Is a college degree worth it?

I have been trying to answer this question objectively for more than ten years.

I don’t mean the philosophical question of whether a college education is good for society, but a simple, value-oriented financial investment question.

I want to know when a chosen four-year college degree is worth investing in.

More precisely, is College a worthy investment for a given high school graduate and those investing on their behalf?

The broad consensus is that a college degree is valuable. Besides the prestige, it usually brings lower unemployment rates and higher wages.

Many studies support the college route, like this one at the Washington Post, which states, “Going to college is worth it—even if you drop out.”(1)

They reinforce the notion that a college degree is worth more to the recipient than not graduating from College over one’s lifetime.

But is it? Does it mean that every field of study, in every College, at every cost, is a good investment?

Parents will intuitively send their children to the best affordable schools they can get into. And even on the question of affordability, parents and students have been willing to pile on debt to afford more expensive schools because of the perceived benefits of that college degree. So, over $1.77 trillion is owed by families as they have made these investments in higher education.(2)

“Price is what you pay. Value is what you get.”

Warren Buffet

Do these investments make sense?

Are the perceptions of value borne out?

Unfortunately, the reality may be starker than you believe.

Some college degrees are incredible investments. Others could be better.

A college investment is a considerable commitment and must receive the requisite due diligence.

It’s crucial to note that investing in a college degree could potentially lead to subpar financial returns. Though not inevitable, this possibility is a risk that needs careful consideration.

Let me explain why and show you how you can make more fact-based and logical choices. By understanding the value of a college degree, you can take control of your investment in education and ensure it becomes valuable.

Don’t read the headlines. Those studies are wrong!

Many studies that show how much more money you earn because of earning a college degree are flawed. They are simplistic and not based on the underlying economic fundamentals of the choice and other reasonable alternatives.

Several studies are so simple that they don’t even adjust to the fact that you will work for fewer years while attending College.

Worse, the “Time value of money,” the most basic financial truth, is completely ignored in their evaluation, and the conclusion is ultimately wrong.

How should you view the investment in a college degree to figure out its ultimate worth?

In choosing to attend College, you give up the option of working after High School and will pay fees while in College. The payoff is that, upon graduation with your college degree, you will receive a higher salary than a high school graduate earns.

You would like to see that over your employment, the incremental wages you earn by attending College would more than offset the fees you paid and the wages you could have earned while attending College.

Those studies use these factors to show that, on average, the total wages earned by college graduates over their lifetime exceed what is earned by the average high school graduate.

Where do they go wrong?

They fail to adjust for the fact that a dollar today is worth more than a dollar tomorrow, “the time value of money.”

Every investor knows you should not just watch cash inflows and outflows without examining when they occur and adjusting them for their actual worth over time.

You inherently understand that no one will lend you $1,000 today and ask you to pay them back $1,000 five or ten years from now. That is because you know that the $1,000 should earn some interest, and you would expect to get back more than just $1,000. So, we need to adjust those future earnings for the ‘Time value of money,’ which is the idea that a dollar today is worth more than a dollar in the future due to its potential earning capacity.

Further, you only get to keep some of those incremental wages. The government takes some of it in taxes.

Thus, a failure of those studies to reflect tax differences and the time value of money leads to fatally flawed conclusions!

The right way to evaluate College Degree investments

The typical high school graduate faces a myriad of choices—whether to attend College, which College, which field of study, etc. These decisions are often influenced by financial constraints, which can limit what they can afford or how quickly they can graduate. This complexity underscores the need for a structured and informed approach to the college investment decision.

Our robust investment model is designed to empower you in your decision-making process. A structured and informed approach ensures you can make confident and well-informed choices about your college investment.

Investors faced with multiple investment choices with similar complexities use the discount cash flow model, a financial valuation method, to calculate the net present value of their various options. This model considers the time value of money, which is the concept that a dollar today is worth more than a dollar tomorrow, and adjusts future cash flows accordingly. The better choice must have the highest net present value.

Can we apply this model to a college investment?

Absolutely. The discount cash flow model is the most accurate and reliable method for adequately evaluating the various outflows and inflows and comparing choices. Its reliability should reassure you about the evaluation process.

