A College Degree is transformational. A good choice will lead to upward mobility for the student and their family. A wrong choice is a financial disaster. The presumption that the latter is rare is fatally flawed.

We must improve financial literacy to understand the differences. Then, we can better transform higher education.

In this article I will lay out the case for why Higher Education needs a transformation. Read on to find out the surprising details.

“Progress is impossible without change, and those who cannot change their minds cannot change anything.”

George Bernard Shaw

- How much change do we need?

- The prevailing wisdom

- We have a problem, but it is limited?

- An illustrative example

- The College Wage Premium Problem

- Evaluating College as an Investment

- Example – Berklee and Juilliard as College Investments

- Results from the College Investment Model

- Fields of Study Challenge

- Implications of fields of study challenges

- Implications for Policy Makers

- Exploring Pell Grant Returns

- The College Debt Problem

- The Retirement Crisis

- How America Pays for College

- The transformation needed

- Reference Sources

- Read More In This Series

How much change do we need?

How much transformation does higher education need?

That depends on our agreement on the scope of the problem.

- Are we talking about tweaks?

- Do we need to fix a few bad schools?

- Are for-profit colleges the main problem?

- Or are there significant systemic challenges?

The general view is that we need narrow improvements.

We disagree.

We are closer to requiring a systemic overhaul of how we view, measure, and invest in higher education.

The prevailing wisdom

The prevailing wisdom is that a college degree is essential.

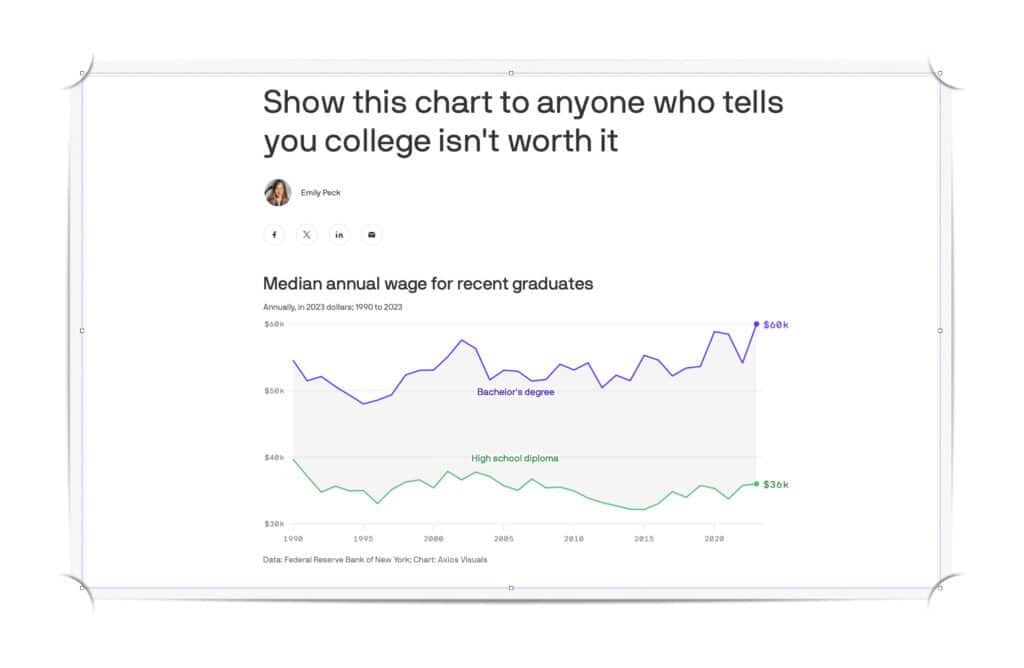

In a March 2024 piece, Axios titled Show this chart to anyone who tells you college isn’t worth it. (1) They show the above chart, which illustrates the widening wage gap between High School and College Graduates.

They state, “Even those who don’t graduate have higher earnings than those who don’t go at all.”

Professor David Deming is a Research Economist at the Harvard Kennedy School. He is quoted in the article saying, “It’s malpractice to tell a young person that a college degree isn’t necessary anymore.“

The Federal Reserve and National Bureau of Economic Research have been calculating and studying the college wage premium for decades. It shows how much more, on average, a college graduate makes over their lifetime. They compare to a high school graduate who chose to go to work rather than attend college.

Since then, various researchers have explored the trends and twists in these measures. All have concluded that a college degree makes good sense.

- Research from the Federal Reserve Bank of San Francisco was published in August 2023. “For most people considering college, the implied increase in lifetime earnings outweighs the cost enough to make college a sound financial investment, often with very high returns (2). This makes college education an important source of upward socioeconomic mobility within and across generations.”(3)

- The Georgetown University Center on Education and the Workforce (CEW). Its famous and frequently cited research is titled The College Payoff. They say: “The data are clear: a college degree is key to economic opportunity, conferring substantially higher earnings on those with credentials than those without.” Moreover, “Over a lifetime, individuals with a Bachelor’s degree make 84% more than those with only a high school diploma.” In their conclusion to their recent report, “No matter how you cut it, more education pays.”(4)

- The Association of Public and Land-Grant Universities (APLU). “Typical earnings for bachelor’s degree holders are $40,500 or 86 percent higher than those whose highest degree is a high school diploma.” And, “Bachelor’s degree holders are half as likely to be unemployed as their peers who only have a high school degree, and they make $1.2 million in additional earnings on average over their lifetime.”(5)

- Sue Cunningham is the president of the Council for Advancement and Support of Education (CASE). She penned a piece in March 2018 titled Claiming Our Story: The Importance of Higher Education to Transform Lives and Society. Sue says, “Although there is plenty of evidence that education is more than proving its worth, there continue to be naysayers worldwide who are uninterested in the facts.” She makes the final case for educating outsiders: “While the evidence for the value and impact of education is clear to those of us working in the sector, it is imperative that we close the understanding gap between those who are already part of our communities and those who currently stand outside of them.”(6)

You get the gist of the prevailing sentiment.

Sure, there is skepticism.

Higher education could be better. However, the value of the college wage premium overwhelmingly favors college degrees.

If anything is needed, it is a few tweaks.

We also need better marketing to the uninformed.

Indeed, Higher Education is under-appreciated.

Sue Cunningham puts it, “Even in the midst of this evidence of a solid return on investment, the United States is decreasing its public investment in education compared to most of the other 33 countries in the recent Education at a Glance 2017 data set.”(6)

What if the prevailing wisdom is wrong?

What if the fundamental metric used to prove the case for higher education is misleading?

We have a problem, but it is limited?

In 2013, President Obama focused on the rising costs of College. He proposed a plan to shame universities into lowering prices.

“It is time to stop subsidizing schools that are not producing good results,” Obama said. (7)

He set an ambitious agenda to create a federal rating system. It is one that parents and students can use to compare colleges easily.

The Republicans, now blamed for skepticism of College Value, were skeptics of this plan back in 2013.

“I’m strongly opposed to his plan to impose new federal standards on higher education institutions. This is a slippery slope that ends with the private sector inevitably giving up more of its freedom to innovate and take risks. The U.S. did not create the best higher education system in the world by using standards set by Washington bureaucrats.” says Senator Marco Rubio. (8)

The plan was scrapped due to the opposition of higher education groups. A few years later, the College Scorecard emerged, but it had no teeth. It did not include ratings and still does not.

President Obama’s Vice President, now President Biden, wants to resurrect the name-and-shame idea. In early 2023, the U.S. Department of Education announced a plan to craft a list of “low-financial-value” programs. It is like Obama’s shaming tactic of publicly calling out institutions with poor outcomes. (9)

Ted Mitchell, who served as the DOE Under Secretary during the Obama-era effort and is now President of The American Council on Education, set out their opinion that it doesn’t think it is possible for the department “to establish a metric or metrics that will fully capture all of the relevant information—both qualitative and quantitative—that would theoretically be used to determine value.”(10)

An illustrative example

The best way to understand the challenge is to illustrate it with an example.

Let us use the College Scorecard website to compare the Juilliard School in New York and the Berklee College of Music in Boston.

These are prestigious and well-regarded institutions. Both are well known for their music programs. Juilliard is much smaller and narrowly focused, with 476 undergraduates. Berklee serves 7,395 students and offers a broader range of fields of study. (11)

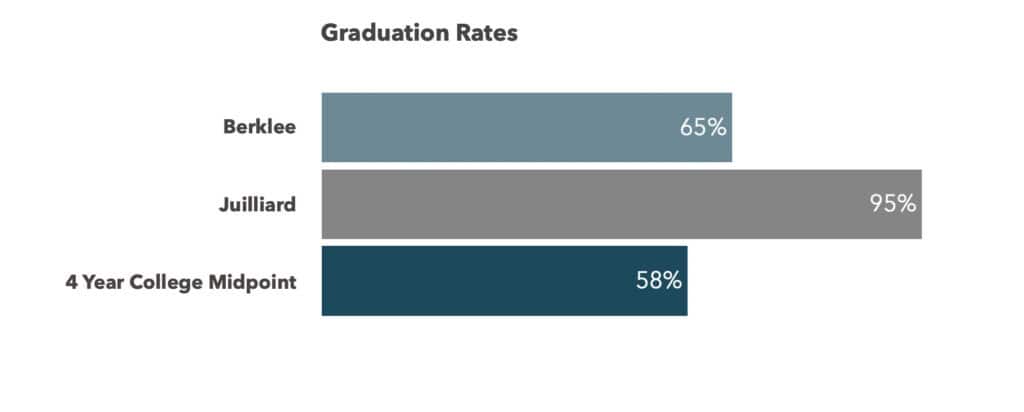

The college scorecard shows graduation rates. It measures the proportion of full-time students who graduate within eight years of starting school.

