Everyone has an opinion on the tariffs, their purpose, whether they make sense, and ultimately, their effects. How can we navigate these issues effectively when so much political emotion is wrapped in those opinions? Returning to first principles and a grounding in the basics helps us all sort out the signal from the noise.

“No nation was ever ruined by trade.”

Benjamin Franklin

- Understanding Tariffs: Rebalancing Trade or Blocking Imports

- The Dual Purposes of Tariffs

- Business Responses: A Game of Margins

- Consumer Dynamics: Elasticity and Alternatives

- Case Study: Apple’s Tariff Tightrope

- Tariffs and Inflation: Beyond the Headlines

- How does this play out?

- Recommendations for Business Leaders

- The Big Picture: Strategy Over Slogans

- Reference Sources

What if a single tax could reshape global trade, save jobs, or send your grocery bill through the roof?

Tariffs aren’t merely fees at the border, they’re high-stakes gambits in an economic chess match, where every move ripples from factories to your wallet.

Meet Maria, a boutique owner hit with a 10% tariff on imported dresses. Now, she faces whispers of a 145% hike. Should she raise prices, risking loyal customers, or absorb the cost, gutting her slim profits?

This dilemma captures the tariff debate: a tool to protect local industries or a trigger for chaos?

Read on as I reveal how businesses and shoppers should navigate the fallout. I will start by stripping tariffs to their core, using first principles to rethink incentives, and then applying game theory to map your strategies.

Understanding Tariffs: Rebalancing Trade or Blocking Imports

No tariff trade means no hand tips the scale in favor of any competitor. Competition is rational, and the market operates fairly. Those suppliers with competitive advantages win more, regardless of their location. Add a tariff, and you change that balance.

Back to Maria’s boutique: that 10% tariff on her dresses is no small potatoes, it’s a tax on every imported thread, reshaping how she competes.

At their core, tariffs are economic levers, tweaking prices to nudge buyers toward local goods or block foreign ones outright. Think of them as dials on a mixing board: a 10% tariff fine-tunes trade, giving domestic producers a leg up without breaking the system. A 145% tariff? That’s cranking the volume to eleven, drowning out imports entirely.

These are strategic plays with real-world stakes, from shielding local jobs to risking supply chain chaos. By zooming in on a 10% rebalancing act and a 145% trade stopper, we’ll use clear-eyed logic to unpack how tariffs shake up businesses and shoppers.

The Dual Purposes of Tariffs

Tariffs affect prices to steer decisions. Producers rethink sourcing, buyers weigh options. But their intent splits them into two camps: rebalancers and blockers. Let’s see how:

10% Tariff: Rebalancing Trade

Picture the EU’s 10% tariff on U.S. cars, shielding its auto giants like BMW.

A 10% tariff is a gentle nudge, often aimed at leveling the playing field, countering U.S. subsidies, or boosting local factories. It bumps up import prices just enough to make you think twice about that American SUV, yet foreign carmakers can still compete if they tweak costs or marketing. Maria’s dresses face this kind of tariff: a push toward local or favorable tariff suppliers without torching her supply chain. It’s about balance, not banishment.

145% Tariff: Blocking Trade

Think of India’s 100-165% tariffs on luxury cars, designed to bolster its nascent auto industry. (1)

A 145% tariff is a sledgehammer, meant to stop imports cold. It makes foreign goods so pricey they’re effectively locked out, protecting local industries or hitting back in trade spats. If Maria’s dresses faced this, her suppliers would likely bail, imports would halt. This isn’t tweaking; it’s isolation.

Here’s the game: 10% tariffs keep players on the board, jostling for position. 145% tariffs clear the table, favoring locals but risking supply shortages.

