple’s brand loyalty is a fortress, customers pay for the logo. And with India’s lower labor costs, those hikes could fade.

The U.S. isn’t quite ready for mass iPhone production, labor’s too pricey, suppliers too sparse, but in time it will be. India is now. Cook’s not waiting for perfect; he’s building it.

The Lessons Learned

Apple’s India strategy isn’t about silencing critics like Moffett. This is about proving them irrelevant.

Short-term thinking traps companies in cycles of panic and patchwork, while Apple is gazing a decade ahead. Tariffs, trade deficits, and Chinese demand are today’s noise; resilience, diversification, and new markets are tomorrow’s signals. By ignoring the myopic chorus, Apple is staying ahead, and it’s redefining what ahead means. That’s why it’s wise to tune out the skeptics, and why the best companies always do.

Reference Sources

- https://www.reuters.com/world/china/apple-aims-source-all-us-iphones-india-pivot-away-china-ft-reports-2025-04-25/

- https://www.cnbc.com/2025/04/26/apple-iphone-assembly-in-india-wont-cushion-china-tariffs-moffett.html

- https://wallstreetpit.com/126370-apple-bear-moving-all-u-s-iphone-assembly-to-india-is-unrealistic/#google_vignette

- https://www.nasdaq.com/articles/forecasting-future-25-analyst-projections-apple