Are wealthy families better off with their kids at Harvard or Bernard Baruch College?

To most of you, this is a no-brainer.

Who hasn’t heard of the prestigious Harvard?

So why would anyone consider the City University of New York’s Baruch a practical and viable alternative?

In this article, I will demonstrate that Baruch is not just an alternative but a potentially more lucrative choice in many cases, offering significant financial benefits.

“It’s choice – not chance – that determines your destiny.”

Jean Nidetch

- The Wealthy Love Prestigious Schools

- The Purpose of College

- Our Investment Model for College Value

- Some assumptions about these college students

- Some Basic Comparisons

- NPV Of College Choices

- My child is not average

- How Does Baruch Compare With Harvard Otherwise?

- How To Make Harvard A Better Choice?

- Conclusion

- Reference Sources

- Read More In This Series

The Wealthy Love Prestigious Schools

Wealthy parents are known for donating large sums, hiring consultants, and paying for expensive prep programs to get their kids into Harvard. They must know something, as they are well-educated and surrounded by intelligent advisers.

And let’s face it; if you are an affluent parent who doesn’t bat an eye at your children driving Bentleys or Porsches to high school, the choice is much more about brand preference and membership in the right club than anything else. ‘Brand preference’ in this context refers to the tendency to favor prestigious or well-known colleges, often based on their reputation rather than their actual value in education and career prospects.

For those who don’t consider themselves wealthy but are well-off, you will likely be paying the sticker price for your child’s education at a prestigious institution such as Harvard.

Wealthy or well-off, you may still be interested in understanding and optimizing the value of your college investments.

This article is designed to guide and inform you in making the best decision for your child’s future.

But before we explore this comparison further, we must agree on what it means to be a better choice.

The Purpose of College

When discussing college values, it’s helpful to start by agreeing on the purpose of college degrees.

We can all agree that there is a multifaceted set of expectations for college degrees. Most are personal benefits to the individual, and some are more social as benefits to the family and society.

We can summarize these broadly as a pathway to a brighter future through:

- Creating a stepping stone to career opportunities by unlocking employment doors and access to extensive career ladders built on a college degree requirement.

- Accelerating personal and intellectual growth, expanding the college student’s horizons, and cultivating independence.

- Building a sound network and access to valuable resources is helpful in the future.

- Increased contributions to our society by being better informed and further capable of driving innovation and growth

College is an investment in time and resources by individuals, their families, and society, with some broad expectations of future benefits.

If it works, we should see long-term gains for the investors (students, their families, and society).

College is a relatively significant investment, and Harvard is one of the more expensive choices.

Wealthy families use investment managers to ensure their investments are worthwhile and add value.

Let’s approach the Harvard choice with an investment manager’s objectivity. This analysis is not about prestige or reputation; it’s about the economic value of your investment.

Our Investment Model for College Value

Like traditional investment analysis, we built our college investment model on rigorous research and objective data. We project costs and earnings over a working lifetime, deduct taxes, and discount the results to calculate the Net Present Value of lifetime earnings after Taxes and Costs.

Our data comes from government sources such as the U.S. Department of Education, the Census Bureau, the Bureau of Labor Statistics, the IRS, and the Federal Reserve. These sources provide comprehensive and reliable data on various aspects of college education and its economic implications.

Some assumptions about these college students

We assume that college students from well-off families are financially secure to the extent that they rarely qualify for academic cost relief (scholarships and grants) and certainly do not qualify for economic financial aid. This assumption comes from an understanding that wealthy families can afford to pay the full cost of their children’s education without significant financial strain. If anything, affluent parents are likely to overpay through donations or other preparatory mechanisms.

We also assume the college student is a median performer in their chosen college and will graduate with a starting salary about the median rate for the college and field of study.

This rating may be a hard pill to swallow.

We Americans suffer from illusory superiority, a cognitive bias in which people overestimate their qualities and abilities compared to others.

For example, 87% of Master of Business Administration students at Stanford University rated their academic performance above the median. (1)

Remember that most students paying a significantly lower cost to attend Harvard are academically superior admissions. They did not qualify because they could afford Harvard, made significant donations, or had a legacy relationship. These students who are receiving subsidies from Harvard to attend are a highly selective bunch of superior academic achievements in very competitive environments, often in challenging fields of study. They most likely did not have preparatory help; they are innately higher performers.

The best-performing students in high-demand fields of study should receive the highest salaries, further supporting the median rating proposed for our evaluation.

If your median student earns above-average compensation because of parental networks or connections, that upside is not attributable to the college choice. So, we are comfortable using the median salaries to evaluate the value of the Harvard investment.

This is what Opportunity Insights concluded when they did the comparison: “Nationally, children from the poorest families are substantially less likely than their peers from richer backgrounds to reach the top of the income distribution. But comparing two students at the same college, this difference almost entirely disappears – a finding that is especially true at highly selective colleges.”(2)

Some Basic Comparisons

For a baseline comparison, we include the median high school graduate who does not attend college and the median college graduate paying median fees, along with the specific results for Harvard and Baruch.