Business Responses: A Game of Margins

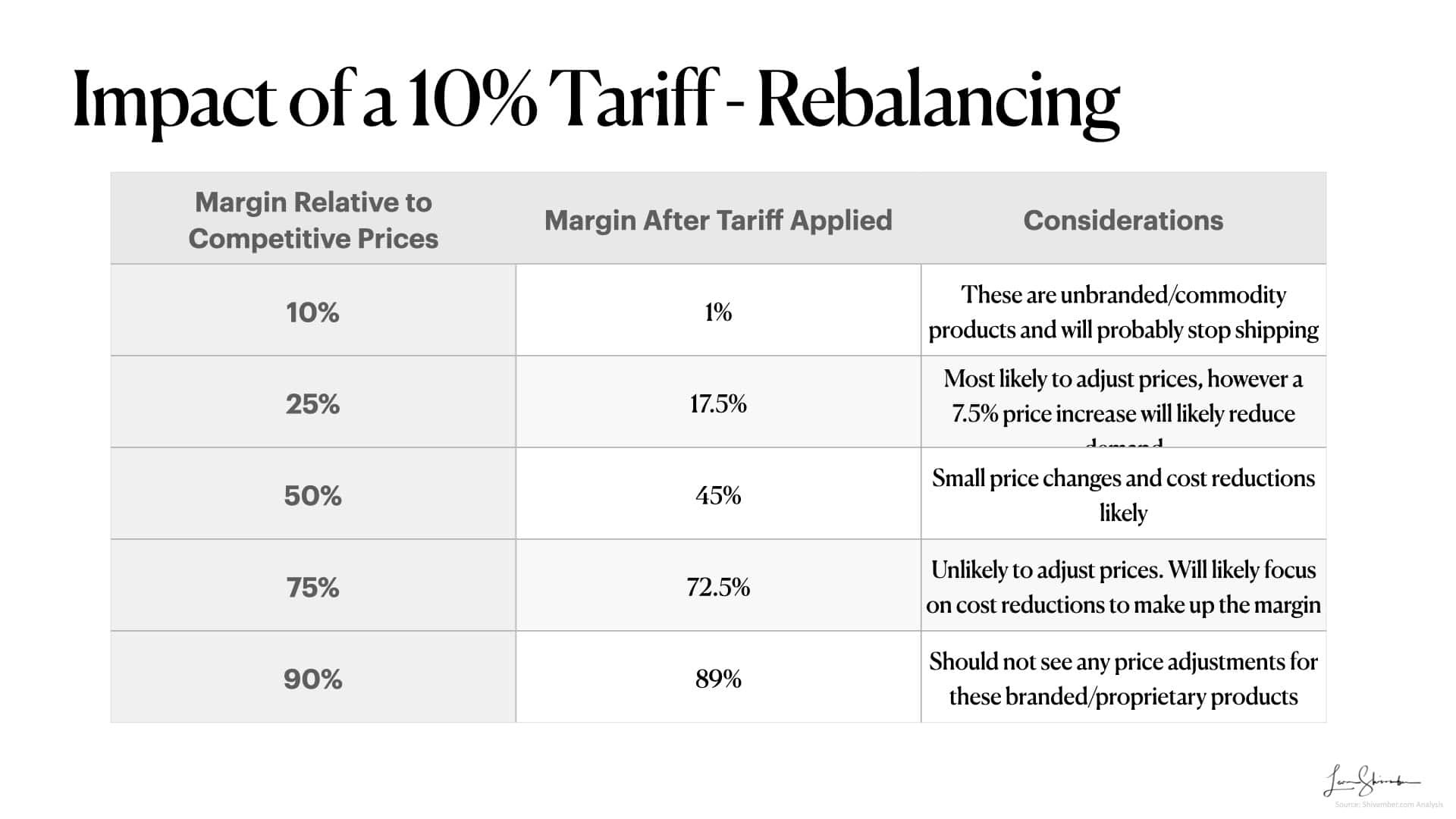

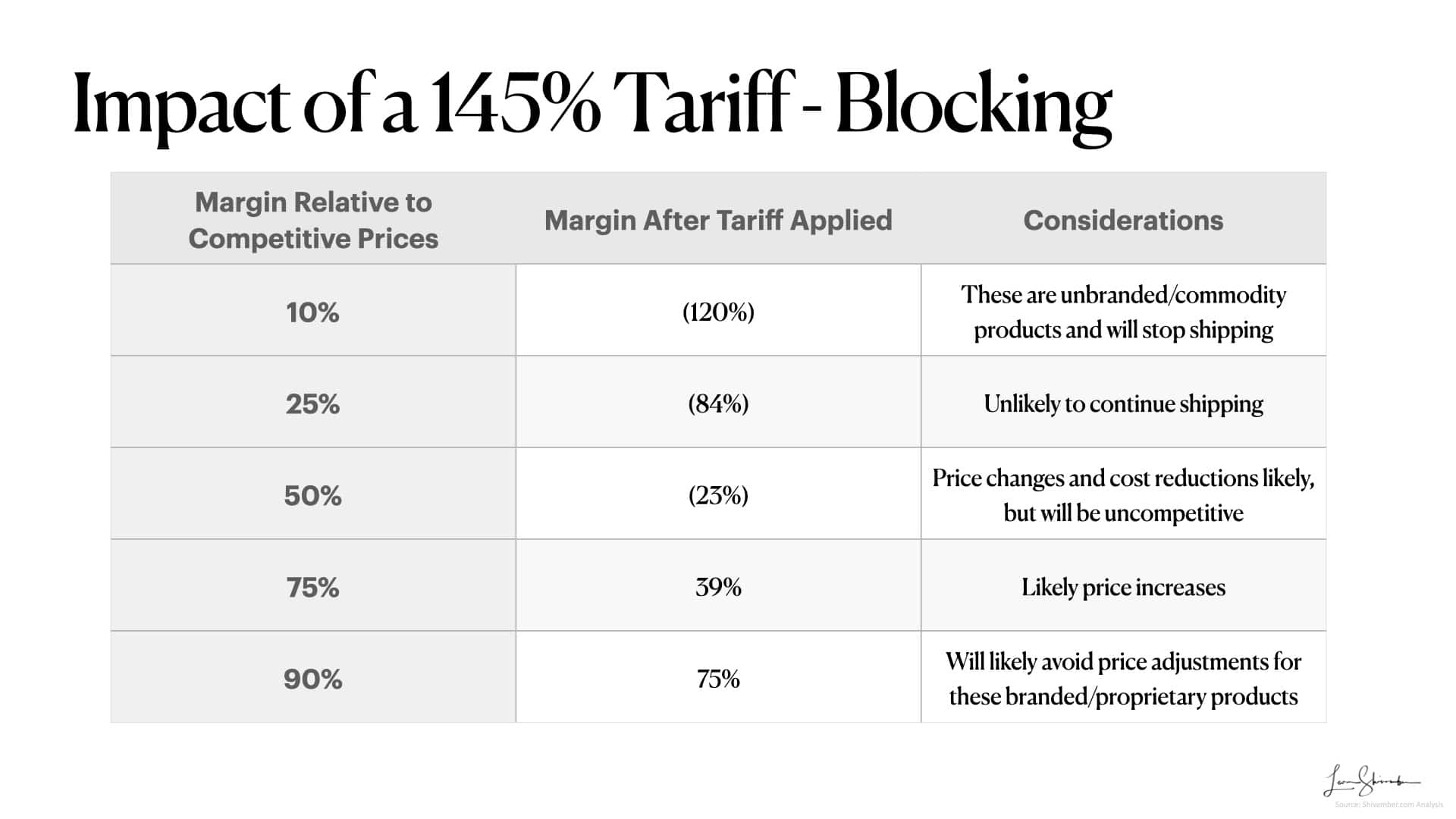

For businesses importing goods, tariffs introduce a new cost variable that demands strategic recalibration. The feasibility of continuing imports hinges on profit margins, product positioning, and the ability to adapt. Using the 10% and 145% tariff examples, we can model these responses across different margin profiles:

Low-Margin Products (e.g., Generic Dresses with 10% Profit Margin)

- 10% Tariff: Maria sells imported dresses for $100, earning a $10 profit on a $90 cost (10% margin). A 10% tariff adds $9, slashing her profit to $1 if she keeps the price steady. For generic dresses with tons of substitutes, that’s a death knell. She might stop importing, switch to local suppliers, or close shop. But if her rival, Big Boutique, absorbs the cost, Maria’s forced to match or lose customers. It’s a brutal game of chicken.

- 145% Tariff: Now the tariff’s $130, jacking the cost to $220. Selling at $100 means a $120 loss. Game over. Raising the price to $220 barely breaks even, and customers search out cheaper options. Imports stop cold, as the tariff slams the door shut. Maria’s out unless she finds a new play.