The rate is 95% at Juilliard, while it is a lower 65% at Berklee.

Stunningly, the midpoint nationally is only 58% after eight years!

The NCES latest shows that only 44% of undergraduates received a degree in 4 years or less.

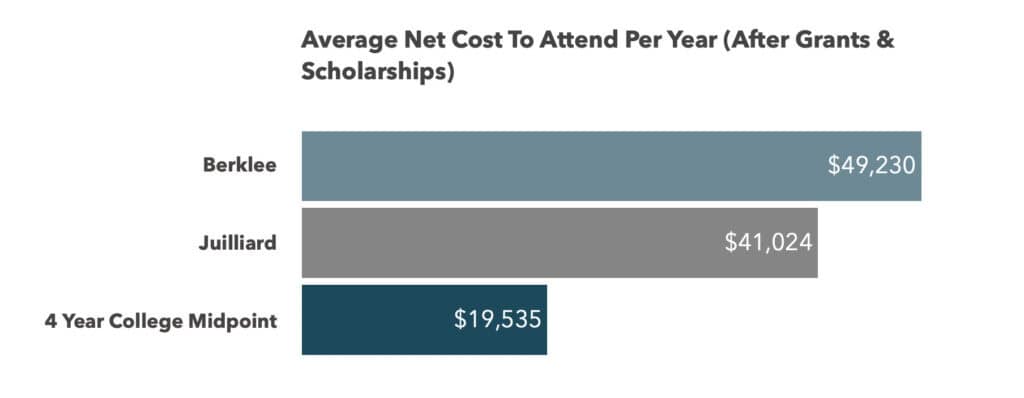

The average cost to attend Juilliard is $41,024 per year; at Berklee, it is $49,230. These costs are more than double the national midpoint of four-year colleges, which is $19,535.

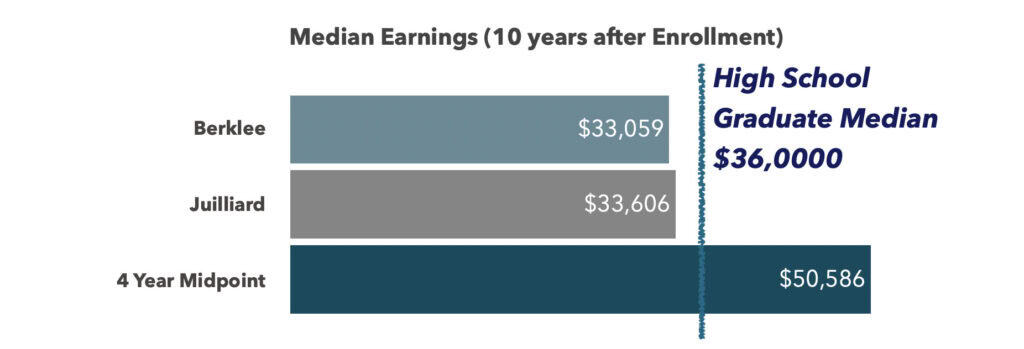

The scorecard provides the median earnings of former students who received federal financial aid. It makes available the median earnings ten years after entering the school.

As of May 2024, the National Median for all Bachelor’s Degrees is $50,806. At Juilliard, it is $33,606, and at Berklee, it is $33,059. Please note that the online data is updated regularly and may be different.

It is worth repeating that these are earnings ten years after enrollment. That means they include time during college (four or more years) and time in the labor force.

These earnings are well below the median earnings of High School graduates aged 22 to 27, at $36,000.

The median student at Juilliard and Berklee pays more than twice the national average to attend College. Still, they earn less than the median college and high school graduates!

The economic value of the Berklee or Juilliard degree is very different from that of the median college graduate and the high schooler.

If the median college student earns less than a high school student, when do they generate a return?

You need a premium to do so. The premium must be enough to repay the direct attendance cost. Ideally, it must also overcome the income foregone while attending College.

We are not debating whether a college education at Berklee or Juilliard is terrible. We are not saying these degrees are not worthwhile or valuable to society. This finding does not mean that Berklee or Juilliard are terrible institutions.

The cost and resulting salary combinations at these schools are not good investments—certainly not as other college degrees may be.

You may be willing to concede the investment challenge, but you think it is isolated.

It could be because these schools are music-related.

Or are the comparisons flawed for another reason?

Well, let’s consider these options strictly as investments. However, first, let’s understand why the College Wage Premium fails.

The College Wage Premium Problem

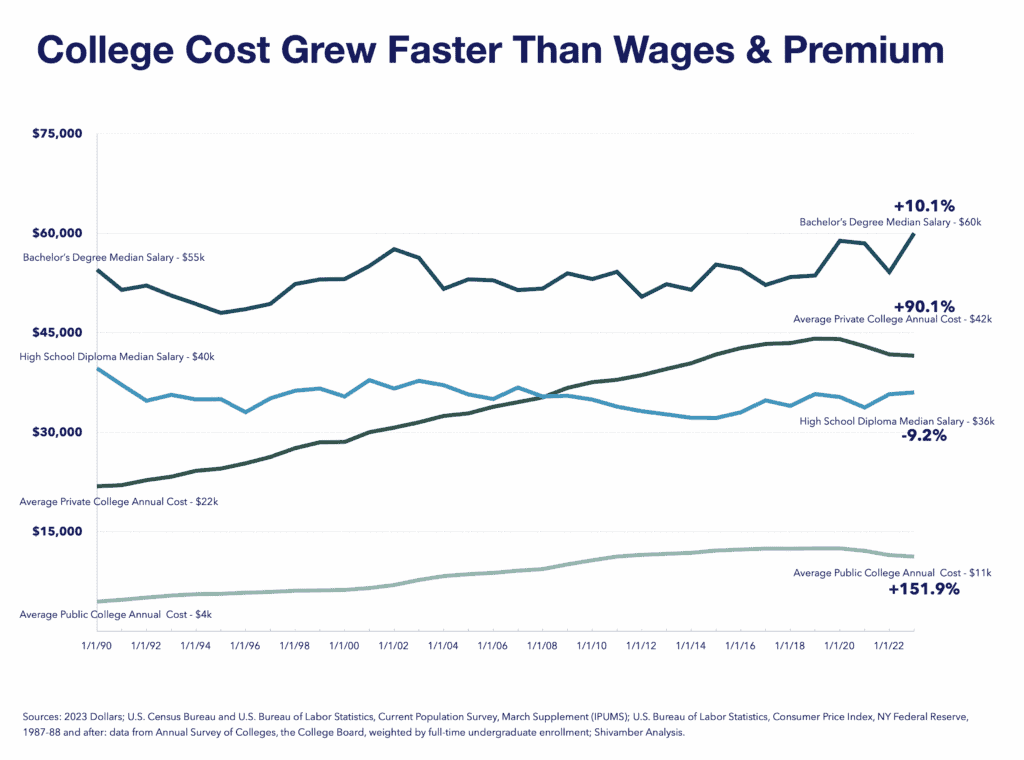

Let’s firstly acknowledge that the wage premium is not the only item to consider. The additional factor is cost. And here, we can see that over the years cost has grown faster than wages, or the wage premium.

But there is more.

What is wrong with using the widely used college wage premium to evaluate College as an investment?

Besides the error of comparing investments simply on the revenue generated, there are four major issues:

- College wage premium studies are biased in their comparison periods. They typically create synthetic lifetime wage projections for ages 25 to 65. That makes sense for college graduates since this is the period when they begin to earn a wage. However, to compare against the high school graduate, one must include the period between 19 and 25 when the high school graduate earns a salary. In contrast, college students may only earn minimal amounts, if any.

- The college wage premium studies ignore college costs. Focusing on what happens between 25 and 65 makes them miss the potentially significant costs of attending College. At some colleges, these could add up to more than $400 thousand.

- The college wage premium ignores the impact of taxes. Our federal tax system is progressive, taxing higher incomes at a higher rate. The graduate only receives the after-tax portion of their salary. It is from this payment that we pay college costs. Tax deductibility for college costs is limited in value and timing.

- The college wage premium ignores the time value of money. College students are making a trade-off. They give up short-term earnings and the costs they pay to attend college. They expect longer-term increases in their earning power. However, a dollar earned later is not equal to a dollar today. So, to properly evaluate the outflows and inflows over different periods, we must adjust for the time value of money.

These errors make the college wage premium misleading when evaluating college investments.

