Transforming Federal Income Taxes: Could we agree on a small tweak to increase economic mobility and Lift Millions out of poverty?

We have an economic mobility problem in the USA, with 41 million living below the federal poverty threshold.(1) It’s only 12.5% of our population(2) they say, which is lower than most. But for one of the wealthiest nations on earth, its 12.5% too high.

We often talk about changing the tax system to improve this situation. Those on the left want to raise taxes so that government subsidies can increase. Those on the right push back that handouts are not a sustainable fix.

What if I told you that a tiny tweak to our tax system could be so good it would be hard for anyone to argue with?

Better yet, it’s not a handout.

Moreover, this slight shift could lift half of America’s earners out of financial hardship, without breaking the bank.

That’s right; there are no overall tax increases, just a tiny shift.

Would you get behind such a change?

It sounds too good to be true, but the numbers tell a different story.

Let me explain.

“I am for doing good to the poor, but I differ in opinion about the means. I think the best way of doing good to the poor is not making them easy in poverty, but leading or driving them out of it.”

Benjamin Franklin

Our current tax system is progressive, meaning the wealthy pay a larger share of taxes, and by most measures, it’s working as designed. Yet, for millions of Americans earning less than a living wage, even a tiny tax burden can feel like a boulder on their backs.

Here’s the good news: a modest change could remove that burden entirely.

The cost? A mere fraction of what we already spend on foreign aid or lose to budget inefficiencies.

It could even be accomplished with a tiny shift among existing taxpayers, a shift that many would voluntarily accept.

Let’s dive into the data, challenge some assumptions, and explore how a slight shift could make a big difference.

The Current System: Fair, but Room for Empathy

Our federal tax system is built on progressivity, those who earn more pay more.