Mid-Margin Products (e.g., Branded Sneakers with 25% Profit Margin)

- 10% Tariff: Picture SneakerTrend, a mid-tier brand selling kicks for $100 with a $25 profit on a $75 cost (25% margin). If prices hold, a 10% tariff adds $7.50, cutting the profit to $17.50 (17.5%). They could bump the price to $108 to keep a $25 profit, but risk losing trend-chasers to cheaper rivals. Or they trim costs, maybe cheaper packaging, to stay competitive. SneakerTrend’s challenge is that their mid-tier branding can only go so far, unlike Nike’s. The slight price increase could lose customers if Nike holds prices steady. It’s a market-share mover. The game’s tight, but playable.

- 145% Tariff: A $108.75 tariff (145% of $75) rockets the cost to $183.75. Selling at $100 means an $83.75 loss (-84% margin). A $184 price breaks even, but who’s paying that for sneakers when Nike is holding at $100? Most likely, SneakerTrend halts imports, scrambling for suppliers in Vietnam or Mexico. Nike is already geographically diversified to avoid these tariffs; they are laughing while SneakerTrend sweats.

High-Margin Products (e.g., Luxury items with 90% Profit Margin)

- 10% Tariff: Now meet LuxeCo, selling high-end jewelry for $100 with a $90 profit on a $10 cost (90% margin). A 10% tariff adds $1, barely denting the margin to 89% ($89). They could absorb it or nudge the price to $101, knowing loyal buyers won’t flinch. If competitor EliteCo keeps prices flat to lure customers, LuxeCo might counter with a flash sale. It’s a flex; the high margins mean they call the shots.

- 145% Tariff: A $14.50 tariff pushes the cost to $24.50, dropping the margin to 75.5% ($75.50) at a $100 sales price. Selling at $115 restores the $90 profit, and their wealthy clientele likely pays up. Still, LuxeCo might explore production in Vietnam to dodge future hits. EliteCo, if less diversified, could lose ground. High-margin players bend, but their desirable brand position and profit leverage mean they don’t break.

These moves aren’t made in a vacuum. Every business and its competitor are affected and watch each other, guessing who’ll blink first. Tariffs force a rethink. Raise prices, cut costs, shift suppliers, or exit. The lower your margin, the faster you’re cornered; the higher, the more you can maneuver. It’s a game where strategy, not panic, wins.

Consumer Dynamics: Elasticity and Alternatives

Consumers also navigate a strategic landscape as the end recipients of tariff-driven price changes. Their responses depend on demand elasticity, how readily they switch based on price, and the availability of substitutes:

- Elastic Demand (Abundant Alternatives): For interchangeable goods like generic apparel, a 10% tariff might prompt a partial shift to domestic or other low-tariff options if prices rise. A 145% tariff, however, could eliminate those imports, forcing a full pivot unless domestic supply lags. Substitution dampens price pass-through, limiting inflationary pressure.

- Inelastic Demand (Few Alternatives): For specialized or branded items, like an iPhone, a 10% tariff might see prices rise slightly, with loyal consumers absorbing the cost. A 145% tariff could push prices beyond tolerance, reducing demand or switching to low-tariff alternatives such as Samsung products from Korea. Brand strength might sustain sales for some time, but hefty tariffs will eventually lead to shifts in demand or supply chains.

This feedback loop ties consumer behavior to business strategy. Aggressive price hikes risk losing elastic-demand customers; absorbing costs strains profitability. Tariffs thus reshape prices and market structures.

Case Study: Apple’s Tariff Tightrope

Let’s zoom in on Apple, the high-margin titan facing tariffs on its China-made iPhones. Say an iPhone costs $600 to produce and sells for $1,200, with a 50% margin ($600 profit). A 10% tariff adds $60, trimming the margin to 45% ($540) if absorbed, or nudging the price to $1,260 to keep the entire profit. Fans grumble but pay up. Brand loyalty’s a beast.

A 145% tariff adds $870, tanking the margin to -22.5% ($-270) at $1,200 or demanding a $2,070 price to hold steady. Even diehards balk, and rivals like Samsung, sourcing from Korea, smell blood.