Evaluating College as an Investment

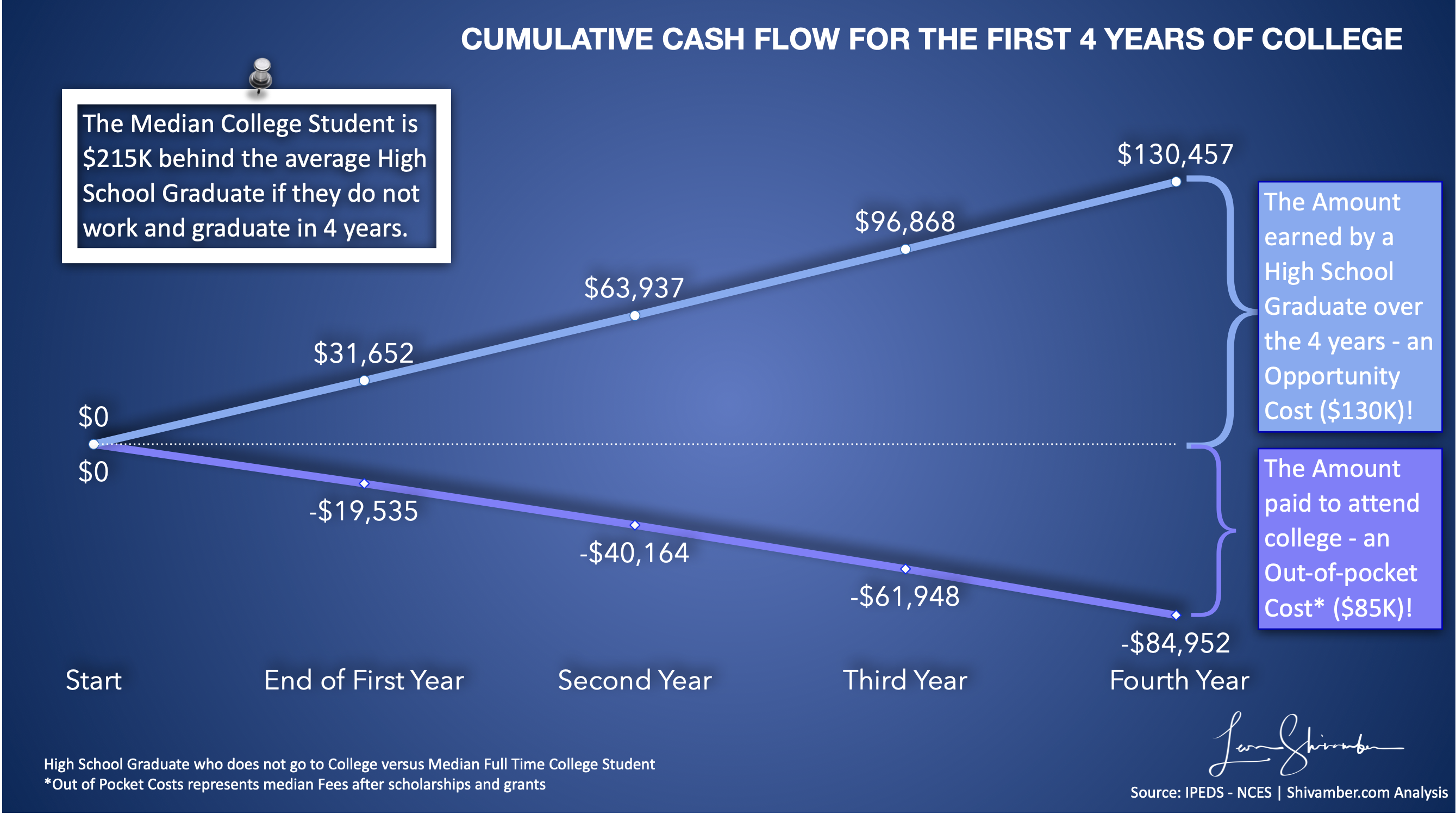

Like traditional investment analysis, we built our college investment model on rigorous research and objective data. We project costs and earnings over a working lifetime, deducting taxes. Then, we discount the results to calculate the Net Present Value of lifetime earnings after Taxes and Costs.

Our data comes from government sources such as the U.S. Department of Education, the Census Bureau, the Bureau of Labor Statistics, the IRS, and the Federal Reserve. These sources provide comprehensive and reliable data. They cover various aspects of college education and its economic implications.