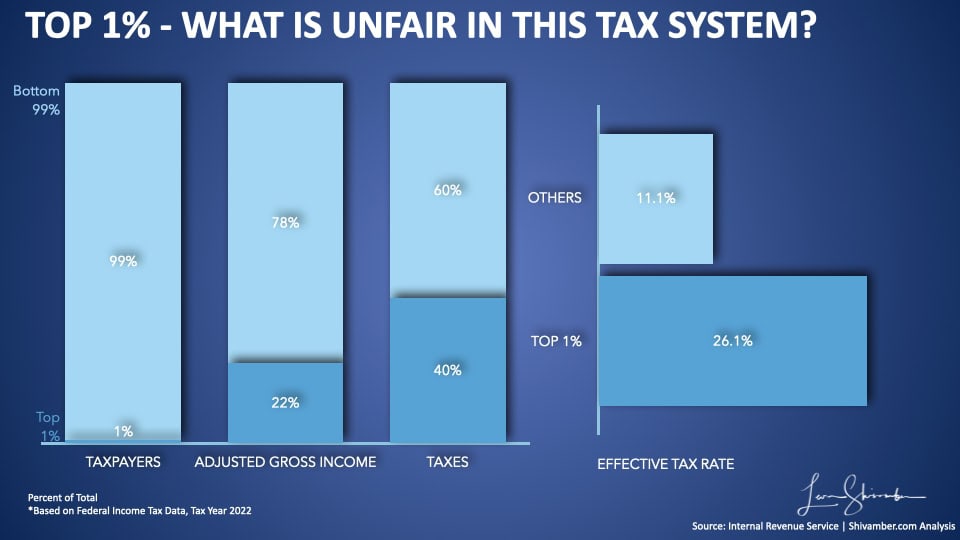

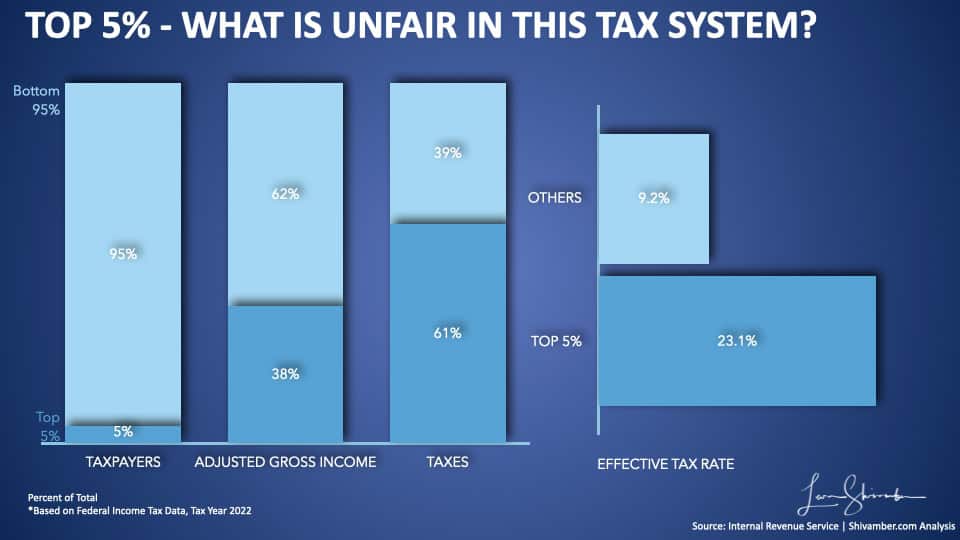

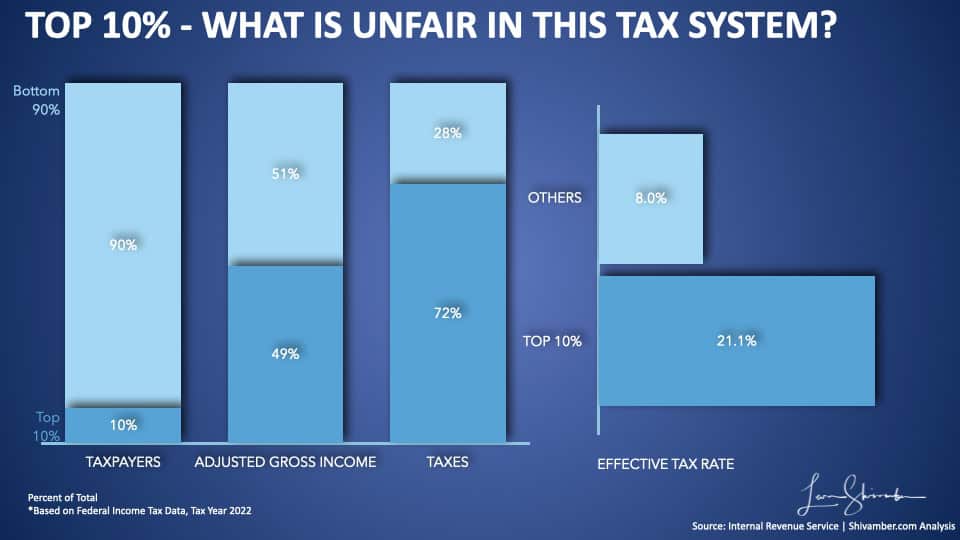

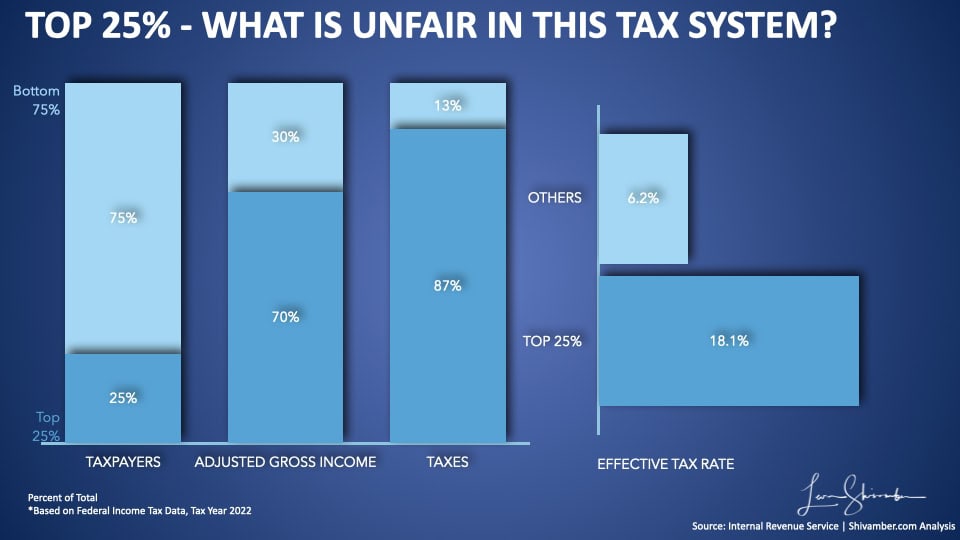

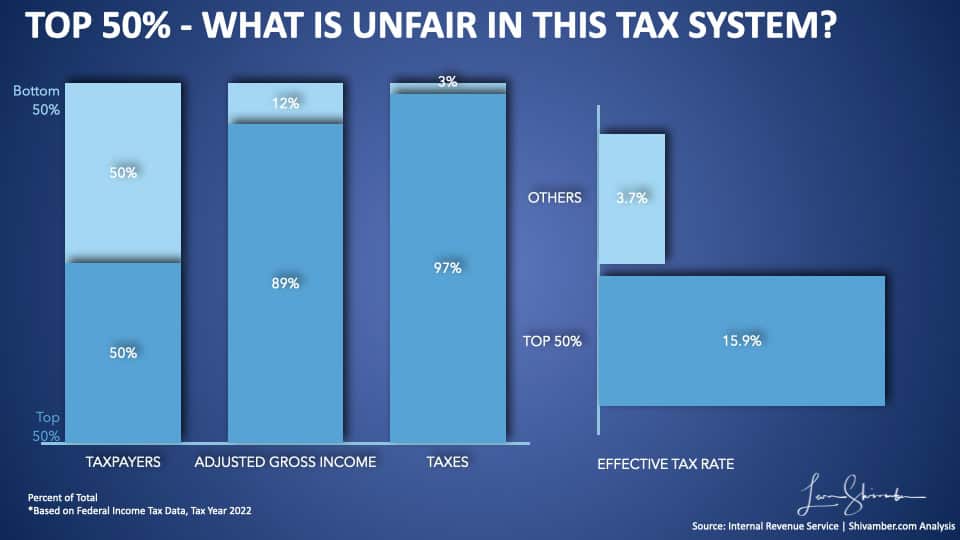

In 2022, the top 1% of earners (making over $663,164) paid 40.4% of all federal income taxes, despite earning just 26.1% of the nation’s income. Meanwhile, the bottom 50%, earning $50,339 or less, paid 3% of total taxes, even though they earned 11.5% of the income.(3)

On paper, this seems fair: the rich shoulder more, while the rest contribute less.

But fairness isn’t just about numbers, it’s about impact.

For the bottom 50%, that 3% tax share amounts to $63.2 billion, which could mean the difference between affording rent or falling behind.