The U.S. Department of Education College Scorecard website collects Median Salaries for various periods after enrollment.(3) Most of the data they make public is limited to students who have received federal aid, so it is incomplete. However, a cursory examination of other public data from different sources indicates that this data is a reasonable source for comparison.

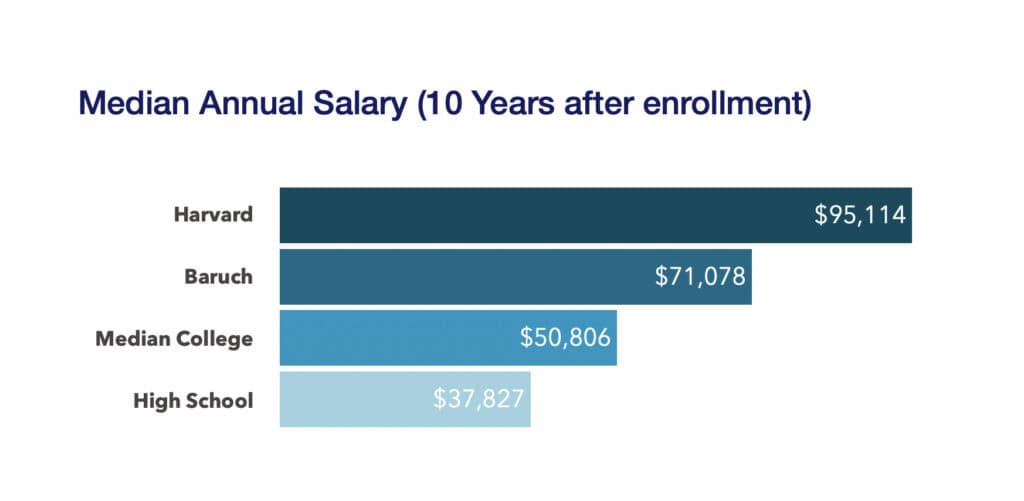

The first metric we care about is the median salary of graduates. In this case, the website shows ten years after enrollment.

You can see Harvard’s advantage, which is deserving of being a prestigious institution.

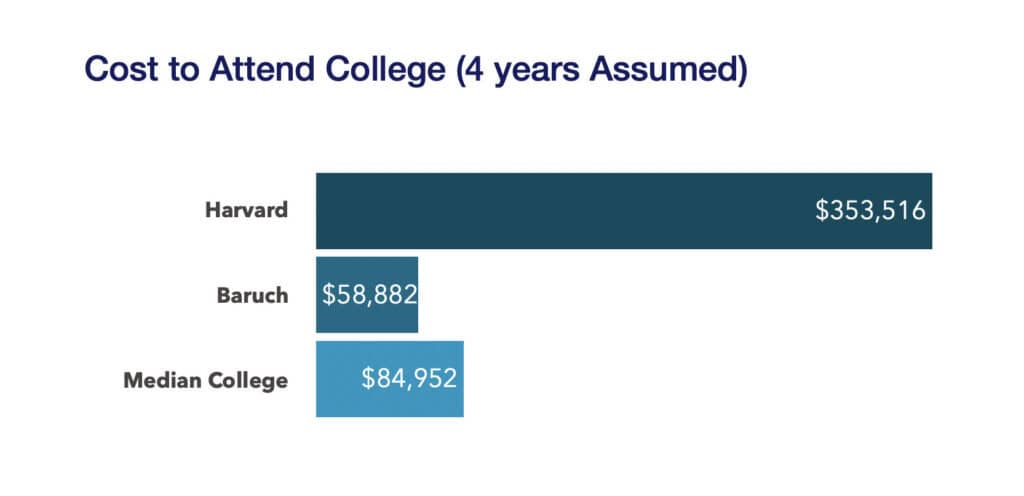

The DOE shows the average net attendance costs, which deduct scholarships and grants. But we are interested in the total costs. Fortunately, they also provide downloadable data containing the average full costs. We use the starting value and increase it by 5.6% annually to calculate the four-year costs.

Harvard is expensive, Baruch a bargain.

