I have been working on this series of articles about college value and higher education as a investment for over a decade.

Here are three charts to get you thinking…

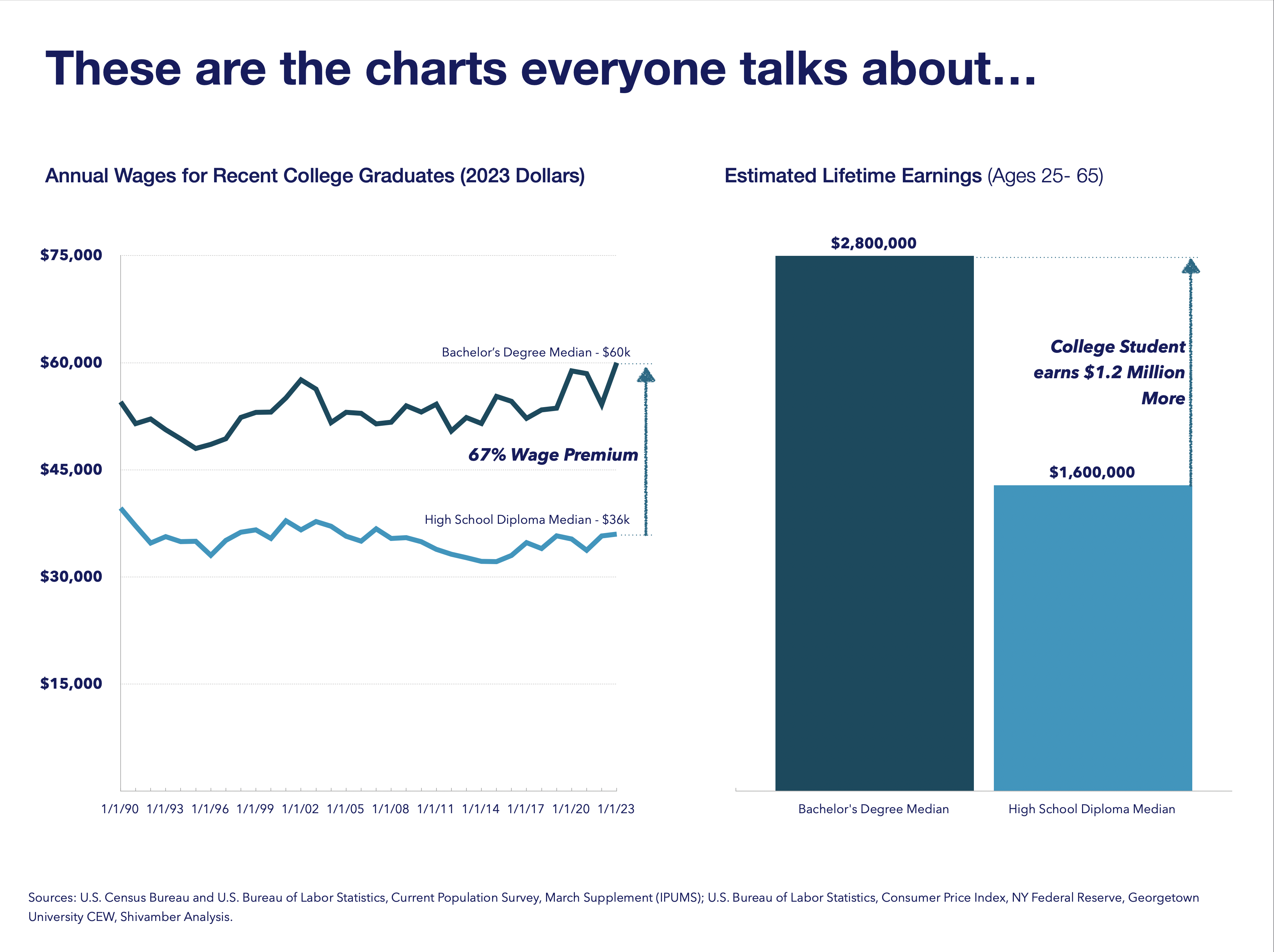

These are the charts everyone wants to talk about

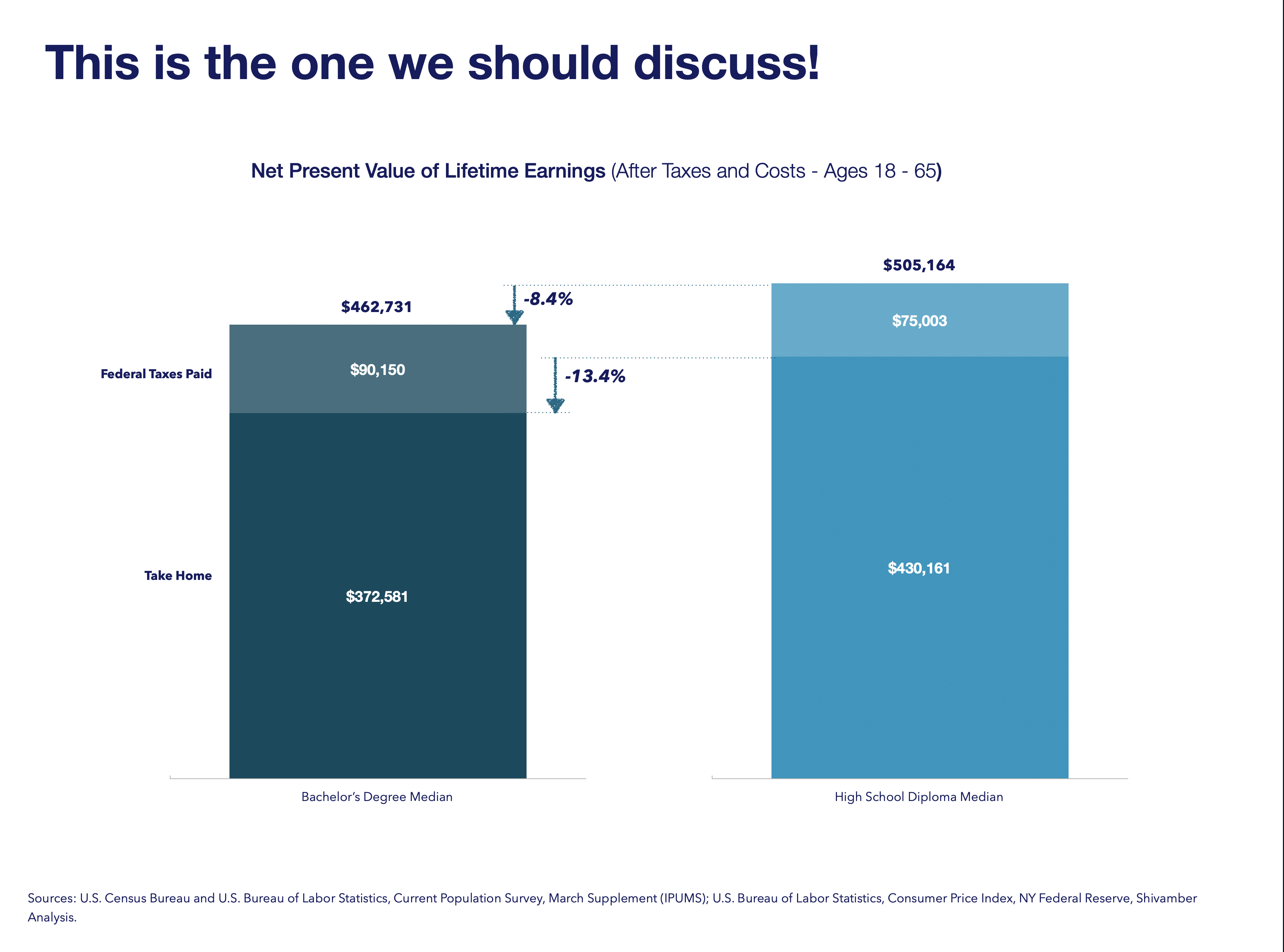

This is the one we should discuss

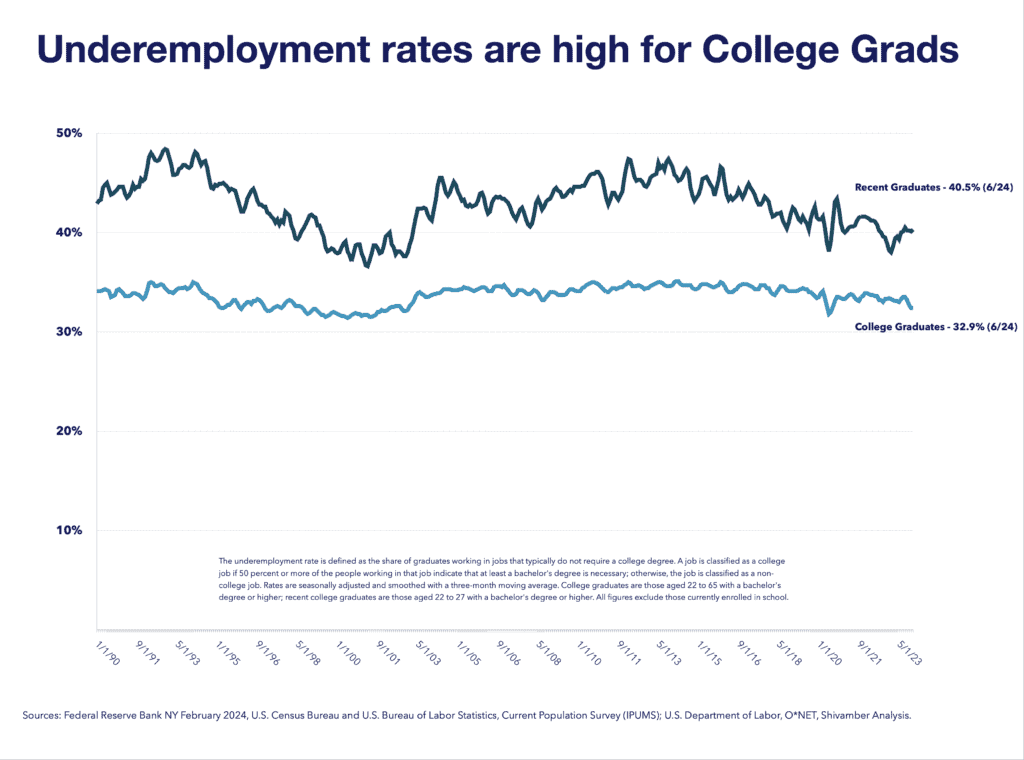

If you are not convinced, here is another

To get the full story, please read the following stories which dives into higher education as an investment in much more detail. I can promise its not what you think!

The Higher Education Series

A College Degree is transformational. A good choice will lead to upward mobility for the student and their family. A wrong choice is a financial disaster. The presumption that the latter is rare is fatally flawed.

We must improve financial literacy to understand the differences. Then, we can better transform higher education.

In this article I will lay out the case for why Higher Education needs a transformation. Read on to find out the surprising details.

-

We need to talk about Higher Education

We need to talk about higher education. Read on to see the surprising results of a decade long research effort to understand and highlight college value as an investment.

-

Higher Education needs a Transformation

A College Degree is transformational. A good choice will lead to upward mobility for the student and their family. A wrong choice is a financial disaster. The presumption that the latter is rare is fatally flawed. Higher education needs a transformation

-

Is a College degree worth it in 2025?

Is a college degree worth it in 2025? More precisely, is College a worthy investment for a given high school graduate and those investing on their behalf? Read on for the surprising answers

-

We need more Financial Literacy

Every pundit has stepped up to the plate, offering a range of college ROI ranking methodologies. In this article, I will explain, why we need more financial literacy, and using simple real-world examples, why many metrics will not help parents or students make better college choices.

-

Why are the experts using the “College Wage Premium” when it is misleading?

The Federal Reserve regularly reports on the college wage premium in America. Does the college wage premium help us reach a definitive conclusion on the question of college value?