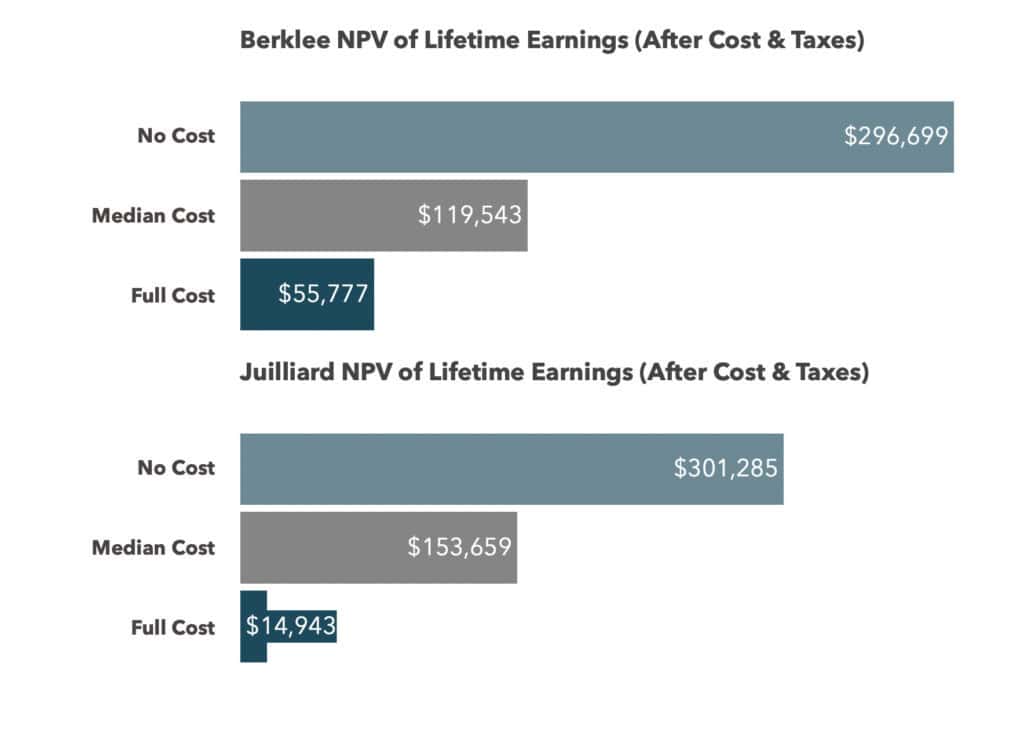

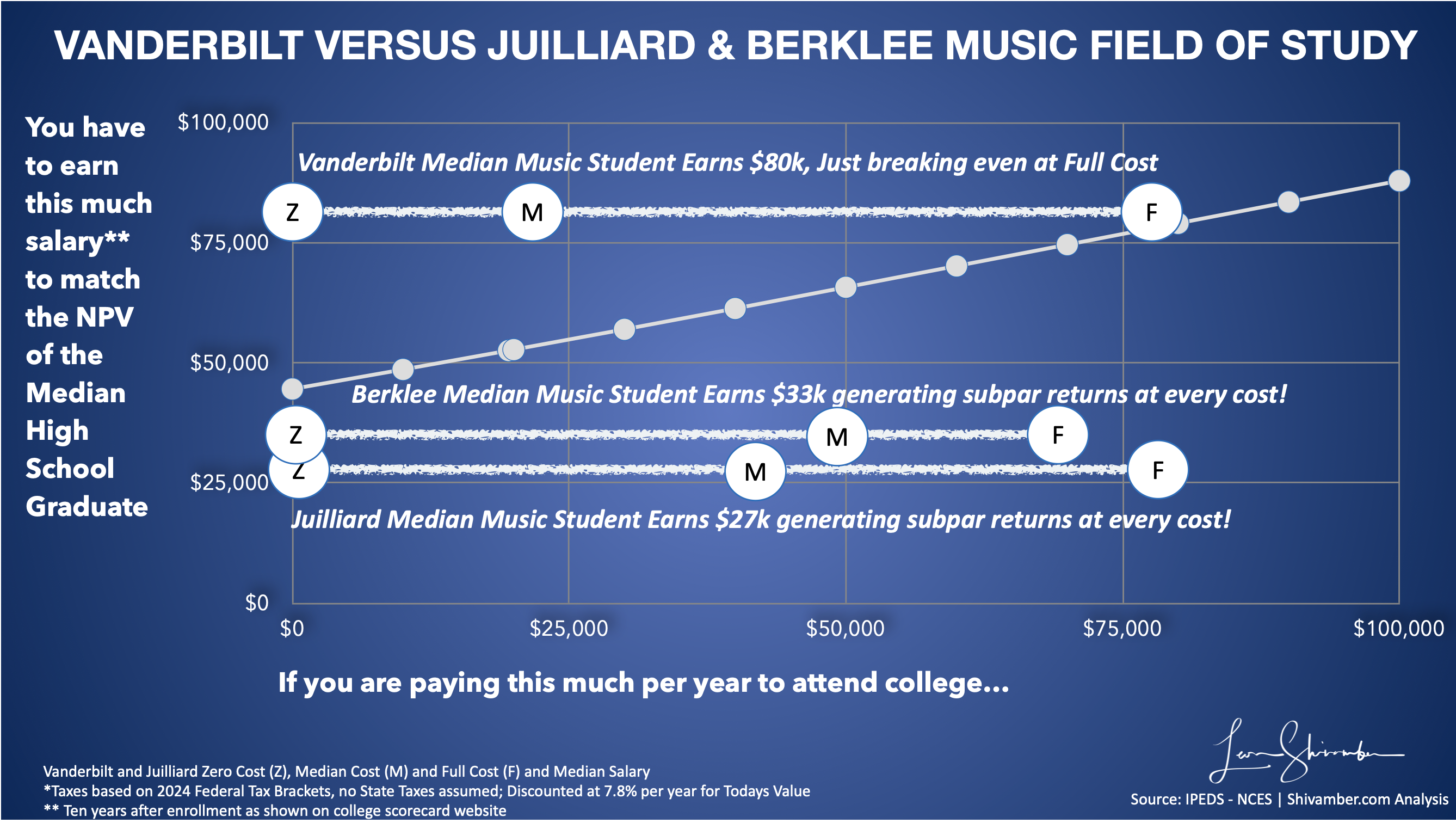

Example – Berklee and Juilliard as College Investments

Using the NPV model, we calculate the value of the lifetime earnings after taxes of our baseline high school graduate, which is $430k.

We can use each institution’s median starting salary and calculate its estimated value. We can do this with three scenarios: if the student/family paid nothing, the median, or the total attending costs.

Our Berklee students, earning the Median Salary, would generate an NPV of $297k if they paid no tuition or fees, $120k if they paid median fees, and $56k for total costs.

Our Juilliard students are slightly better because of their higher Median Starting Salary, with an NPV of $301k if they paid no tuition or fees. $154k when paying median fees. However, the NPV is only $15k at total fees due to the higher complete costs.

What is happening here? Both schools are generating returns below those of the median high school graduate. For both Berklee and Juilliard, the trade-off does not work out.

The students are giving up four years of income. They are paying above-average tuition and fees. Then, they graduate with jobs that pay below the median for a high school graduate. There is no premium to make up for their up-front investments.

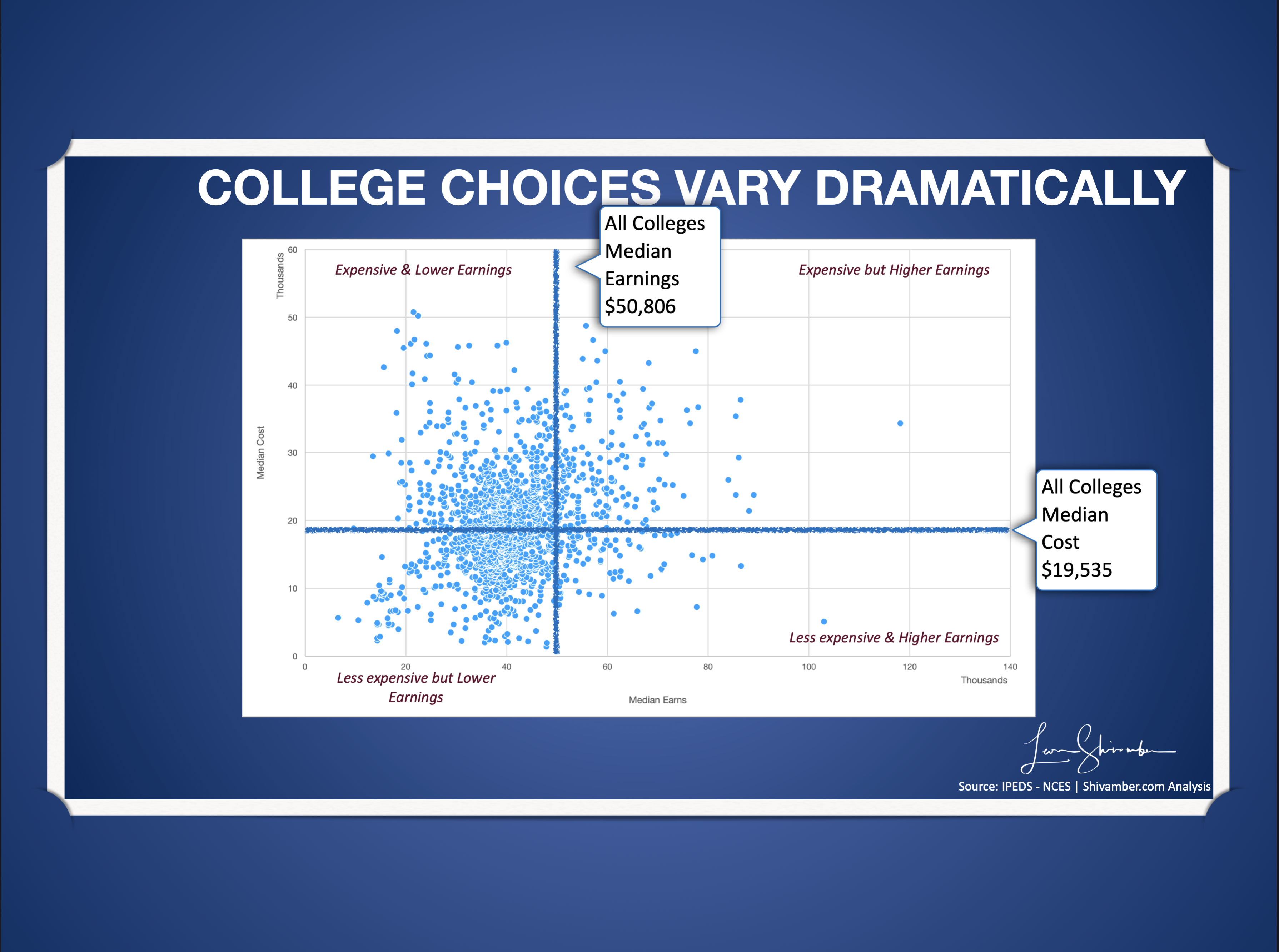

Results from the College Investment Model

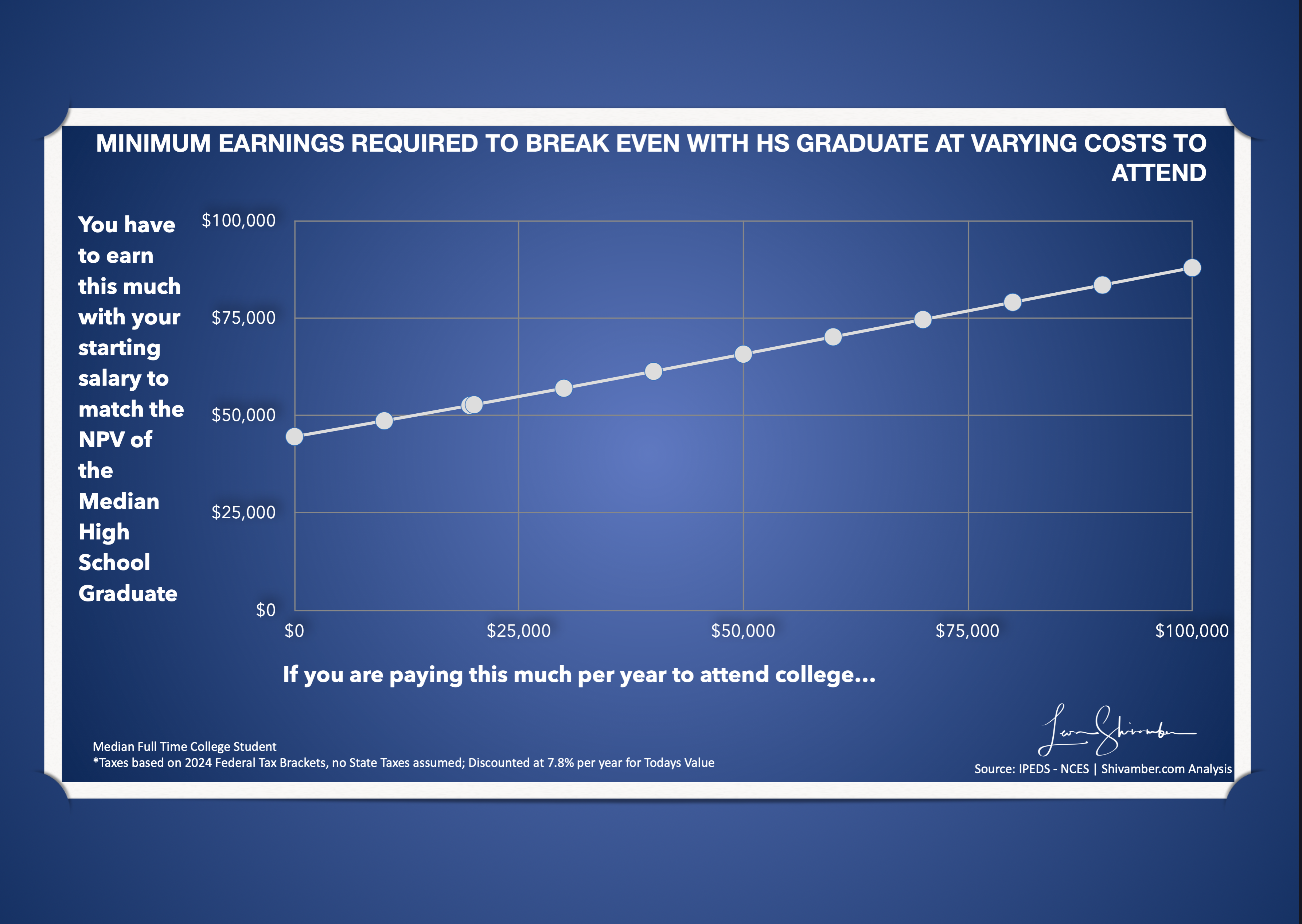

The College Investment Model can be used to evaluate any institution. All we need are the median salaries and costs of attendance.