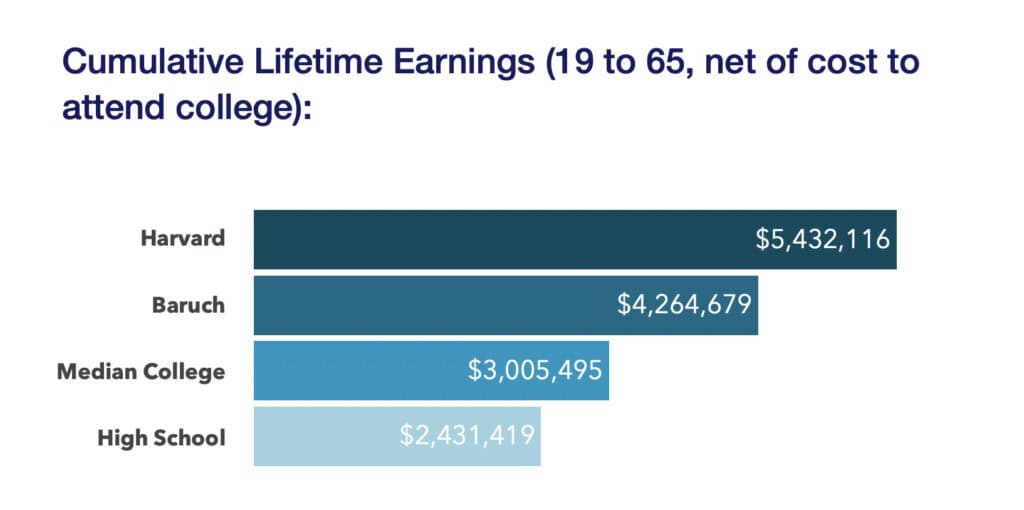

Using the salaries provided, we can project backward to a starting salary after graduation and forward to retirement. Thus, we can calculate a synthetic lifetime earning for each choice.

We recognize that an actual lifetime of earnings also heavily depends on the economy, the performance of the chosen employer, the performance of the employee, and personal situations (such as women departing from the workforce after pregnancies).

The further one goes from graduation, the more critical the latter factors are than the upfront college decision.

Thus, our synthetic model of a lifetime of earnings best reflects the impact of the college by favoring the near-term impact.

Based on the results above, the Harvard choice appears justified.

Researchers use these results regularly to make the case for college. It is called the college wage premium. A researcher will point out that the Harvard graduate makes $3M more than a High School Graduate or $1.2M more than a Baruch Graduate.

Sometimes, we express the premium as a percentage advantage. The median Harvard Graduate has a 125% ($3m/$2.4m) College Wage Premium over a High School Graduate. It’s 29% over Baruch.

Indeed, Harvard is the better choice. After all, it’s 29% better and $1.2M higher after deducting all the costs.

But is it?

We investment managers are quirky beasts. We need to add a few essential variables to the above comparison.

The above results have not factored in the impact of taxes or the time value of money.

For a proper investment evaluation, we must consider the Net Present Value of Lifetime Income After Taxes and Costs.