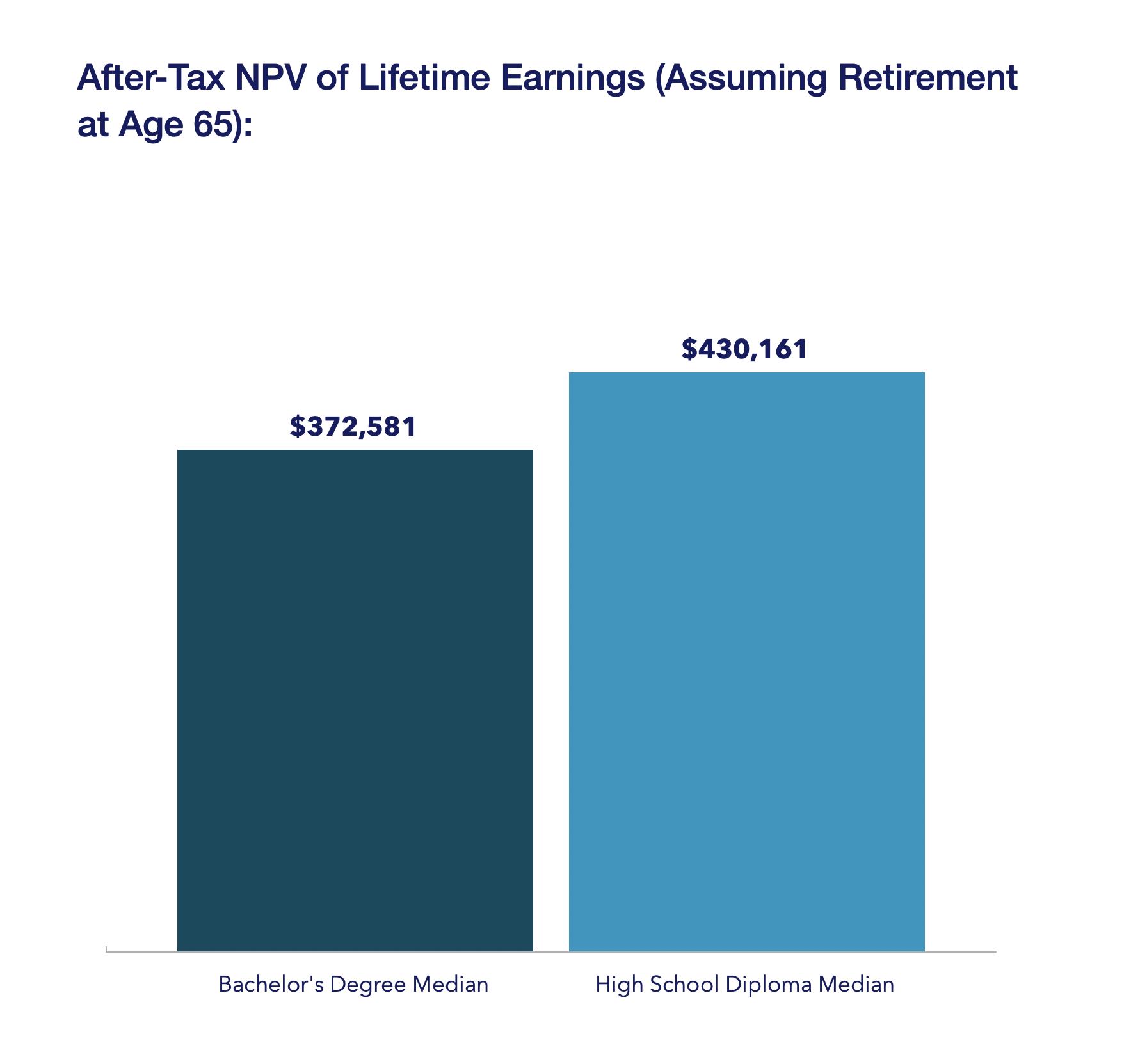

This result is the study everyone uses to promote the idea that a college degree is worth it; after all, you earn $600k more over your lifetime.

But what happens if we adjust those inflows and outflows over more than 40 years of payments and earnings for the time value of money?

