What happens when smart people trend follow, misinterpret their data, and lightly skim essential subjects? We can get consequential social failures that persist over very long periods. Let’s examine a real-time occurrence: The case of the Federal Reserve’s $1.6 Trillion Blind Spot.

“The moment we want to believe something, we suddenly see all the arguments for it, and become blind to the arguments against it.”

George Bernard Shaw

- How America’s Central Bank Misses Consequential Insights in Its Own Data

- The Shocking Reality Hidden in Plain Sight

- This Isn’t New. It’s Been an Ignored Systemic Failure for More Than 35 Years

- How the Federal Reserve Missed Its Own Story

- The Federal Reserve’s Contradictory Research

- The Credential Inflation Trap

- Why Smart Institutions Make Dumb Mistakes

- One Solution: Better Integrative Metrics

- What This Means for You

- The Bottom Line

- Reference Sources

How America’s Central Bank Misses Consequential Insights in Its Own Data

For decades, one statistic has held mythic power in American education policy: college graduates have lower unemployment rates than those without a degree. But what if this trusted metric obscures a more troubling reality that contributes meaningfully to the troublesome $1.6 trillion student loan debt?

The other metric that underlies the “any college is good” belief is the significant college wage premium. In simple terms, the college wage premium shows that the median college graduate earns more over their lifetime than the median high school graduate. I have written extensively on this issue, highlighting the limitations of a simplistic approach. Here is a good article to review: https://shivamber.com/a-critical-analysis-of-college-roi-research-georgetown-university-college-payoff/

Picture this: You’re hanging out with friends, and the conversation turns to their high school graduate considering college options.

Someone mentions they read that college graduates have much lower unemployment rates than high school graduates.

Everyone nods knowingly.

Case closed. College works. Right?

Hold on, not so fast. Let’s explore this point further.

As someone who spends my time challenging conventional wisdom, I recently came across something that should prompt every parent, student, and policymaker to pause and reflect.

The Federal Reserve, yes, that Federal Reserve, published research in May 2025 trumpeting the employment advantages of college graduates, while simultaneously sitting on data that tells a dramatically different story.

The story they missed?