NPV Of College Choices

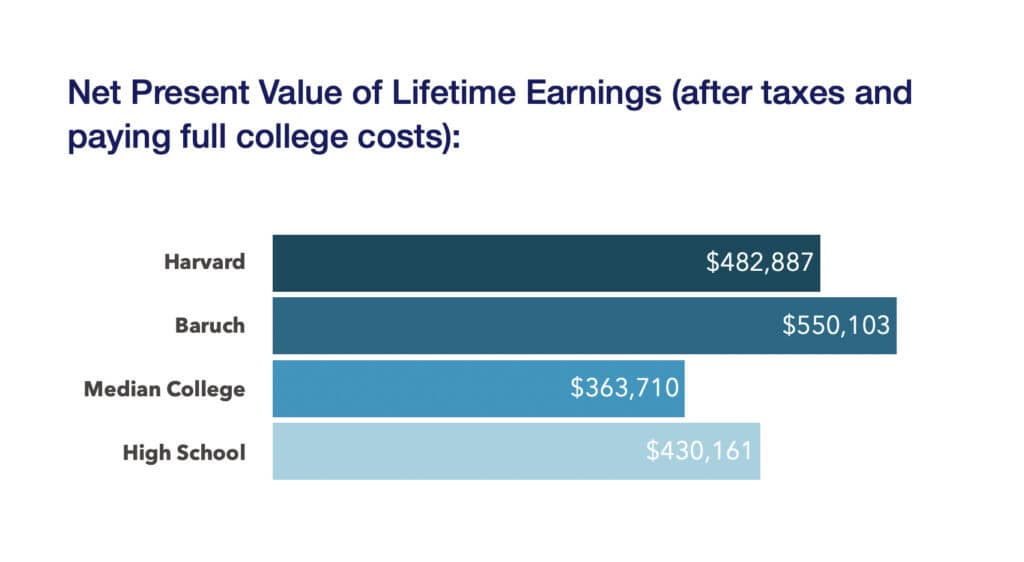

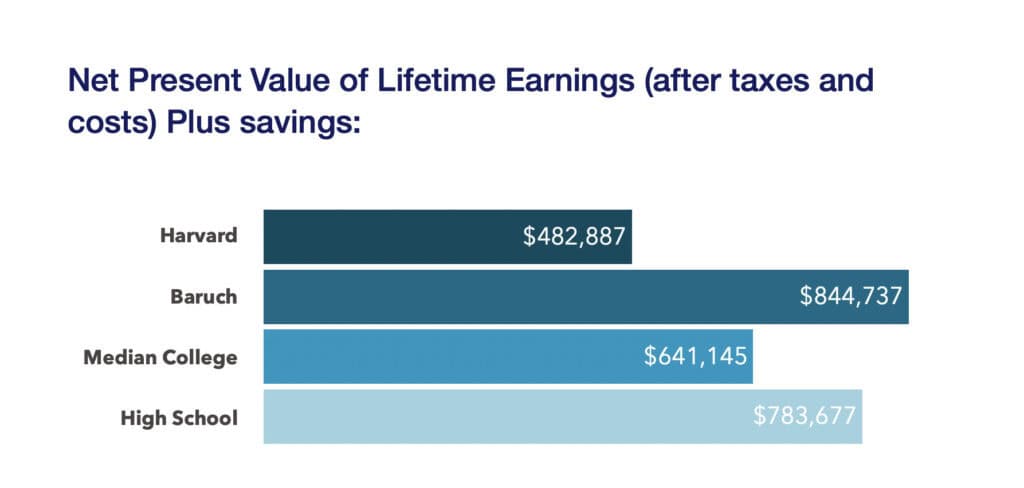

To calculate the Net Present Value, we take all those earnings and project them out to 65 years old. We apply the 2024 tax code to each year’s earnings. We reduce those earnings by any cost in a given year, and then we discount it all back to the starting point to get what it would be worth at the beginning of the investment.

The sum of those years is the Net Present Value of the lifetime of earnings after taxes and costs.

This value represents the current worth of all the future earnings, considering the time value of money and the impact of taxes and costs

The value when paying full costs of the Baruch College Degree is higher than the median Harvard University Graduate!

Important Insights:

- Comparing lifetime incomes to establish the merit of college degrees is misleading.

- The impact of college, cost, taxes, and the time value of money dramatically changes whether a specific choice is a better investment.

- The median college graduate generates a lower NPV than a comparable high school graduate who went to work directly.

- Baruch College at full cost is a better investment than Harvard at full cost.

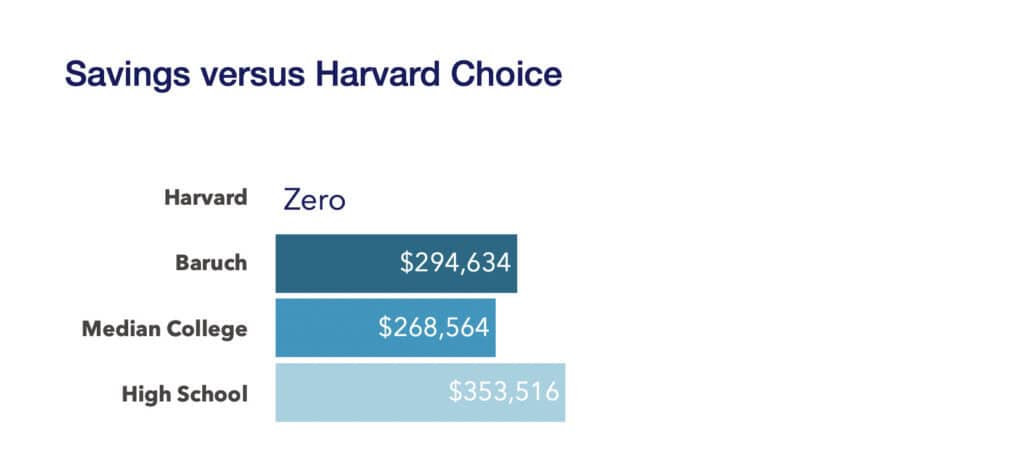

Keep in mind that each of these choices started with different parental investments.

The high school students didn’t have to pay anything, while the Harvard students paid $353,516 to get the above result.

The results above only reflect the specific investment required for the various choices.

If we assume the wealthy parents gave $353k to the student in all scenarios, the results would be even more dramatic. Some students will have savings left over to add to their previous NPV (which presumably could be invested over time).

We can add these upfront savings to the previous NPV to see what value accrues under each choice.

The brutal reality is that the incremental earnings, after taxes, from a Harvard degree for the median student don’t quickly enough compensate for the high cost of attendance. Adding all the other preparatory costs and donations could be much worse.

My child is not average

You may argue that your child is not average. You point out that Harvard is much more difficult to get into.

Would that not mean you believe your students are also likely to do much better at Baruch than they might at Harvard? Would their salaries not also be equivalently higher?

You may believe the median salary for Harvard scholarship students is lower than your child would earn.

One sobering statistic you should consider is that, according to The Crimson’s 2022 survey of graduating students, 15% of men and 25% of women graduates expected to earn less than 50k.(4) These students will earn a subpar return to the median high school graduate, even if they attended free of tuition and fees.

To match the Baruch College returns, your child must earn an equivalent salary 50% above the Harvard median of $95k!

That may be likely in some fields of study. But again, that incremental value is also open to your child at Baruch.

All is not lost, though. There are a few bright spots.