-

What Does The College Wealth Premium Tell Us About College Value?

Higher Education researchers indicate that income and wealth are heavily influenced and indicative of the value of college. In this essay, we examine the claim. Does the state of America wealth, and specifically the college wealth premium, say much one way or the other about college value?

-

Warning: This Degree Could Be Hazardous To Your Wealth!

Higher education is generally believed to be good for your wealth. Yet here weare Warning: This degree could be hazardous to your wealth! Read on to find out why

-

The Challenge of Low Expectations

Perhaps one of the biggest roadblocks to higher education transformation is the ubiquitous challenge of low expectations. In this article, I will explore these low exceptions, how we got there, and propose some new ways to think about responsibility for improving education in the USA.

-

Are wealthy families better off with their kids in Harvard or Baruch?

Are wealthy families better off with their kids at Harvard or Bernard Baruch College? Sounds like a crazy question to ask. But let’s explore the details. Read on to learn something new about college choices

-

Why big donors prefer elite schools, and how they can improve their investment returns

Big donors prefer elite schools. Here is why and how those social impact investors can do much better.

-

Buying The Next Meltdown

Are current higher education policies likely to buy the next meltdown, this time among college investors? Read on for a look at the industry as we explore the likelihood.

-

A Toxic Combination, Bad Regulations, and Subsidies

Who is served with a toxic combination of bad regulations and subsidies for higher education? A cautionary tale

-

America’s $31 Billion College Bet: How Pell Grants Shape Higher Education

Every year, the federal government writes checks totaling over $31 billion to help low-income students attend college through the Federal Pell Grant program. Are we getting our money’s worth?

-

Rethinking How America Invests in College Students: How the Pell Grant is used matters!

The Pell Grant is a laudable attempt by the Federal Government to provide college cost relief to the financially challenged. Here’s why and how those federal investments can do much better.

-

College ratings are useful, rankings useless

Are rankings the best way to choose a college? I will show why you should ignore those rankings and why college ratings and the return on investment (ROI) are far more valuable tools for making informed decisions.

-

How to calculate a college return on investment

There are many ways to calculate a college return on investment. Many are incomplete and misleading. In this article we show you the most complete and useful method to help you navigate this critical decision

-

College return on investment? Whose ROI?

There are so many parties involved that when we talk about College Return on Investment, we ought to clarify whose ROI we are talking about. The return may be very different depending on who is being measured. Let’s explain.

-

Assumptions, caveats, data sources when determining a college return on investment

The College ROI is based on financial modeling. Every decision model makes assumptions. We explain our assumptions, caveats, data sources when determining a college return on investment

-

Degrees of Assumption: Examining the Fed’s College ROI Math

Examining the Federal Reserve latest research on college value and ROI. Do they get it right? WIll this bring more confidence to American families considering college?

-

The Damage When Smart People Miss Critical Insights? A $1.6 Trillion Blind Spot

The damage when smart people miss critical insights can be consequential. Explore the Federal Reserve researchers $1.6 Trillion blind spot

-

When does it make sense to use debt to finance higher education?

When does it make sense to use debt to finance higher education? Did the 42 million American who have borrowed $1.63 Trillion make the right decision? Is there a way up front to know if borrowing to finance college is a good idea?

-

A Critical Analysis of College ROI Research – Georgetown University College Payoff

CEW introduced its College Payoff Report in 2011. They established that, on average, higher education pays off with substantially higher lifetime earnings than those without college credentials. It has been a mainstay support in the argument over higher education value. Why then the growing skepticism, did they get it right?

-

A Critical Analysis of College ROI Research – Georgetown University ROI

Georgetown University CEW introduced its first try at calculating college ROI in 2019. Did they get it right?

-

Unmasking the Flaws of College ROI Research – A Critical Look at IHEP Rising Above The Threshold

IHEP says 83% of American Colleges exceed Threshold 0 and therefore generate a beneficial return to college graduates above that of a high schooler. Does this research hold up?

-

Who am I, and why am I writing about Higher Education?

Too many American families do not adequately understand their choice of college investment. College can be a better investment!