The federal student loan rate for parent plus loans is 8.05%, but we previously used 7.8% in 2012, so let’s adjust all the cash flow each year using the lower discount rate. This calculation results in the net present value (NPV), the current value of all future cash flows, discounted at the appropriate rate.

What is happening here?

Trading off earlier wages and paying to do so means earning much more in later years to compensate for those.

And it gets worse.

If we adjust for taxes and then discount for the time value of money, this is what that comparison looks like:

We used the 2024 Federal Tax Rate Structure for a single individual, including a $14,600 standard deduction, a 6.2% Social Security, and 1.45% Medicare applied to a maximum of $168,600 annual wages. No state or local taxes were assumed.

The result is an investment that is economically worse than the alternative. The effect of taxes on wages and the time value of money together make this a terrible economic decision.

You can improve your college degree investment by paying less than was assumed here for College, such as by going to a less expensive institution or getting grants to reduce your outlay.

Is that college degree worth it?

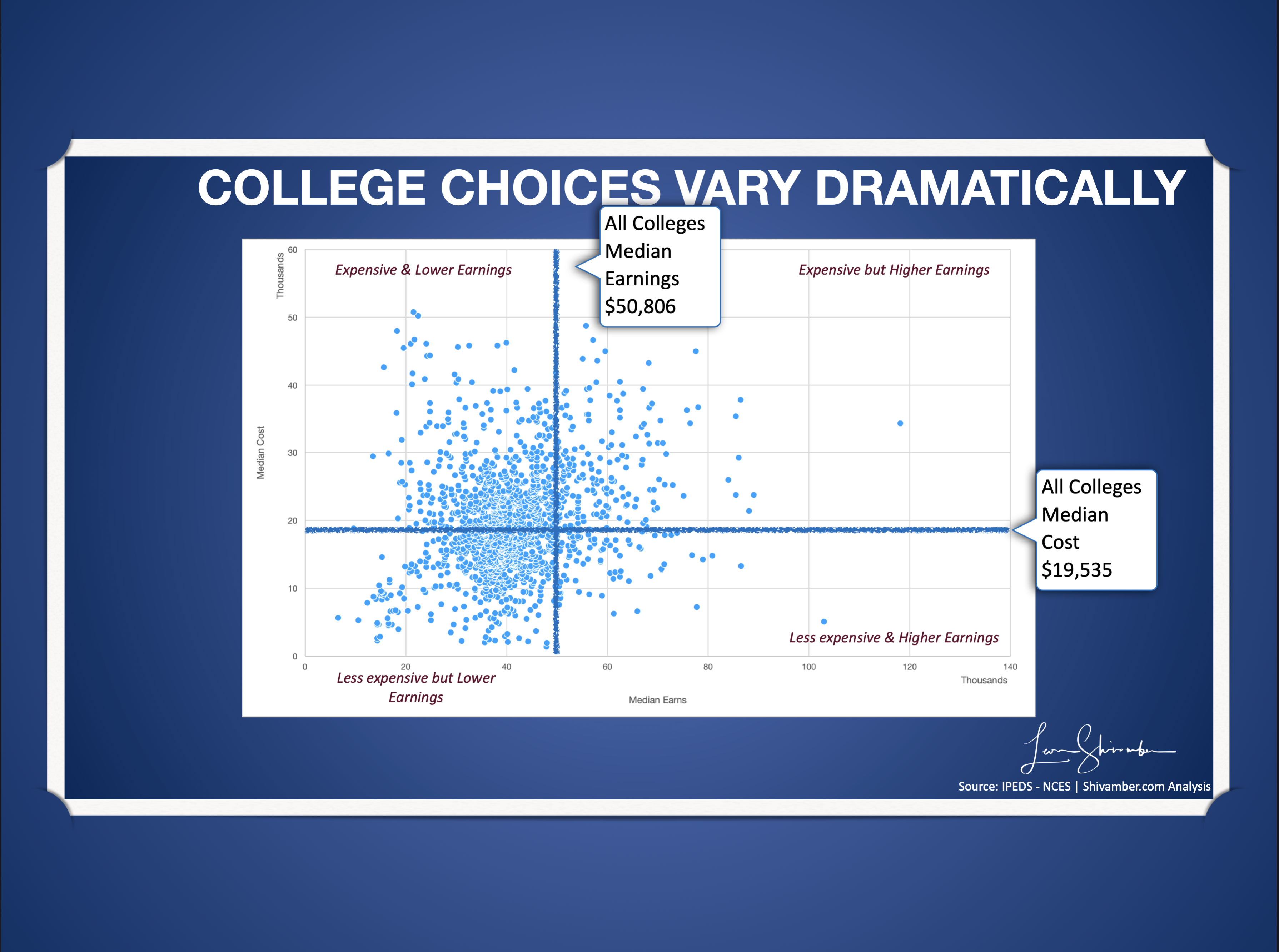

Our College Scorecard database found 1,732 institutions with data we could use. They serve 8.5 million students.