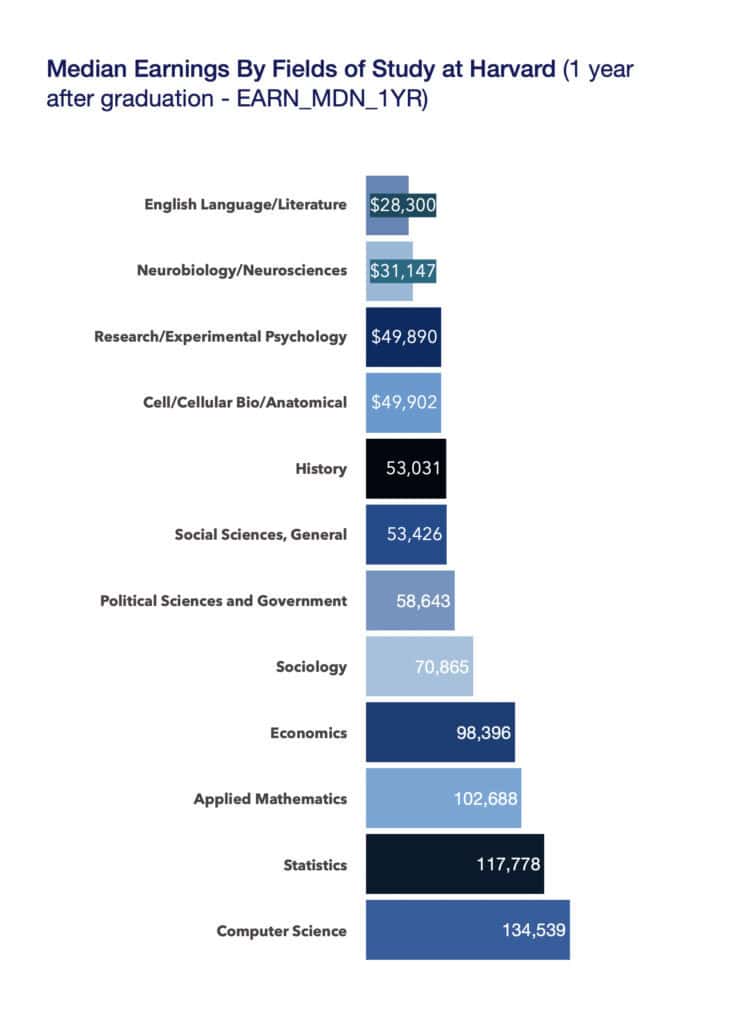

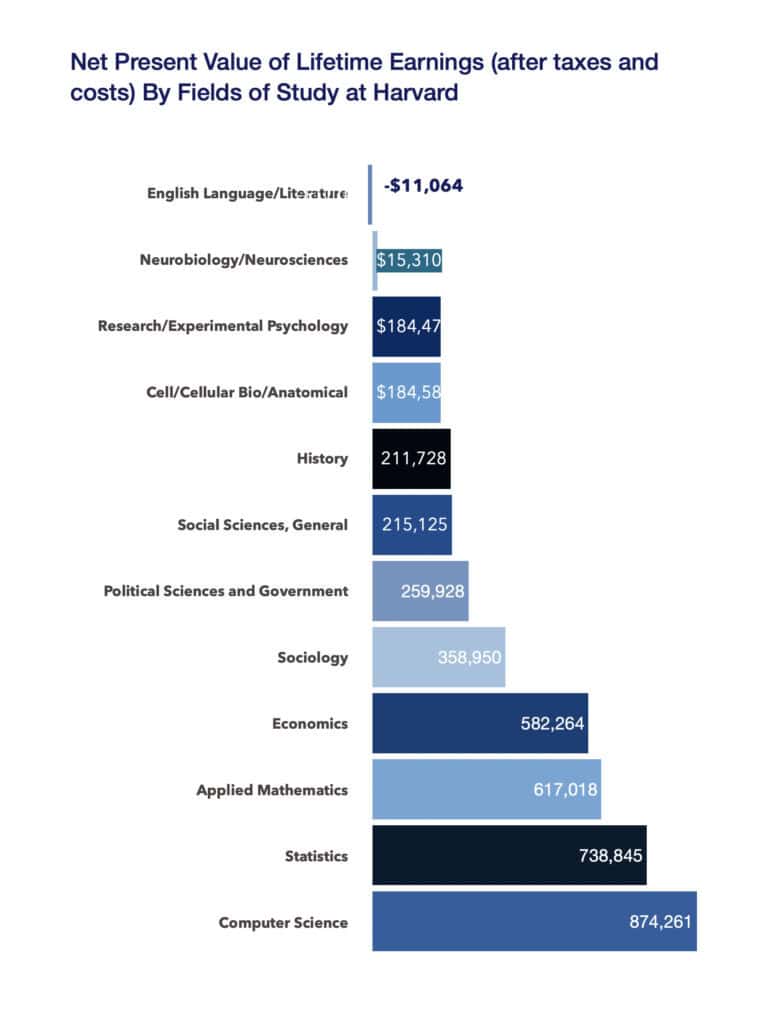

Let’s look at some of the Fields of Study performance at Harvard.