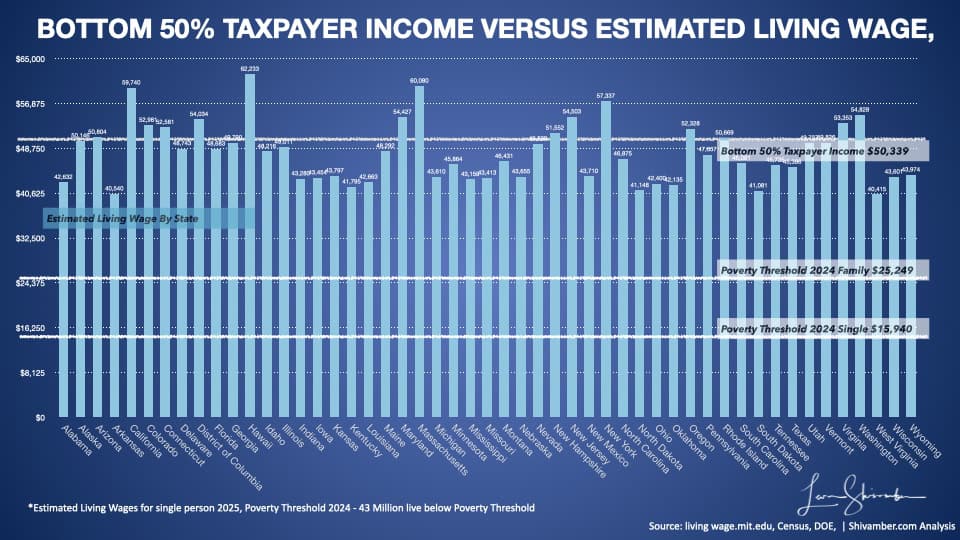

These families already earn less than the MIT-calculated living wage, which accounts for basic needs like housing, food, and healthcare.

In many regions, $50k doesn’t stretch far enough to cover the essentials, let alone taxes.

The Problem: Taxes on Those Who Can’t Afford Them

The MIT living wage calculator estimates the income needed for a modest but sustainable life. For a single adult, it starts at $40,540 in Arkansas and is over $60,000 in states like Hawaii and Massachusetts.(4)

The bottom 50% of earners, with a maximum income of $50,339, often fall short, especially in high-cost regions or for families with dependents. Yet, they still pay federal income taxes, chipping away at tight budgets.