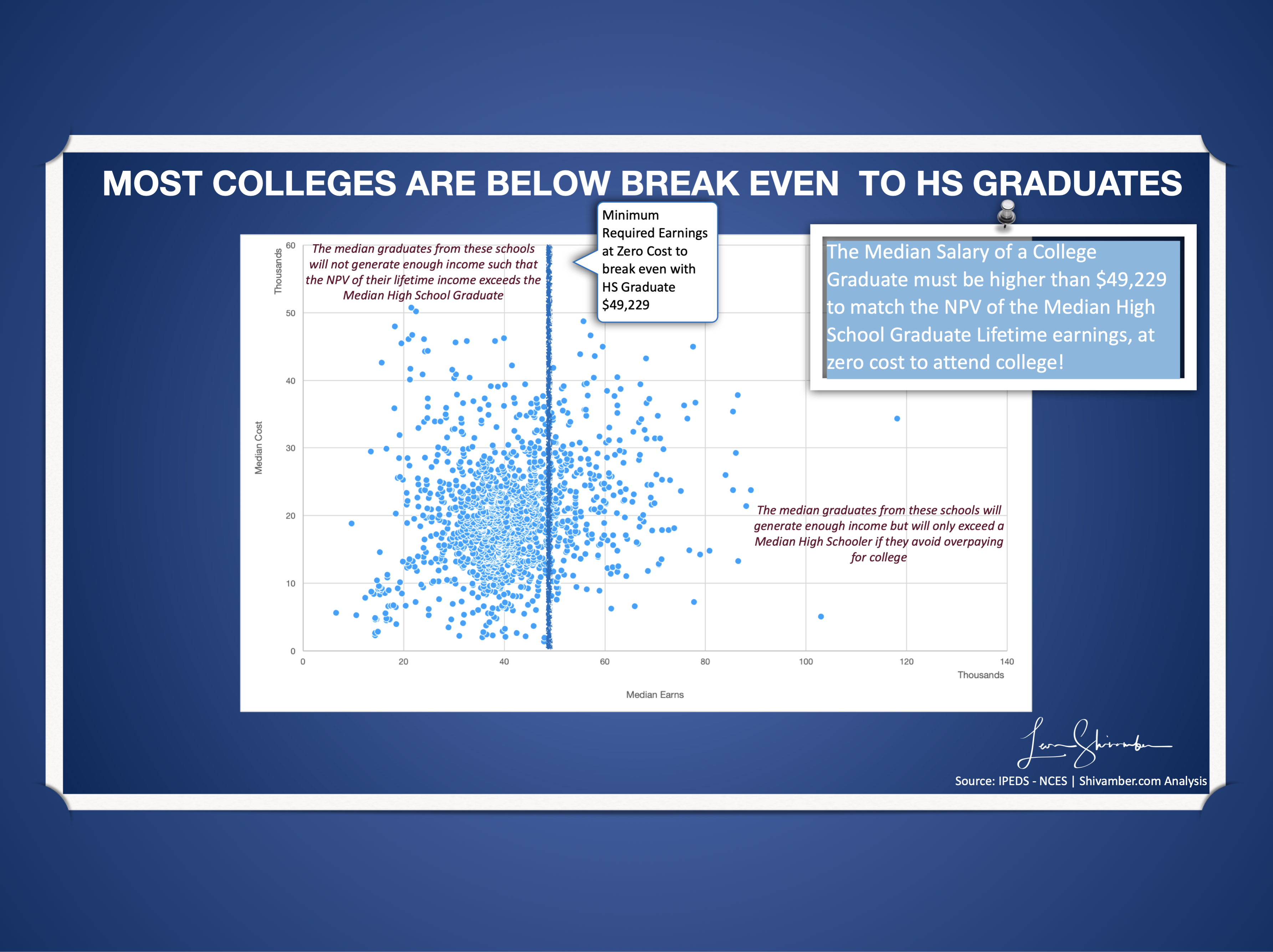

Nearly a quarter of those students (2.2 million) attend 797 institutions (46%), and the median salary was less than required to break even with a high school graduate, even if the student paid nothing to attend those institutions!

That’s worth repeating. Almost a quarter of four-year college students attend schools where, no matter what they pay (including nothing), if they make less than the median student, their college degree would provide a subpar return to a high school graduate. That would apply to at least 50% of those students!

Another quarter of students (2.3 million) attend 472 (27) institutions, where the median salary is insufficient to match the high school graduate’s return if you pay the median costs to attend. That means if the student paid the median costs or above (50% of them), and their salary was the median or below (50%), their return would be subpar.

272 Institutions (16%) hosting 1.9 million students (22%) have total costs so high that if you paid full price and earned the median or below salary, you would generate a subpar return.

Only 11 percent of these institutions (191) with 2.1 million students delivered a median salary sufficient to generate a return higher than the median high school graduate, even if the student paid the full cost. Keep in mind that even within these elite institutions, there are fields of study where the graduates will generate a subpar return because they earn below the median, depending on how much they pay.

The “College is more than Economics” argument

Whenever I discuss or read about college value skepticism, I inevitably hear the response that College is more than about income and wealth.

The New York Times wrote a thought-provoking article titled “Americans are losing faith in College. Whose fault is that?“(3)

One commenter says, “…we should reject the premise that a college education is above all a career strategy focused wholly on financial return on investment. And with that rejection, any aversion to humanities majors should also be thrown out the window.“

This comment is typical of the “College is not about economics” argument.

Wealthy parents can undoubtedly gift their college students a degree that generates subpar returns. Others are more likely to care that what they spend on a college degree is a reasonable investment.