The first eight specializations show median salaries below the overall Harvard Median of $95,114, resulting in an even worse NPV than previously.

There is better news if your student specializes in Economics, Applied Mathematics, Statistics, or Computer Science.

They all show improvements to the overall NPV. Still, only Computer Science shows an improvement above Baruch NPV plus the savings (from not attending Harvard).

How Does Baruch Compare With Harvard Otherwise?

Baruch is a better financial investment for most students paying full Harvard costs. But how do Harvard and Baruch compare otherwise?

Harvard is popular. It receives 33 applications for every seat, Baruch 2. The result is that Harvard is more selective; Baruch is more accessible.

Remember, if Baruch became more popular, the admission rates would decrease. Thus, we view this metric as more descriptive than prescriptive.

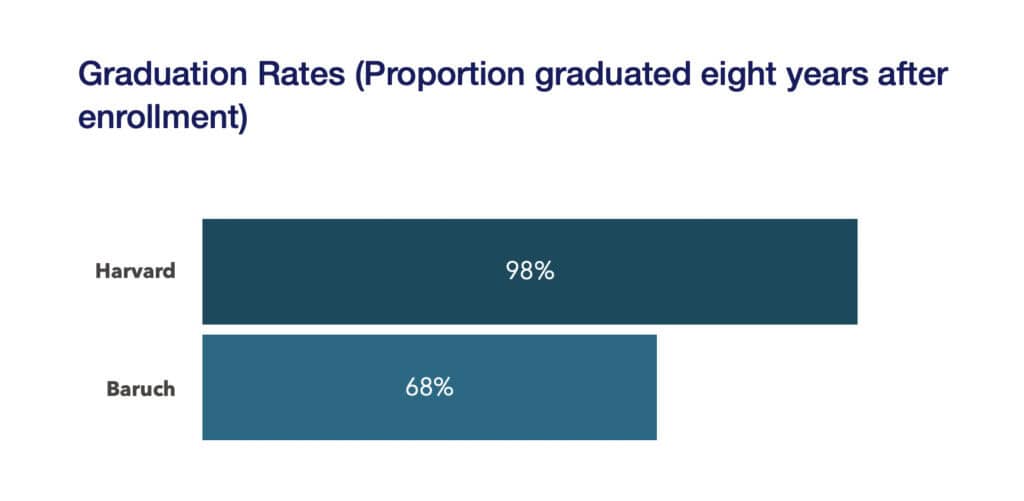

While the gap appears decidedly in Harvard’s favor, several mitigating factors exist. At Harvard, 93% of the students are enrolled full-time compared to the much lower 81% at Baruch.

The mission of Baruch has been to provide various opportunities for students to attend college, so they have been quite innovative at adding evening programs for full-time workers and other part-time enrollment programs. Further, as part of a large City University System, enrolled students who find their interests underserved or the program too challenging have many options to transfer—a significant one in eight students transfers elsewhere. Withdrawals are much higher at 17% versus Harvard 1%.

Still, in a comparable sample evaluation period, Baruch served nearly three times as many students and graduated nearly twice as many students (6,786) as Harvard (3,286).