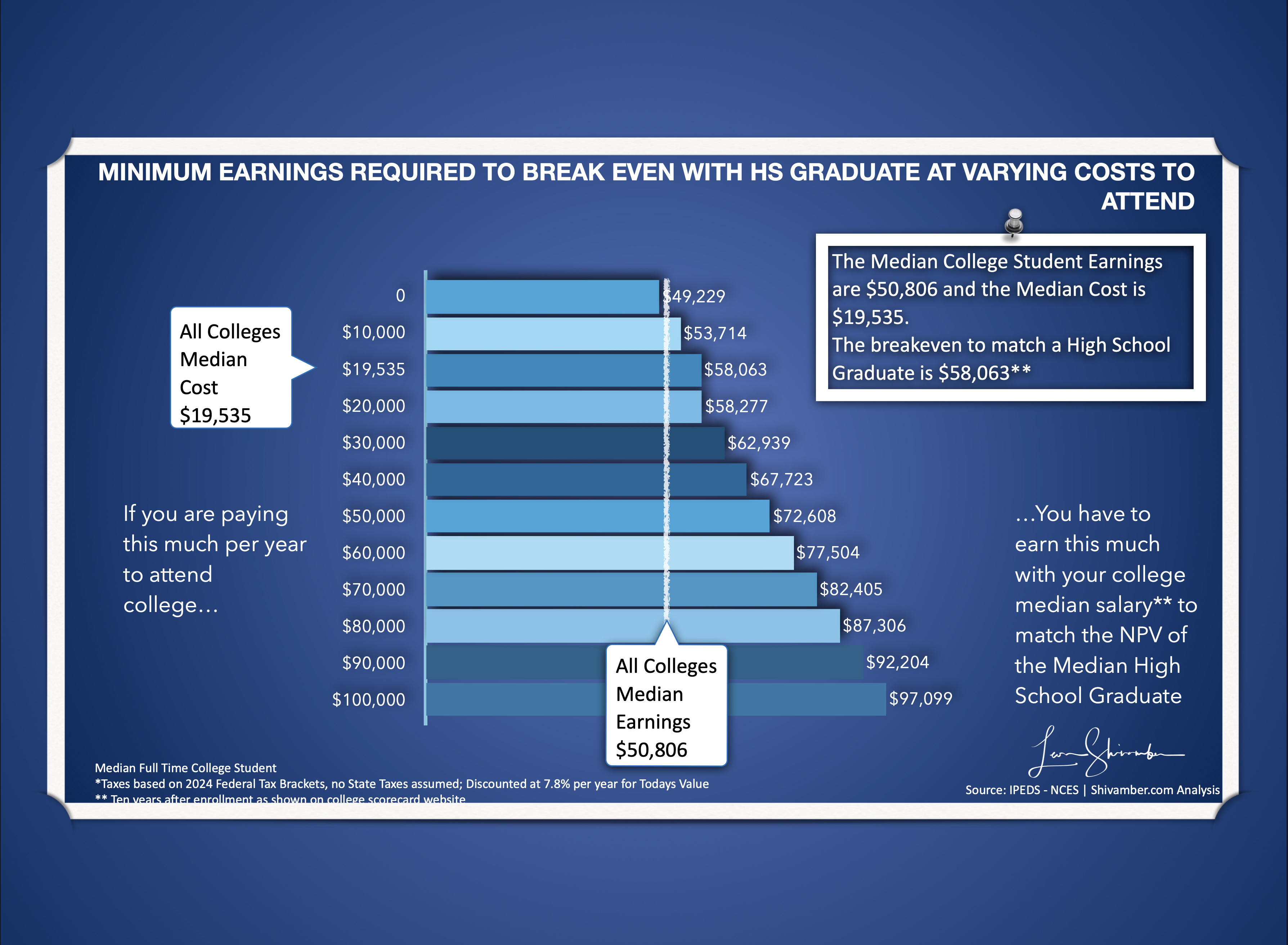

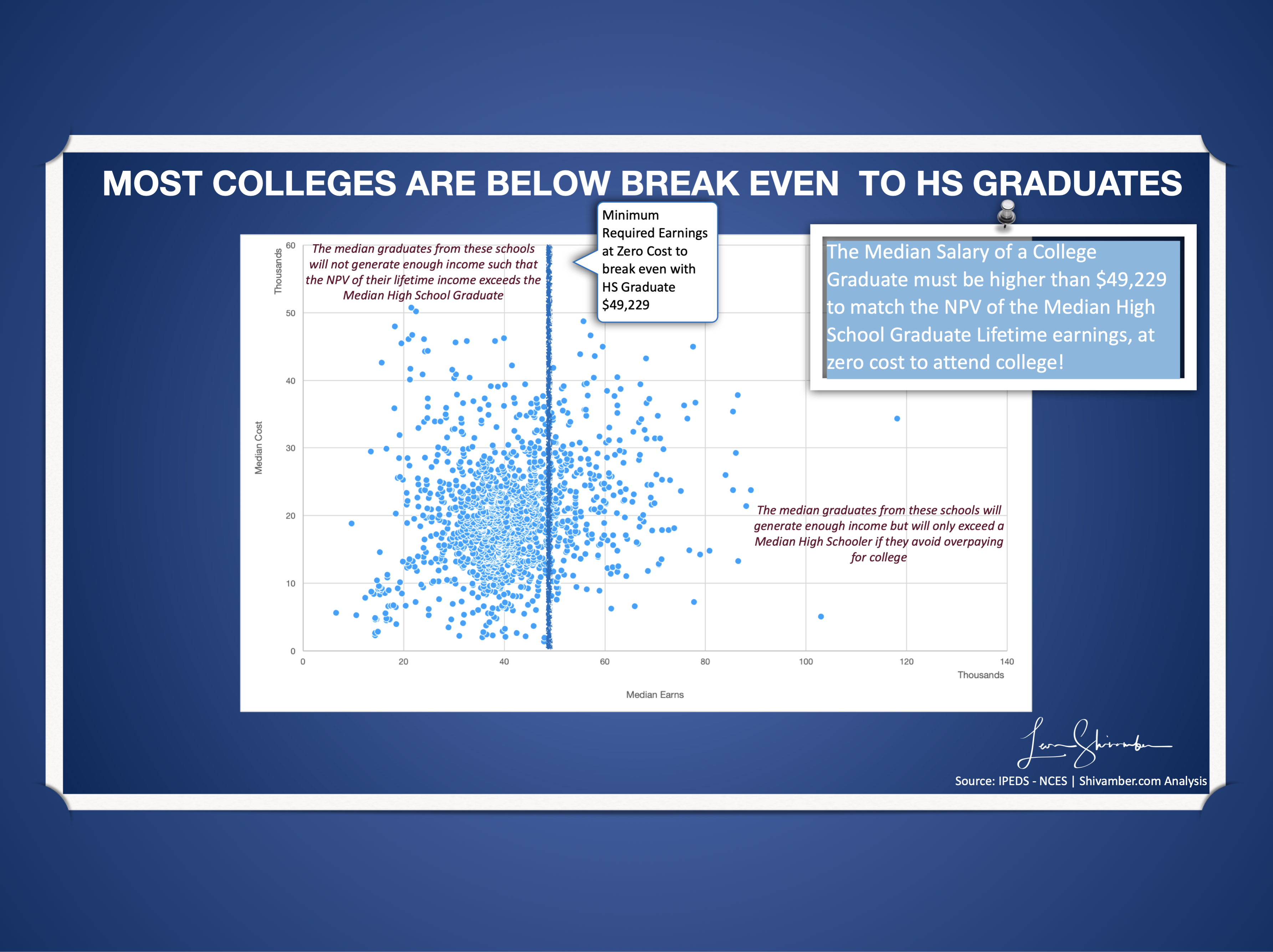

Using the model, we can identify the breakeven salary. That is the salary required for College costs to match a high school graduate’s value.