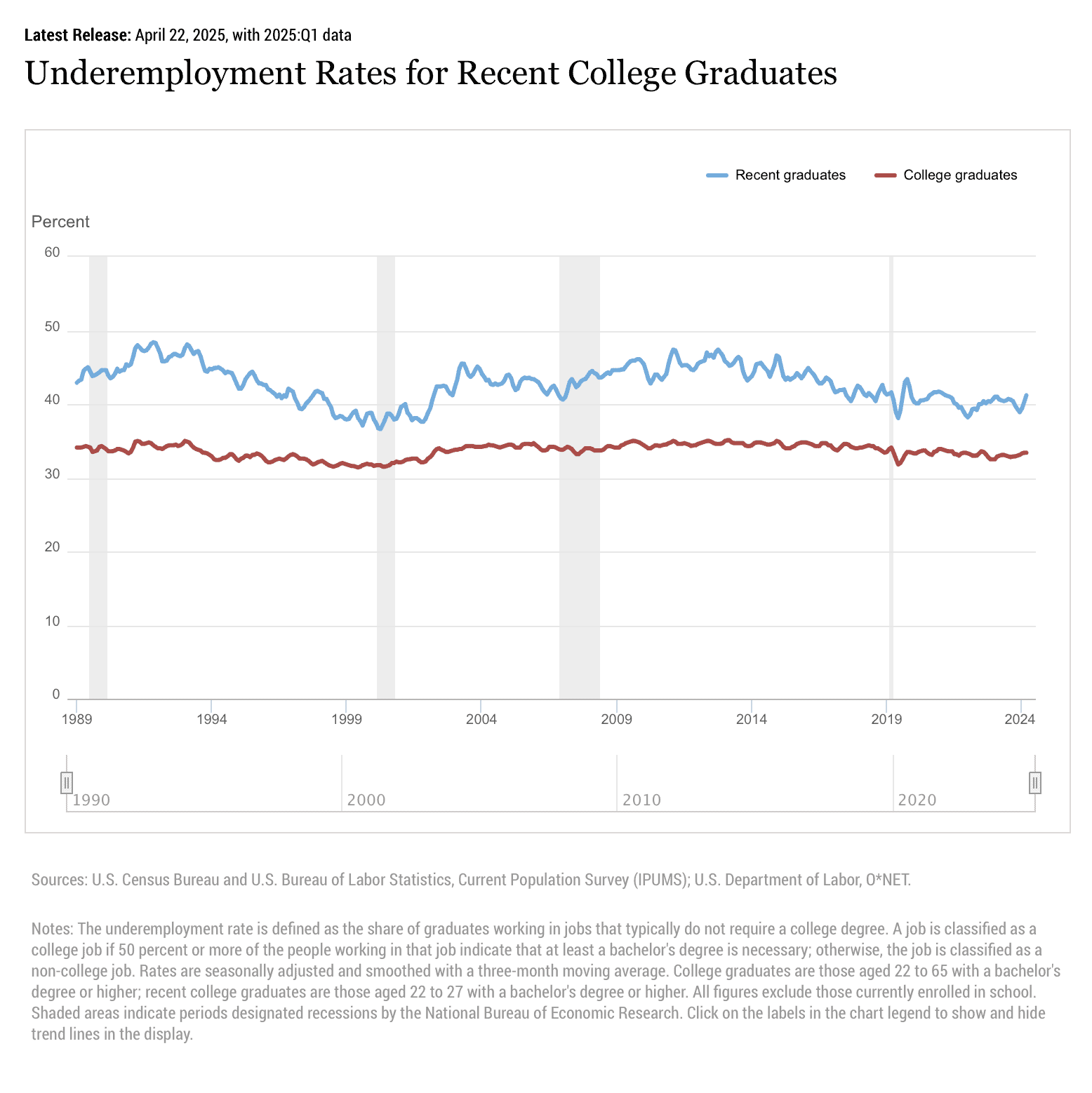

The unemployment rate for recent college graduates stands at 5.8%, nearly 50% higher than the overall rate for all workers at 4.0% (as of March 2025). Additionally, 41.2% of recent college graduates can’t find jobs that utilize their degrees.

Federal Reserve April 22, 2025

The Shocking Reality Hidden in Plain Sight

53% of recent college graduates are “effectively employed,” the rest are unable to secure degree-appropriate work

Let me break down what the Federal Reserve’s March 2025 data shows when you connect the dots they missed:

The Real Employment Picture for Recent College Graduates (Ages 22-27)

- 53% – Working in Degree-Required Jobs

- 41.2% – Underemployed (Working Below Degree Level)

- 5.8% – Unemployed

Source: Federal Reserve Bank of New York, March 2025

Read that again.

53% of recent college graduates are working in jobs that require their expensive degrees. The other 47% are either unemployed or competing with high school graduates for the same positions, often winning due to credential advantages that artificially inflate their “success” rates.

This Isn’t New. It’s Been an Ignored Systemic Failure for More Than 35 Years

Key Insight: Federal Reserve data shows that underemployment among recent college graduates has consistently ranged between 38% and 47% since 1990. For all college graduates, including those who have recently graduated, the underemployment rate has persisted at around 33%. This isn’t a temporary issue; it’s a structural flaw in our higher education employment system.

If any other industry showed a third of its products failing to work as advertised for three and a half decades, we’d call it a scandal. When it comes to higher education, we often refer to it as “the college experience.”