This isn’t a statistic, it’s a daily struggle for half of America’s workforce.

Imagine working full-time, only to find that you can’t afford groceries and rent after taxes. That’s the reality for millions, a problem our tax system could help solve.

The Solution: Exempt the Bottom 50% from Federal Taxes

What if we exempted these earners from federal income taxes? They would continue to contribute to Social Security and Medicare, but not be required to pay additional income taxes.

This would mean forgoing $63.2 billion in tax revenue, a drop for a government that spends trillions annually.

For the bottom 50%, however, it would be life-changing. That extra money could cover childcare, car repairs, or even a small emergency fund, which builds stability.

But how do we make up the revenue? There are two straightforward options:

- A Tiny Tax Shift for the Top 50%

A mere 3.0% increase in taxes for the top half of earners could cover the entire $63.2 billion. We are not talking about 3% more taxes on their income; we mean a 3% increase in the taxes they pay. If they were paying $1,000 in taxes, they now pay $1,030! The top 50% pay an average income tax of $27k, which would increase by approximately $800 to $27.8k. For a single person making $100,000, it works out to about $500 more per year, about $40 a month. The average effective tax rate of the top 50% is 15.9%. It would rise to 16.4%. For the wealthy, it’s a rounding error; for the bottom 50%, it’s a massive lifeline. Wouldn’t Americans be willing to spend an extra $40 or $70 per month to ensure the weakest don’t suffer in poverty? - Cut Waste, Not Programs

Alternatively, we could look inward. The U.S. government spends over $60 billion annually on questionable aid and programs, which nearly matches the revenue gap. Or consider the billions lost to inefficiencies, duplicative programs, improper payments, and fraud, as flagged by the Government Accountability Office.(5) Redirecting even a fraction of this waste could make the exemption revenue-neutral, and no tax hikes would be needed. - Tweak discretionary tax breaks which exclusively favor the wealthy

The State and Local Tax (SALT) deduction historically sheltered $104 billion in federal taxes. These deductions ended up subsidizing local and state taxes. The Tax Cuts and Jobs Act (TCJA) of 2017 imposed a $10,000 cap on the deduction, significantly lowering costs to the current $21 billion.(6) If the cap expires after 2025, the revenue loss will return to a higher $139 billion.(7) These tax benefits are concentrated among high-income households, especially in high-tax states. Eliminate SALT deductions and save at least $21 billion, or as much as $139 billion after 2025.

Why It’s Feasible and Fair

This idea isn’t a pipe dream; it’s grounded in practical realities and aligns with values we already hold. Here’s why it can work:

Budget Perspective:

Picture your household budget.

If you could help a struggling neighbor by spending just 1% more on groceries each month, say, an extra $10 out of a $1,000 budget, wouldn’t you do it?

That’s the scale we’re talking about here.

The $63.2 billion needed is less than 1% of the federal budget, which topped $6.1 trillion in 2023.(8)

This isn’t about slashing programs or raising taxes through the roof; it’s about reallocating a tiny sliver of an enormous pie to make a massive difference for millions.

The federal government already juggles far larger sums without blinking. Think of the $1 trillion in annual defense spending. This is a rounding error by comparison.

Economic Boost:

Money in the hands of low-income families doesn’t sit idle, it moves.

That extra $500 or $1,000 a year per household doesn’t vanish into savings accounts or stock portfolios; it goes straight to local businesses. Think grocery stores stocking more shelves, repair shops fixing more cars, or daycares hiring extra staff.

Economists call this the multiplier effect: when low earners spend, it creates a ripple of activity that boosts communities from the ground up.

It’s relief; and, it’s a grassroots stimulus that strengthens the economy where it’s needed most.

Studies, like those from the Congressional Budget Office, consistently show that increasing disposable income for lower earners fuels demand more effectively than tax cuts for the wealthy. That is because the wealthy tax cuts dont always result in consumption, while lower income tax cuts do. Consumption is a fuel for economic growth.

Moral Clarity:

We’ve already bought into the idea that everyone deserves a living wage. It’s why we debate minimum wage laws and celebrate companies that pay fairly.

So why are we taxing people who don’t even reach that threshold? It’s like charging someone for water use because they have a well, even when it has run dry.

Exempting the bottom 50% isn’t about handouts but consistency with our principles. If we agree that $50k isn’t enough to live on in many parts of the country, why pile on a tax burden that pushes people further underwater?

This is not a handout.

It’s money they earned.