Further, the purpose of pointing out the challenges in generating a good return by some fields of study and colleges is not to eliminate them but to develop insights and fixes leading to higher value.

Some fields of study experience significant upside-down supply-demand characteristics.

Government subsidies of demand are creating far more students, and the limited supply of spaces in institutions is driving up costs.

Even with constraints, the supply of graduates from some fields of study is more significant than the demand, which results in suboptimal wage levels.

For the fields struggling to generate a return, we need to reconsider their supply and demand, reevaluate how much families pay to get those degrees, and consider the quality of the degrees. All degrees significantly vary in what employers are willing to pay for their graduates.

The skepticism should not suggest that the humanities will disappear. It suggests the humanities will need to change.

What can you do?

The value of a college degree depends on the right combination of College selected, cost for attendance, and college major.

The more I have contemplated the worth of college degrees, the more it has become apparent that the question is ultimately a very personal one that each individual and their family grapples with. We can make a massive difference in improving college value by equipping decision makers with better tools and an understanding of the trade-offs.

It’s simple: the less you pay for college and the higher your salary upon graduation, the better off you will be.

If you get those wrong, you’ll make a costly decision. That’s why we built a college investment model to help you understand these choices and their financial implications.

Pick a field of study that’s in demand. Find schools that deliver a decent salary for relatively low costs.

Reference Sources

- Matthews, Dylan. “Going to college is worth it – even if you drop out” Washingtonpost.Com. The Washington Post, June 10, 2013. https://www.washingtonpost.com/news/wonk/wp/2013/06/10/going-to-college-is-worth-it-even-if-you-drop-out/.

- Federal Reserve Bank of New York. “Household Debt and Credit Report. (Q1 2024)“ Accessed on July 9, 2024. https://www.newyorkfed.org/microeconomics/hhdc.

- Tough, Paul. “Americans Are Losing Faith in the Value of College. Whose Fault Is That?” Nytimes.Com. New York Times, September 5, 2023. https://www.nytimes.com/2023/09/05/magazine/college-worth-price.html.