How the Federal Reserve Missed Its Own Story

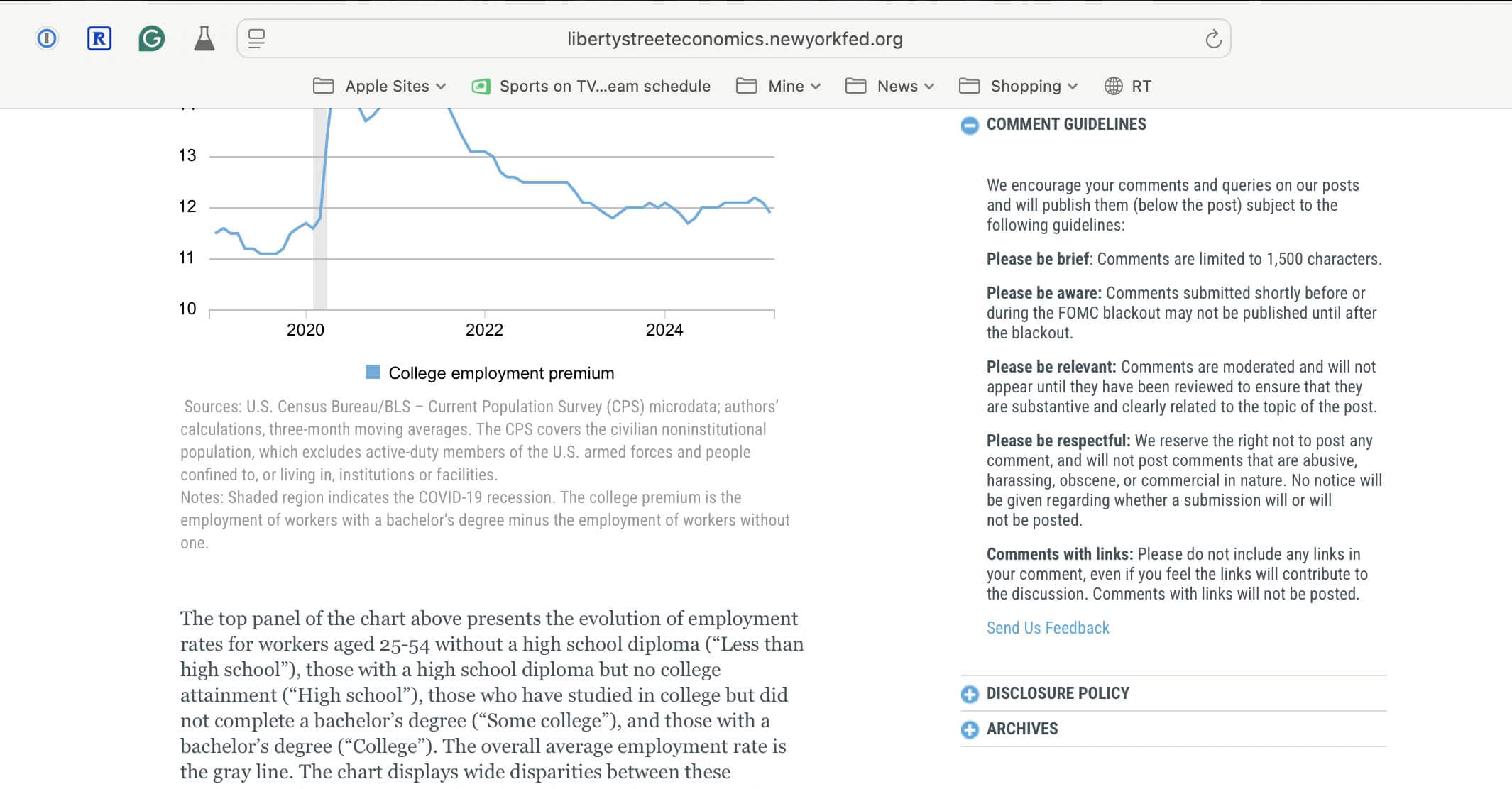

Here’s where it gets interesting. In May 2025, Federal Reserve researchers published “The College Economy: Educational Differences in Labor Market Outcomes,” highlighting the lower unemployment rates of college graduates as evidence of the value of higher education.