A student’s salary must exceed $49,229 for equivalence with a High School Graduate if they pay no costs to attend college.

This wage premium is required to compensate for the earnings foregone over four years of college to achieve the high school student equivalence.

We can also evaluate the median for all four-year institutions.

The median net college cost is $19,535 annually after grants and scholarships.

We estimate the median total price to be $27,090 (before grants and scholarships).

The median salary is $50,806.

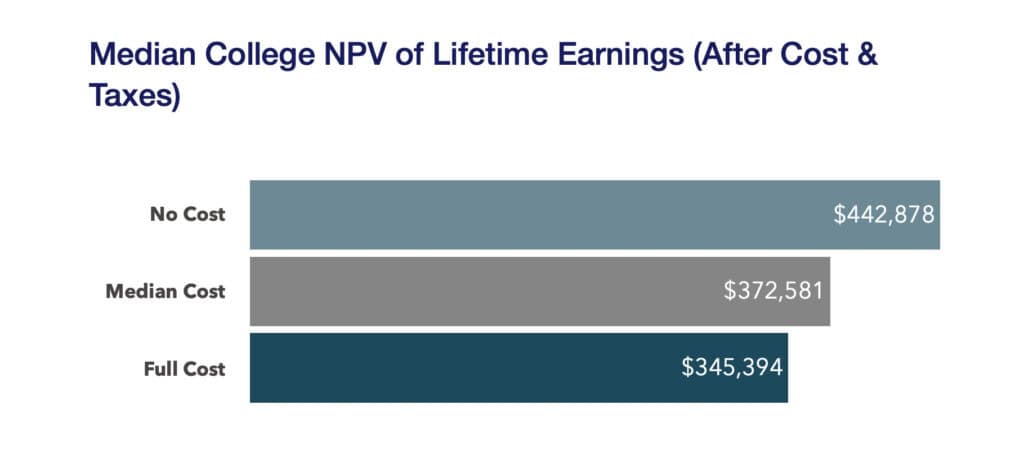

The Median College students earning the Median Salary would generate an NPV of $443k if they paid no tuition or fees, $373k if they paid the median fees, and $345k for total costs.

Median College NPV of Lifetime Earnings (After Cost & Taxes)

With the high school graduate return at $430k, here are the implications of those median college returns:

- 50% of four-year college students’ starting salaries will be at the median or below $50,806. This salary is close to the minimum requirement of $49,229 for breaking even with zero cost. That means a preponderance of four-year college students will generate a return below that of a high school graduate, even if they paid zero costs.

- 50% of four-year college students will pay a median or above $19,535 per year to attend college. The breakeven required to match the median High School graduate is $58,063. With a median salary of $50,806 or less, they will generate a return below that of the median high school graduate.

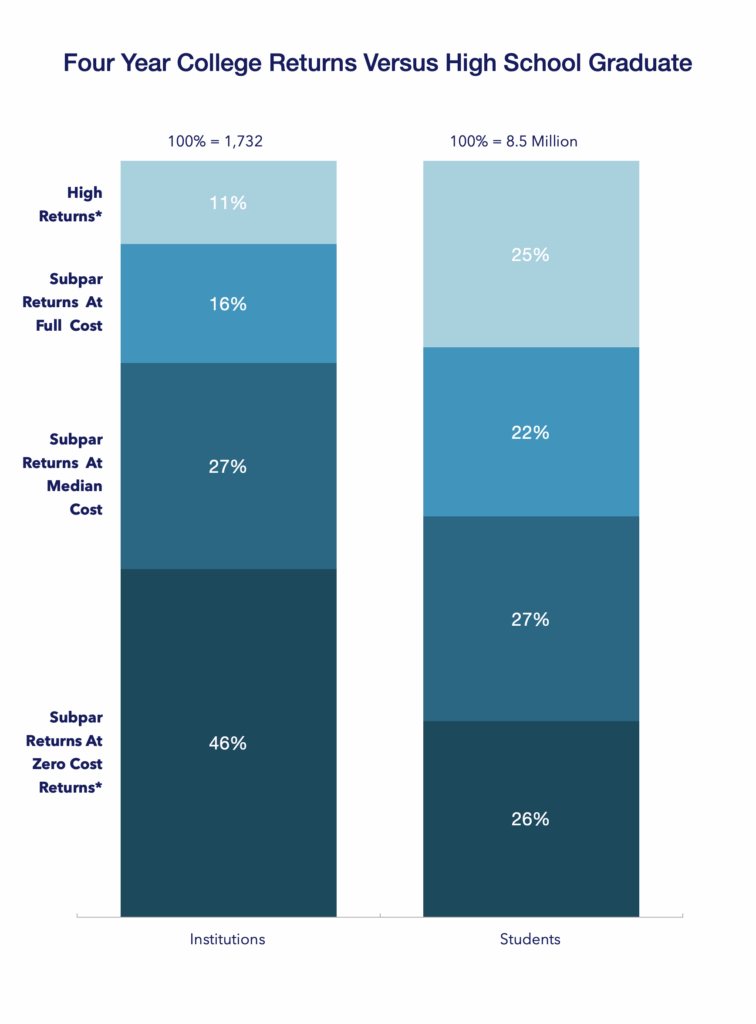

Our College Scorecard database found 1,732 four-year institutions with data we could use. They serve 8.5 million students.

How would these institutions stack up when we measure them against the breakeven required to match the median High School Graduate?

Would a student earning the median salary be safe if they paid the full cost? How about the median cost? Are there schools where the median earnings would be insufficient to generate a reasonable return even if the student went there for free?

More than a quarter of those students (2.2 million) attend 797 institutions (46%), where the median salary was less than required to break even with a high school graduate, even if the student paid nothing to attend those institutions!

Another quarter of students (2.3 million) attend 472 institutions (27%), where the median salary is insufficient to match the high school graduate’s return if you pay the median costs to attend. That means if the student paid the median costs or above (50% of them), and their salary was the median or below (50%), their return would be subpar.

272 Institutions (16%) hosting 1.9 million students (22%) have total costs that, if you paid full price and earned the median or below salary, you would generate a subpar return.

Only 11 percent of these institutions (191) with 2.1 million students delivered a median salary sufficient to generate a return higher than the median high school graduate, even if the student paid the full cost.

Even so, remember that some students will fail to achieve a good return even within these better institutions.

There are fields of study where the graduates will generate a subpar return because they earn below the median, depending on how much they pay.

Fields of Study Challenge

College graduates’ earnings vary substantially according to their major field of study (Monaghan & Jang, 2017). Moreover, majors typically trump the impact of college selectivity on labor market outcomes (Garman & Loury, 1995; Kim, Tamborini, and Sakamoto, 2015).

If you study Music, the median Berklee graduate earns approximately $33k, while the median Juilliard graduate earns $28k. Regardless of the amount paid to attend these schools, the earnings are insufficient to generate a return equivalent to a High School Graduate.

Conversely, Vanderbilt generates the highest median salary of $79k for its music graduates. That means a Vanderbilt student can pay up to $80k to attend and generate a breakeven return. Hopefully, they will spend less than that.

Two significant factors drive every institution’s overall median salary.

The first is the mix of the fields of study they offer. The median will be high if they provide mainly STEM, Engineering, Healthcare, or Business degrees. Liberal Arts and Humanities institutions will have lower medians.

The second factor is the attractiveness of an institution’s graduates to the employers’ marketplace. Call this the quality factor, as measured by the buyers.

Presumably, the more expensive institutions produce higher-quality students. However, that is only sometimes evident from the results.

Some fields of study have such great imbalances in significant supply and lower demand that the starting salaries are understandably low. Even a degree from an elite institution may not be enough for graduates in these fields to deliver a good return, independent of the cost paid.

Some examples of these fields of study include English Language and Literature, Psychology, Teacher Education and Professional Development, Sociology, Liberal Arts and Sciences, General Studies, and Humanities.