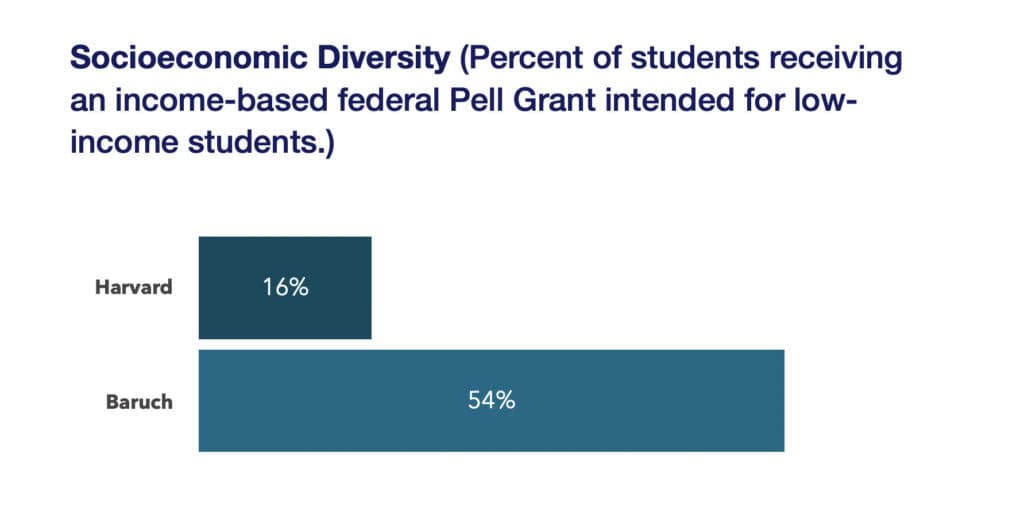

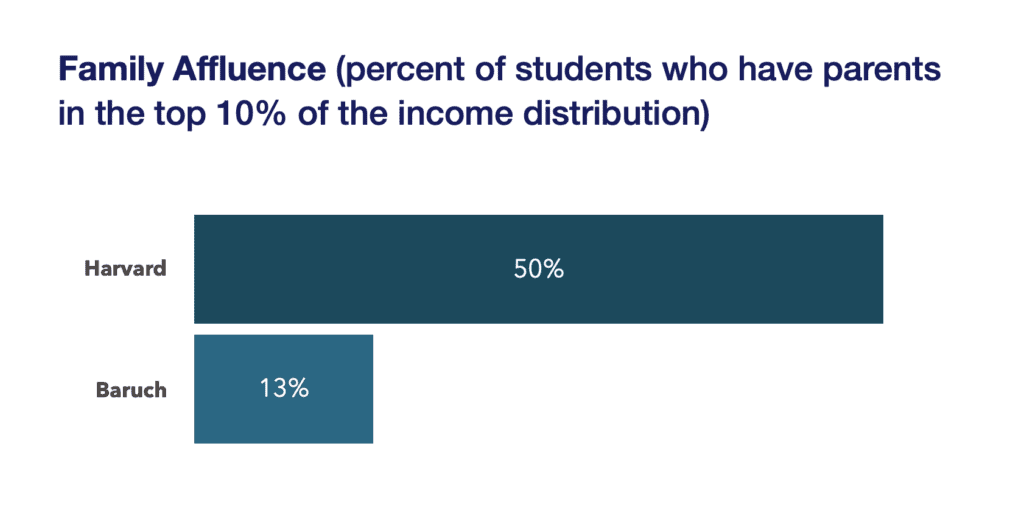

Harvard families and students are generally financially secure. It is a place where the wealthy and elites are overrepresented. Conversely, Baruch is a social mobility engine serving more than a fair share of the financially insecure.

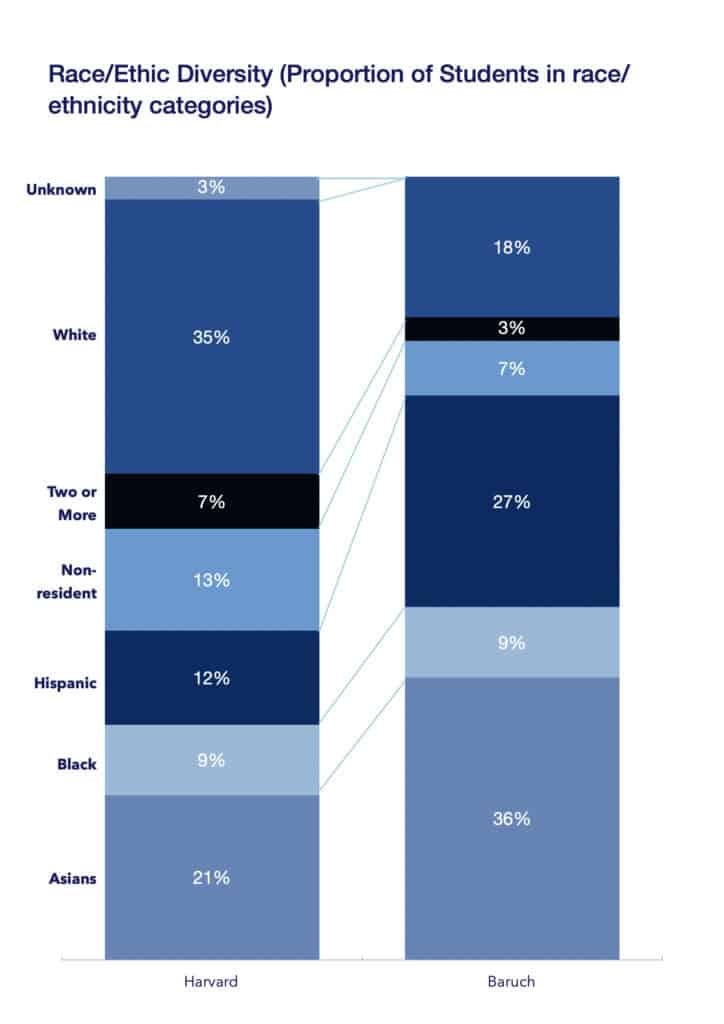

Despite Harvard’s now struck-down affirmative action program, which gave them the freedom to recruit a more diverse student body, they are woefully short of the diversity achieved by Baruch.