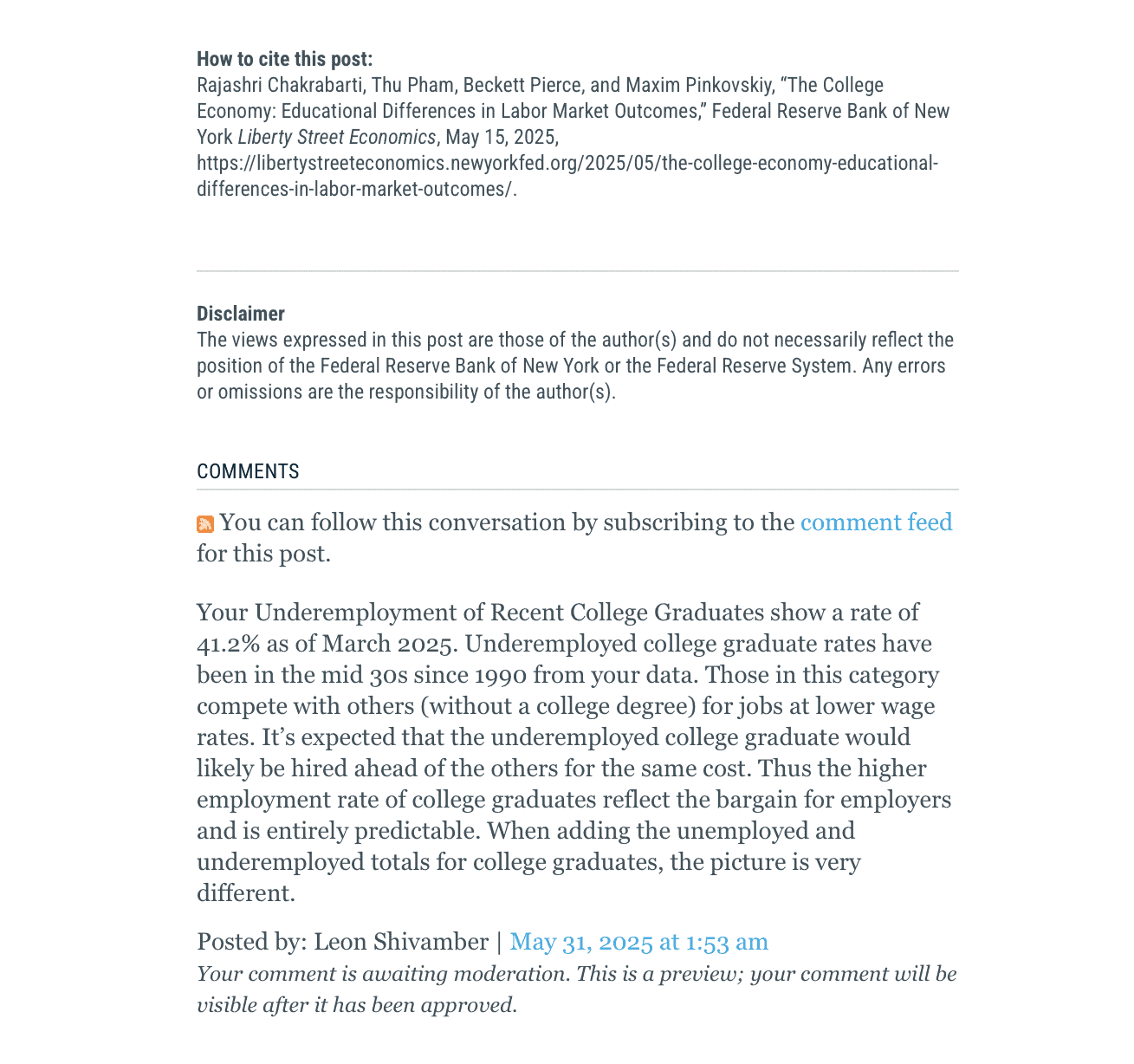

I read it and immediately noticed what they didn’t discuss: their comprehensive data on underemployment. So I submitted a comment on May 31st, pointing out that 41.2% of recent and 33.4% of all college graduates were underemployed.

They chose not to publish it.

Maybe it was poorly written, or they are thinking about it, and it’s stuck in moderation. I don’t think I violated their comment guidelines (attached below). I was brief, relevant, respectful, and did not include links.

Authoritative sites make it incredibly difficult to challenge their thinking.

Sometimes the most telling part of institutional research isn’t what they say, it’s what they won’t let others say.

The Federal Reserve’s Contradictory Research

Here’s where the cognitive dissonance reaches peak absurdity. Just one month before their employment analysis, in April 2025, Fed researchers published ROI studies acknowledging that college provides questionable returns for significant portions of graduates.

Return on Investment Comparison:

- Median of Graduates: 12.5% annual return on investment

- Bottom 25% of Graduates: 2.6% annual return, labeled by the Fed as “questionable investment”

These results dramatically understimate the problem, but that’s another story, which I will tackle in a later post. For now, we will run with their analysis.

Here is why we should be concerned about the Federal Reserve’s cognitive dissonance: The same institution simultaneously promotes the benefits of college employment while acknowledging that 25% of graduates receive questionable returns on their investment.

Now I hear you saying that 75% with good returns means a majority, and there’s nothing wrong with advocating for the benefits.

I agree with you if the 75% is right.

It’s not; it’s much lower.

However, even if it results in a 25% investment failure, given the high level of risk, advocacy should always come with a warning label.

These contradictory findings suggest that different research teams are operating with incompatible frameworks, failing to integrate their insights into coherent guidance.

The $1.6 Trillion Question

With outstanding student debt exceeding $1.6 trillion and millions of graduates working below their qualification levels, we’re witnessing the systematic misallocation of human and financial capital on an unprecedented scale.

The Credential Inflation Trap

However, what makes this even more insidious is that those 41.2% of recent underemployed college graduates don’t simply disappear. They create what I call “cascading displacement effects” throughout the job market.

One in five of the recent College graduates will eventually work their way into a position that requires their college degree. Still, a persistent third of all college graduates end up displacing high school graduates.

Consider this scenario: A marketing coordinator position opens up. It requires basic computer skills, practical communication abilities, and some creativity. These are all skills that a motivated high school graduate can handle. But when employers see a pile of résumés, they prefer the college graduate as “safer,” even when their degree adds zero value to job performance.