They are not slacking off, they continue to contribute social security, Medicare, and sales taxes.

This is about aligning our tax policy with the values we claim to uphold, fairness, opportunity, and a baseline of dignity.

The Pushback: Addressing the Critics

No change comes without objections, so let’s tackle the big ones head-on:

“It’s Unfair to the Wealthy”:

Critics might argue that the top 50% already carry the load, paying 97% of federal income taxes.

Adding a 3% increase feels like piling on, right?

But let’s break it down.

For someone earning $100,000, that’s about $40 a month, less than most pay for those takeout coffees.

For a millionaire, it’s a drop in the bucket. The top 1% currently experience a 26.1% effective tax rate. This tweak would change it to a meager 26.8%.

Now compare that to a family scraping by on $30,000: that $1,000 in tax relief could cover a month’s rent or a semester of school supplies.

The tax system does a decent job of creating tax policies that favor the wealthy, whether throught SALT dedcutions, accelerated depreciation for the Gelandawagon, or many others.

The effective tax rate of the wealthy top 1% is a relatively low 26.1% (the top federal income tax rate is 37%, so there are a lot of breaks).(9) The tax breaks are intended to stimulate certain industries and products. But, in practice, they tend to outlast their intended use and are gamed by those who can spend more time taking advantage of the complex code.

Fairness isn’t about who pays what percentage, it’s about who can bear the burden.

The wealthy won’t miss the additional contribution; low earners feel every dollar.

This isn’t punishing success; it’s recognizing the capacity to uplift those far behind.

“Foreign Aid Matters”:

Some will say we can’t cut foreign aid to fund this, it’s a lifeline for vulnerable people worldwide, and pulling back could hurt our global standing.

They’re not wrong; foreign aid is crucial, and the $50 billion we spend annually does real good.

But here’s the counterpoint: when half of Americans struggle to afford basics like food and housing, shouldn’t we prioritize our backyard first?

This isn’t about isolationism or abandoning allies; it’s about balance.

We don’t have to zero out foreign aid, trimming it slightly or redirecting inefficiencies elsewhere (like the $100 billion lost annually to improper payments, per GAO estimates) could cover the gap.

My mother was charitable, feeding the poor when we couldnt predict where our next meal would come from. The American people are the most generous in the world. The government aid programs are not the only way we have to help the poor around the world.

Charity starts at home, and a stronger domestic foundation lets us help others from a place of strength.

“It’s a Slippery Slope”:

The loudest skeptics might warn that exempting the bottom 50% opens the door to endless tax breaks, next it’ll be the bottom 75%, then no one pays taxes, and the system collapses.

It’s a fair concern, but this isn’t a free-for-all.

This proposal is targeted and data-driven, pegged to the MIT living wage standard, not some arbitrary line.

We’re not tossing out the tax code or handing out blank checks; we’re fine-tuning a specific pain point backed by economic reality.

Slippery slope arguments assume we can’t draw lines, but we already do. Think child tax credits or mortgage deductions.

This is just another deliberate adjustment, not a radical overhaul.

A Small Step, a Giant Leap for Fairness

Our tax system is fair by design, but could be improved in practice.

Exempting the bottom 50% from federal taxes isn’t radical. It’s empathetic.

It acknowledges that those below a living wage shouldn’t be taxed deeper into hardship. And with options to fund it through a tiny tax tweak or by tackling waste, it’s practical.

So, here’s the question: If we can lift millions out of financial strain with a change that costs less than 1% of the budget, why wouldn’t we?

Let’s rethink fairness and our community obligations, considering the lives it touches.

Reference Sources

(1) https://data.census.gov/table?q=Official%20Poverty%20Measure

(2) https://www.census.gov/search-results.html?searchType=web&cssp=SERP&q=Official+Poverty+Measure&search%3Atab=Pages#search

(3) https://taxfoundation.org/data/all/federal/latest-federal-income-tax-data-2025/

(4) https://livingwage.mit.edu

(5) https://www.gao.gov/products/gao-24-105833?utm_campaign=usgao_email&utm_content=topic_govops&utm_medium=email&utm_source=govdelivery

(6) https://taxpolicycenter.org/briefing-book/how-does-federal-income-tax-deduction-state-and-local-taxes-work

(7) https://bipartisanpolicy.org/explainer/how-salt-may-shake-up-the-2025-tax-debate/

(8) https://en.wikipedia.org/wiki/United_States_federal_budget

(9) https://www.irs.gov/filing/federal-income-tax-rates-and-brackets