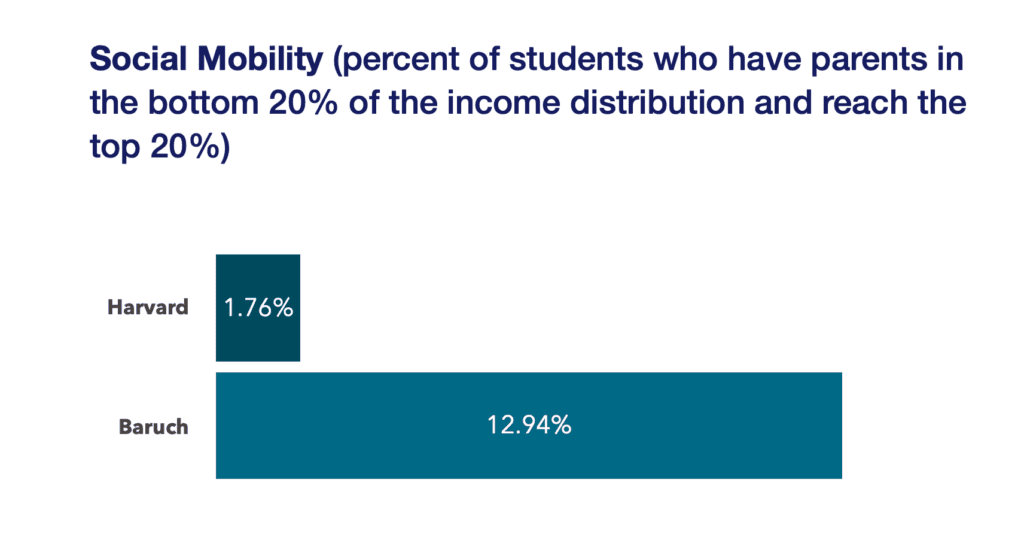

Harvard Professor Raj Chetty and a team published their paper in 2017: Mobility Report Cards: The Role of Colleges in Intergenerational Mobility.(5) They showed that students from low-income families have excellent long-term outcomes after attending selective schools, but there are very few low-income students at these schools.

According to their analysis, one in eight students attending Baruch moved their family’s financial situation from the bottom 20% income distribution to the top 20%. This result was seven times higher than Harvard’s mobility rate.

Baruch is a social mobility engine; Harvard is not. In addition to being a better family choice, Baruch is a better Social investment.

How To Make Harvard A Better Choice?

Baruch is a much better investment than Harvard at full cost.

The high cost of attending Harvard crushes the financial returns, even though Harvard graduates make more than Baruch students when they graduate. More is needed to make up for the significantly higher attendance costs.

Make Harvard free to attend, and it will become an excellent investment.

The median Harvard graduate will generate an excellent return if they do not pay the high full cost of attending Harvard. However, several fields of study will still generate subpar returns.

Even a Harvard degree cannot overcome some fields of study’s awful supply/demand market dynamics.

Harvard has the resources and enough endowment to make undergraduate attendance free. If it does so, the returns generated for children of wealthy parents will be significantly better.

Wealthy parents making donations at the total cost is better than paying for the expenses. This approach allows them to take advantage of the tax break for charitable contributions.

Still, Harvard would have to significantly change other aspects of the program to become a social mobility engine like Baruch.

Conclusion

Wealthy parents are spending heavily through donations, paid consultants, or preparatory programs to increase the chances of their kids attending Harvard (and other Ivy League Universities).

Whether this is a good decision depends on how these parents view the investment and its potential return.

If this investment falls into the same decision-making process centered on brand preference at all costs, then no economic argument changes the decision.

On the other hand, if these parents review these investments critically from an economic value creation/destruction perspective, they may have to revise their thinking.

Schools like Baruch College, which are social mobility engines, can deliver students who earn well above average salaries, and it does so at well below educational costs.

Baruch can be described as an engine increasing social mobility, while Harvard is better described as reproducing inequality. That makes Baruch a better economic investment than Harvard in most cases.

Reference Sources

- Zuckerman, E. W., & Jost, J. T. (2001). What Makes You Think You’re so Popular? Self-Evaluation Maintenance and the Subjective Side of the “Friendship Paradox” on JSTOR. Social Psychology Quarterly, 207. https://doi.org/3090112

- Chetty, Raj. “How Can We Amplify Education as an Engine of Mobility?” Opportunityinsights.Org. Opportunity Insights at Harvard University, Accessed July 12, 2024. https://opportunityinsights.org/education/.

- U.S. Department of Education. ”College Scorecard.” Colleegscorecard.Ed.Gov. Accessed July 12, 2024. https://collegescorecard.ed.gov.

- Knieriem, Declan J. “The Graduating Class of 2022 by the Numbers.” Features.Thecrimson.Com. The Harvard Crimson, Accessed July 17, 2024. https://features.thecrimson.com/2022/senior-survey/after-harvard/.

- Chetty, Raj, John N. Friedman, Emmanuel Saez, Nicholas Turner, and Danny Yagan. “Mobility Report Cards: The Role Of Colleges in Intergenerational Mobility.” Opportunityinsights.Org. Opportunity Insights at Harvard University, July 1, 2017. https://opportunityinsights.org/wp-content/uploads/2018/03/coll_mrc_summary.pdf

Read More In This Series

Previous

The challenge of low expectations