Research shows this dynamic may be costing 6.2 million workers job opportunities due to artificial degree requirements that exceed actual job demands. The larger unemployment rate of high school graduates is more than explained by this competition dynamic.

We’re wasting college graduates’ education; and we’re systematically locking out capable high school graduates from positions they could perform excellently.

Why Smart Institutions Make Dumb Mistakes

So, why does a sophisticated institution like the Federal Reserve miss insights hidden in its data?

Having worked with major organizations for decades, I’ve seen this pattern repeatedly:

Timeline of Institutional Blindness:

- Methodological Inertia – Researchers default to traditional unemployment metrics rather than integrated analyses that might challenge established frameworks

- Departmental Silos – Employment researchers and ROI researchers work separately, never synthesizing their conflicting findings

- Confirmation Bias – Institutional assumptions about college advantages lead analysts to frame studies that confirm rather than challenge conventional wisdom

- Echo Chamber Effects – Academic and policy institutions make alternative interpretations difficult to recognize or validate

One Solution: Better Integrative Metrics

Introducing the “Effective Employment Rate”

Instead of focusing solely on unemployment rates, let’s measure the percentage of graduates working in jobs that require their degrees. This single metric would instantly transform discussions about college outcomes.

Imagine if we evaluated medical treatments the way we assess college degrees. “Great news! Only 5.8% of patients died during treatment!” while ignoring that 41.2% saw no improvement in their condition. We’d demand better metrics and better outcomes.

A Better ROI

I have written extensively about the financial measurement of the potential value of a college degree. The simple college wage premium is not an effective measure for evaluating the investment in a college degree. Instead, I have recommended a proper assessment of the Net Present Value of Lifetime Income after costs and taxes, compared to the benchmark median of a High School Graduate.

Honest risk assessment and disclosure

When discussing college investments, there should be an honest disclosure of the risks.

It’s not enough to say the median college degree returns 12.5% if 25% of them return 2.6%. The Federal Reserve researchers write about the risks in a separate post, which may never be accessed by the parent or child eager to consider attending college.

What This Means for You

If you’re a parent or student: Don’t let unemployment headlines fool you. When nearly half of recent graduates are underemployed, you need to ask much more complex questions about specific programs, schools, and career outcomes.

If you’re a policymaker: Stop using incomplete metrics to justify policies affecting millions of lives and billions in taxpayer dollars. Demand integrated analyses that account for underemployment, ROI variations, and opportunity costs.

If you’re an employer: Examine whether your degree requirements align with job performance or simply reflect hiring convenience. You might be missing great talent while contributing to credential inflation.

If you are the Federal Reserve: Allow disparate voices to challenge your publications. Liberty Street Economics does allow comments, and I agree that spam could be a problem, but valid disagreements should be published.

The Bottom Line

The Federal Reserve case ultimately demonstrates that expertise without humility becomes a limitation rather than an asset. Sometimes, the most important questions come from outsiders asking “naive” questions that challenge fundamental assumptions.

The $1.6 trillion student loan debt is a blind spot, or, at worst, is tackled politically rather than strategically.

As someone who serves on a college fund board while working independently of government or academic institutions, I have both the freedom and responsibility to ask uncomfortable questions that insiders might find difficult to voice.

The human cost of missed insights, whether measured in misdirected educational investments, ineffective policies, or limited opportunities for workers, makes this intellectual blind spot impossible to ignore.

We can do better. We must demand better data, ask more probing questions, and recognize that even our most trusted institutions can miss critical insights when they operate within unchallenged assumptions about what matters most.

“The wisest institutions create systematic ways to ensure contrarian voices are heard and their insights integrated into decisions that affect millions of lives.”

The Federal Reserve’s $1.6 trillion blind spot proves that transformative insights often come not from sophisticated new research methods, but from examining familiar data through fresh analytical lenses that challenge institutional assumptions.

It’s time we started looking.

UPDATE: After emailing the editors of Liberty Street Economics, I received a response on October 8th from the Federal Reserve that my comment indeed did not violate any standards and has been published. That’s great news, and I hope it means they will do a better job of allowing diverse views and comments on these important issues!

Reference Sources

- The Federal Reserve Bank of New York Liberty Street Blog. https://libertystreeteconomics.newyorkfed.org/2025/05/the-college-economy-educational-differences-in-labor-market-outcomes/

- The Federal Reserve Bank of New York Economic Research. https://www.newyorkfed.org/research/college-labor-market#–:explore:unemployment

- The Federal Reserve Bank of New York Liberty Street Blog. https://libertystreeteconomics.newyorkfed.org/2025/04/when-college-might-not-be-worth-it/