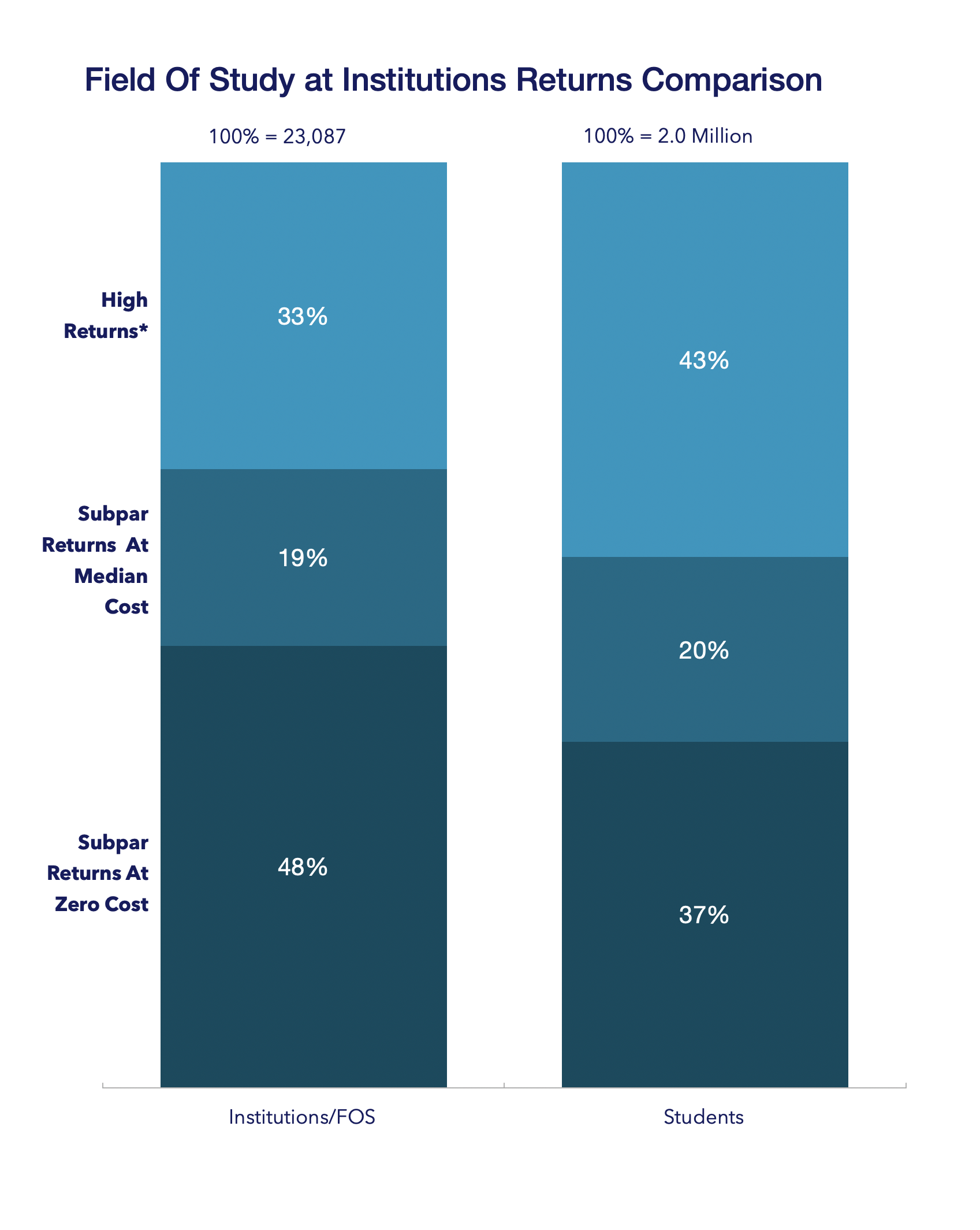

Our database provides insights on 23,087 fields of study/institution combinations, covering almost 2 million students:

- 37% of the students (747k) in Eleven thousand twenty-one combinations (48%) delivered subpar returns even when the student paid zero attendance costs.

- Another 20 percent of students (399k) were subpar in 4,406 fields of study/institution combinations (19%). The median salary was insufficient to match the high school graduate’s return when paying the median costs to attend.

- 43% of the students in a third of the fields/institution combinations delivered a median salary sufficient to generate a return higher than the median high school graduate when the student paid the median cost or less.

Some fields of study have such good supply-demand characteristics that graduates at almost every institution were able to generate a median salary sufficient to generate a better return.

These fields of study include the generally well-known attractive choices of Mechanical Engineering, Registered Nursing, Nursing Administration/Research, Information Science/Studies, Finance and Financial Management Services, and Computer and Information Sciences.

Even in those fields of study, some graduates will generate a subpar return because they earn below the median, and depending on how much they pay.

Pure liberal arts schools struggle to generate a meaningful investment return for their student, especially when they are expensive schools to attend.

Implications of fields of study challenges

It’s not just a college cost problem!

Some fields of study fail to deliver a better return even if attendance is free.

It’s also an opportunity cost problem.

We cannot force a socialized salary increase sufficient to fix a field of study challenge.

Artificially raising the wages for these fields of study would, in fact, further exacerbate the unfavorable supply-demand conditions.

Free college would also make things worse, attracting more candidates.

We must find creative approaches to balancing supply and demand.

Are 4-year college degrees necessary for some of the roles students take in these fields of study?

Employers should reconsider which roles require a bachelor’s degree. If completed on time, Associate Degrees reduce the opportunity cost by 50% and certificate programs by 75%.

Requiring a bachelor’s degree and paying less than $50k is akin to:

- Requiring the student to pay some quarter of a million dollars to buy tools before they can get a job.

- Offering a job that pays less than they could have earned without purchasing those tools.

Implications for Policy Makers

The prevailing wisdom leans towards the view that attending College is valuable even if you have not finished it.

That argues for more public funding. And there is no meaningful debate.

However, the evidence suggests that far different returns are generated depending on the field of study, the College selected, and the time it takes to graduate, among other factors. Thus, there should be dramatic differences in the return on tax funding.

Students generate different income returns by attending other colleges and studying different fields. The same is true for taxes generated. A Pell Grant to a Baruch College student generates a substantial return, while a Pell Grant to the median college student loses money.

Exploring Pell Grant Returns

We can take the Government’s view of partly funding college attendance using Pell Grants.

Federal Pell Grants are usually awarded only to undergraduate students with exceptional financial need and without a bachelor’s, graduate, or professional degree.

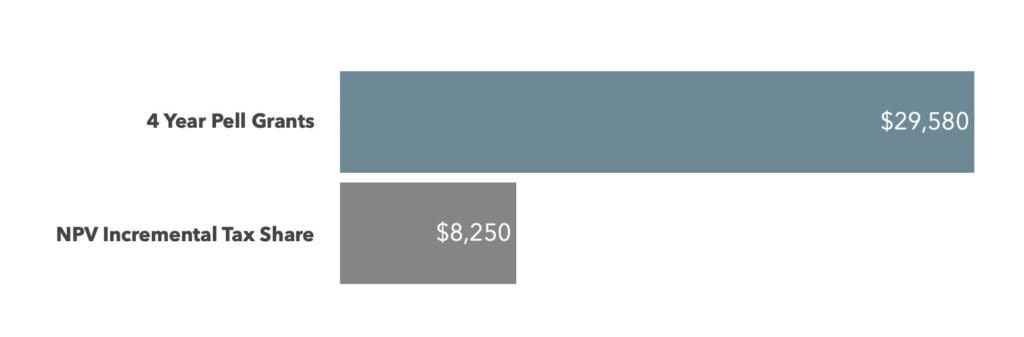

The maximum Pell Grant for fiscal 24-25 is $7,395, which pays for 27% of the median college cost per year ($27,090). The total Pell Grant funding over four years is an estimated $29,580. Due to price increases over the four years, this amount is approximately 25% of the total.

The Government does not have to spend any money if the high schooler goes to work. They are offering the Pell Grant to stimulate a shift to college. This decision should result in higher income and, thus, taxes.

Comparing Pell Grants To Returns in Tax Receipts – Median College

The Net Present Value of Lifetime Taxes generated by the median College Student over those generated by High School Graduates is approximately $33k. That’s all. Remember, this is Present Value. (12)

One-quarter of this was paid for by the Pell Grants, or $8.25k.

The Government provides almost $30k in funding to receive a fraction of their investment back ($8.25k return). That’s a loser.

In contrast, the same Pell Grant pays for 55% of a median Baruch College graduate per year. That student generates an incremental $124k NPV of Taxes over the High School Graduate. That $30k four-year funding now generates $68k of incremental taxes.

Comparing Pell Grants To Returns in Tax Receipts – Baruch College

The two are not the same! One generates a return, the other loses money.

Policymakers must rethink how we deploy taxpayers’ funds to ensure wiser investments.

The College Debt Problem

As you read this, College Loans exceed $1.77 trillion. (13) This obligation is 50% more than nationwide Credit Card debt ($1.10 trillion), and about 10% higher than Auto Loans ($1.62 trillion).

Our Economists, Administrators, the media, and policymakers have used the misleading college wage premium to promote college degrees as a no-brainer.

Our results suggest a need for improved financial literacy.

We can understand why we are in a college debt crisis when many college buyers are attracted to promised life-changing results without proper due diligence.

This uninformed behavior suggests dramatically higher debts that taxpayers and our Government must forgive as we unwind bad historical college investment decisions.

Low-cost debt is an excellent way to finance high-return investments. However, it can be disastrous when the investment generates subpar returns.

The debt decision should only occur after the decision maker considers the potential return on their investment.

Too many students likely acquire debt merely to attend a more expensive institution despite a subpar field of study.

We must reconsider the appropriateness of debt and ensure that the borrower conducts due diligence to understand the risks. Before considering debt, each student, high school counselor, and parent should calculate their college investment projections and discuss the implications.

The Retirement Crisis

The rising cost of college education, the burden of student loan debt, and the questionable value of some college degrees exacerbate the retirement crisis.

In 2022, the Federal Reserve estimates that 46% of American households do not have a retirement account, and the median value of those that do is $87k.(14)

They also estimate that 12% of those 60 years or older have no retirement savings. Among these, 59% know their retirement is not on track.(15)

It is 19% with no retirement savings for those 45 to 59. 66% of them are uncertain about their retirement.