Apple’s countermove? Ramp up production in India, where trade talks might lower tariffs. Apple is playing chess, not checkers, and betting on supply chain shifts to outmaneuver the tariff trap.

Tariffs and Inflation: Beyond the Headlines

The link between tariffs and inflation is often overstated. A 10% tariff might raise the prices of affected goods once, but substitution and competition temper the broader effects.

A 145% tariff, by blocking imports, could strain domestic supply, nudging prices up if capacity falters. Yet evidence suggests limited sustained impact. Studies, such as those from the Economic Policy Institute, attribute only minor inflationary contributions to tariffs (e.g., 0.5% over the years), dwarfed by supply chain shocks. (2)

The interplay of margins, elasticity, and adaptation dilutes simplistic narratives. One must examine the competitive landscape of the largest affected trade sectors to understand the inflationary impact fully. Yes, disruptions will occur that may lead to price increases. How long and how much will vary dramatically. (3)

How does this play out?

So, how do tariffs play out for businesses like Maria’s or giants like Apple? It’s a strategic dance with two paths: high tariffs (like 145%) could decouple U.S.-China trade, forcing supply chain overhauls, or cooler heads might negotiate lower tariffs (10% range) for mutual gain. Let’s map the fallout across business types, using game theory to spot winners and losers:

Commodity Resellers (e.g., Maria’s Boutique): Importing generic dresses from China, Maria’s 10% margin crumbles under a 145% tariff. She’ll pivot to suppliers in Vietnam or Bangladesh, but rivals with local sourcing could steal her customers first. Consumers switch to cheaper alternatives, keeping prices in check.

Proprietary Products with Alternatives: Think mid-tier tech with Chinese patents. A 145% tariff shrinks demand as buyers eye non-Chinese options. Firms must slash prices or relocate production, a costly bet against competitors’ moves.

Unique Proprietary Products: High-margin goods like specialized medical devices face price hikes under 145% tariffs, but loyal buyers absorb it. Firms hold steady, banking on inelastic demand.

Non-Chinese Proprietary Products: If Apple’s iPhones are shifted to India, they will dodge the worst. However, competitors like Samsung, already diversified, could undercut prices, forcing Apple to innovate or cut margins.

The game’s clear: low-margin players face disruption; high-margin giants adapt. Consumers, meanwhile, flex their choices or grit their teeth. Tariffs push everyone to rethink their next move.

Recommendations for Business Leaders

The tariff uncertainty introduces enormous volatility into business operations, creating risks and opportunities for the astute. How you navigate your choices depends on the long-term market prospects of your business and your relative competitive advantage:

- If you have competitive advantages and are in a market with long-term growth, now is a great time to invest against your weaker competitors.

- If you are at the other extreme, without any advantages and a declining market, you might do well to consider alternative choices for your focus.

- Great market prospects, but limited competitive advantages? Now would be a good time to invest in building a moat.

- If you have competitive advantages but your market prospects are limited, you want to harvest your investment. Consider carefully if you have fully explored complementary markets that would value your solutions.

Visionary business leaders see times of uncertainty as opportunities to outmaneuver their competition. I think you would do well to look over your strategic positioning and move accordingly.

The Big Picture: Strategy Over Slogans

Here’s the deal: tariffs aren’t saviors or villains.They are catalysts, sparking a chain reaction from Maria’s boutique to global boardrooms. A 10% tariff nudges trade toward balance, giving local players a shot without wrecking supply chains. A 145% tariff slams the brakes, prioritizing protection but risking shortages and trade wars.

Forget the hype about inflation. Data shows tariffs add a mere 0.5% to prices over the years, drowned out by more significant shocks. Yet the real risk isn’t just prices; it’s the ripple effects, disrupted supply chains, retaliatory tariffs, or a full-on U.S.-China decoupling.

Maria’s pivoting to local suppliers, Apple’s eyeing India, and you’re deciding whether to pay up or switch brands. The board’s alive, and every move counts. So, next time a tariff headline screams chaos, pause.

Who’s winning, who’s scrambling, and what’s the long game? Dig into the data, question the noise, find the signal, and play smart, because this economic chess match is yours to navigate.