Could the large payments parents are making to fund their children’s college degrees lead to a high proportion of this shortfall?

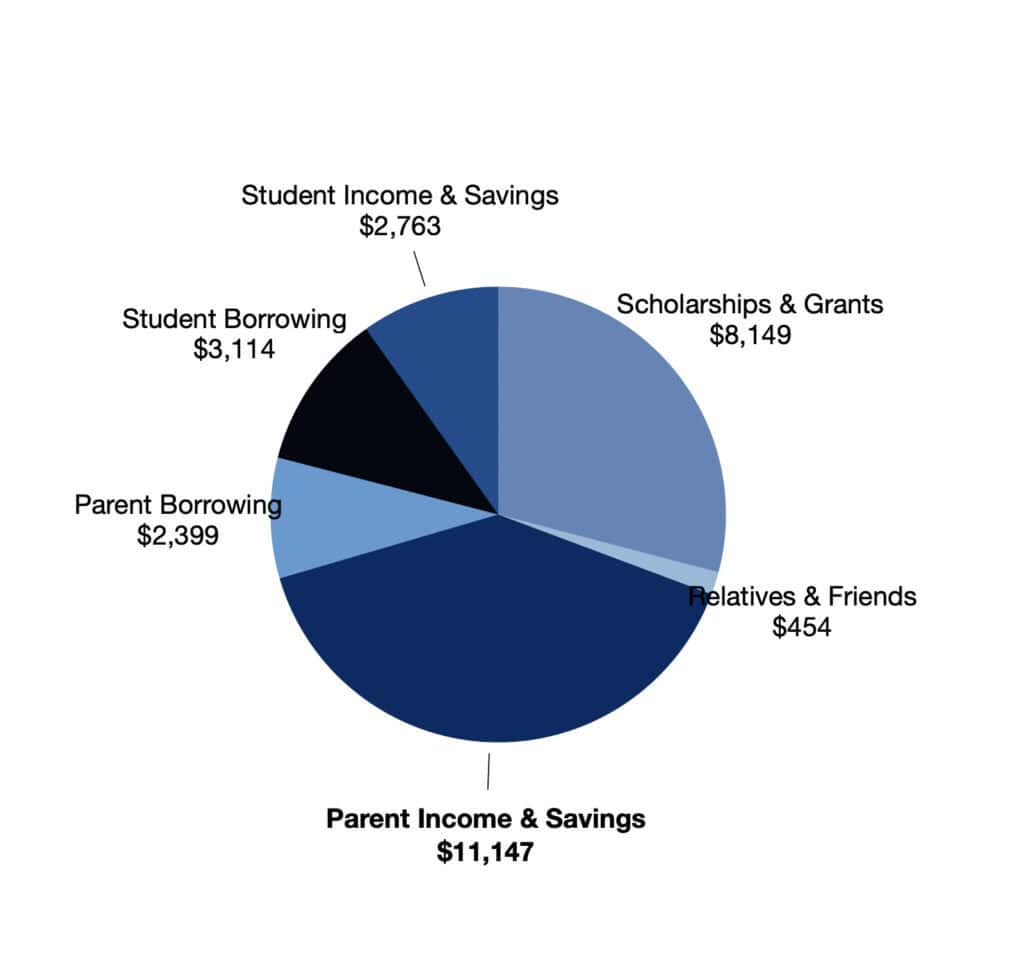

How America Pays for College

The Sallie Mae report How America Pays for College 2023 says, “Families spent an average of $28,026on College last year. 50% of those costs were covered by family income and savings and 29% by scholarships and grants.”(16)

The Parent Income and Savings contribution is worth $225k if invested at 7.8% over 40 years and $78.5k at 5%. That is for each year of contributions!

When financially challenged parents save for their children’s college education, a generational wealth transfer increases their retirement challenges. The crisis becomes more significant as the funded degrees generate subpar returns.

The transformation needed

Transformation takes place if there is a recognition that significant challenges and opportunities for improvement exist.

Education is essential to our society and the key to a better future. However, using the superb performance of some institutions to justify subpar college outcomes is social malpractice.

We have an information problem when we misinform the public and ignore proper due diligence on college investments.

We have a cost and quality problem. Too many fields of study and institutions produce degrees that generate subpar returns, even if the student attended for free.

Some subpar institutions will disappear, and others will restructure or merge to deliver the necessary results.

A small number of institutions get it right. They should be modeled and emulated.

Public policy will help by reducing subsidies, which create artificial demand and exacerbate the supply-demand equation. Public policy and donor investments will generate exceptional social returns when focusing funds on the most valuable social impact opportunities.

Higher education needs a transformation!

Reference Sources

- Peck, Emily. “Show This Chart to Anyone Who Tells You College Isn’t Worth It.” Axios. March 4, 2024. https://www.axios.com/2024/03/04/college-graduates-median-annual-wage-difference.

- Daly, Mary C., and Leila Bengali. 2014. “Is It Still Worth Going to College?” FRBSF Economic Letter 2014-13, May 5. https://www.frbsf.org/publications/economic-letter/2014/may/is-college-worth-it-education-tuition-wages/

- Valletta, Robert G., Leila Bengali, Marcus Sander and Cindy Zhao. 2014. Falling College Wage Premiums by Are and Ethnicity” FRBSF Economic Letter 2023-22, August 28. https://www.frbsf.org/research-and-insights/publications/economic-letter/2023/08/falling-college-wage-premiums-by-race-and-ethnicity/

- Anthony P. Carnevale, Ban Cheah, and Emma Wenzinger. The College Payoff: More Education Doesn’t Always Mean More Earnings. Washington, DC: Georgetown University Center on Education and the Workforce, 2021. cew.georgetown.edu/ collegepayoff2021.

- The Association of Public and Land-grant Universities. “How does a college degree improve graduates’ employment and earnings potential?” Accessed on July 10, 2024. https://www.aplu.org/our-work/4-policy-and-advocacy/publicuvalues/employment-earnings/

- Cunningham, Sue. “Claiming Our Story: The Importance of Higher Education to Transform Lives and Society.” Higher Education Today. American Council on Education, March 9, 2018. https://www.higheredtoday.org/2018/03/09/claiming-story-importance-higher-education-transform-lives-society/.

- Obama, Barack. “Remarks by the President on College Affordability — Buffalo, NY.” The White House President Barack Obama. WHite House, August 22, 2013. https://obamawhitehouse.archives.gov/realitycheck/the-press-office/2013/08/22/remarks-president-college-affordability-buffalo-ny.

- Shear, Michael, and Tamar Lewin. “On Bus Tour, Obama Seeks to Shame Colleges Into Easing Costs.” New York Times. New York Times, August 22, 2013. https://www.nytimes.com/2013/08/23/us/politics/obama-vows-to-shame-colleges-into-keeping-costs-down.html

- U.S. Department of Education. “Biden-Harris Administration to Create New National Recognition Program for Institutions that Increase Economic Mobility.” Ed.Gov., April 24, 2024. https://www.ed.gov/news/press-releases/biden-harris-administration-create-new-national-recognition-program-institutions-increase-economic-mobility.

- Knott, Katherine. “Battle Lines Drawn in Fight Over List.” Inside Higher Ed. Inside Higher Ed, February 13, 2023. https://www.insidehighered.com/news/2023/02/14/higher-ed-groups-oppose-plan-list-low-value-programs.

- U.S. Department of Education. ”Compare Schools and Fields of Study.” College Scorecard. Accessed July 10, 2024. https://collegescorecard.ed.gov/compare/?toggle%3Dinstitutions%26s%3D164748%26s%3D192110.

- Note: For our regular NPV related to the student or family, we used a 7.8% capital discount rate. However, we agree the government will have a different risk perspective and financing rate. Thus for the analysis of tax benefits over time accruing to the government, we calculated the NPV of the taxes with a lower cost of capital (5.4%). This is the current funding rate for the U.S. government debt and is more applicable to a Government portfolio.

- Federal Reserve Bank of New York. “Household Debt and Credit Report. (Q1 2024)“ Accessed on July 9, 2024. https://www.newyorkfed.org/microeconomics/hhdc

- Board of Governors of the Federal Reserve System. ”Survey of Consumer Finances (SCF) 1989-2022.” FederalReserve.Gov. Accessed July 10, 2024. https://www.federalreserve.gov/econres/scf/dataviz/scf/table/#series:Retirement_Accounts;demographic:all;population:all;units:median.

- Board of Governors of the Federal Reserve System. “Report on the Economic Well-Being of U.S. Households in 2022 – May 2023.” FederalReserve.Gov. Accessed July 10, 2024. https://www.federalreserve.gov/publications/2023-economic-well-being-of-us-households-in-2022-retirement-investments.htm.

- Sallie Mae. ”2023 How America Pays For College – Sallie Mae’s National Study of College Students and Parents Conducted by Ipsos.” SallieMae.Com. Accessed July 10, 2024. https://www.salliemae.com/content/dam/slm/writtencontent/Research/HowAmericaPaysforCollege2023.pdf.