There are nearly 6,000 institutions of higher education in the USA, of which almost 4,000 are degree-granting institutions.

All of them receive external funding to support their mission.

Many receive private support for their mission through donations from social impact investors, alumni, and foundations.

A small number of those institutions, often the elite and prestigious ones, receive disproportionate donations. This concentration of funds can have significant implications for the overall funding landscape of higher education, potentially leaving other institutions with fewer resources to support their missions.

Here is why and how those social impact investors can do much better.

“A life is not important except in the impact it has on other lives.”

Jackie Robinson

Why do big donors give?

Generous donors give to select higher education institutions for a variety of reasons:

- Affiliation and loyalty: Many large donors are alumni of the institutions they support, driven not just by a deep sense of community but also by shared values and a desire to give back to their alma mater.Prestige and reputation: Elite and prestigious universities with solid academic reputations tend to attract more large donors, who view their gifts as investments in maintaining institutional excellence and global standing.

- Targeted impact: Large donors often have specific interests or causes they wish to support, such as funding research in a particular field, establishing scholarships, or supporting capital projects. They select institutions that are aligned with those interests and driven by a sense of responsibility and duty towards society.

- Tax benefits: In the U.S., large charitable donations to educational institutions can provide significant tax deductions for wealthy individuals and organizations, incentivizing giving.

- Legacy and recognition: Some large donors are motivated by the prospect of having their name attached to buildings, programs, or endowed positions, creating a lasting legacy at the institution.

- Influence and access: There are concerns that substantial gifts may give donors undue influence over institutional decisions, admissions processes, or academic priorities, though institutions aim to maintain independence.

While personal gratification may be involved, donors usually want to see their money put to good use and have a positive social impact. This sense of pride and accomplishment is a significant motivator for many big donors.

Who are the favored institutions?

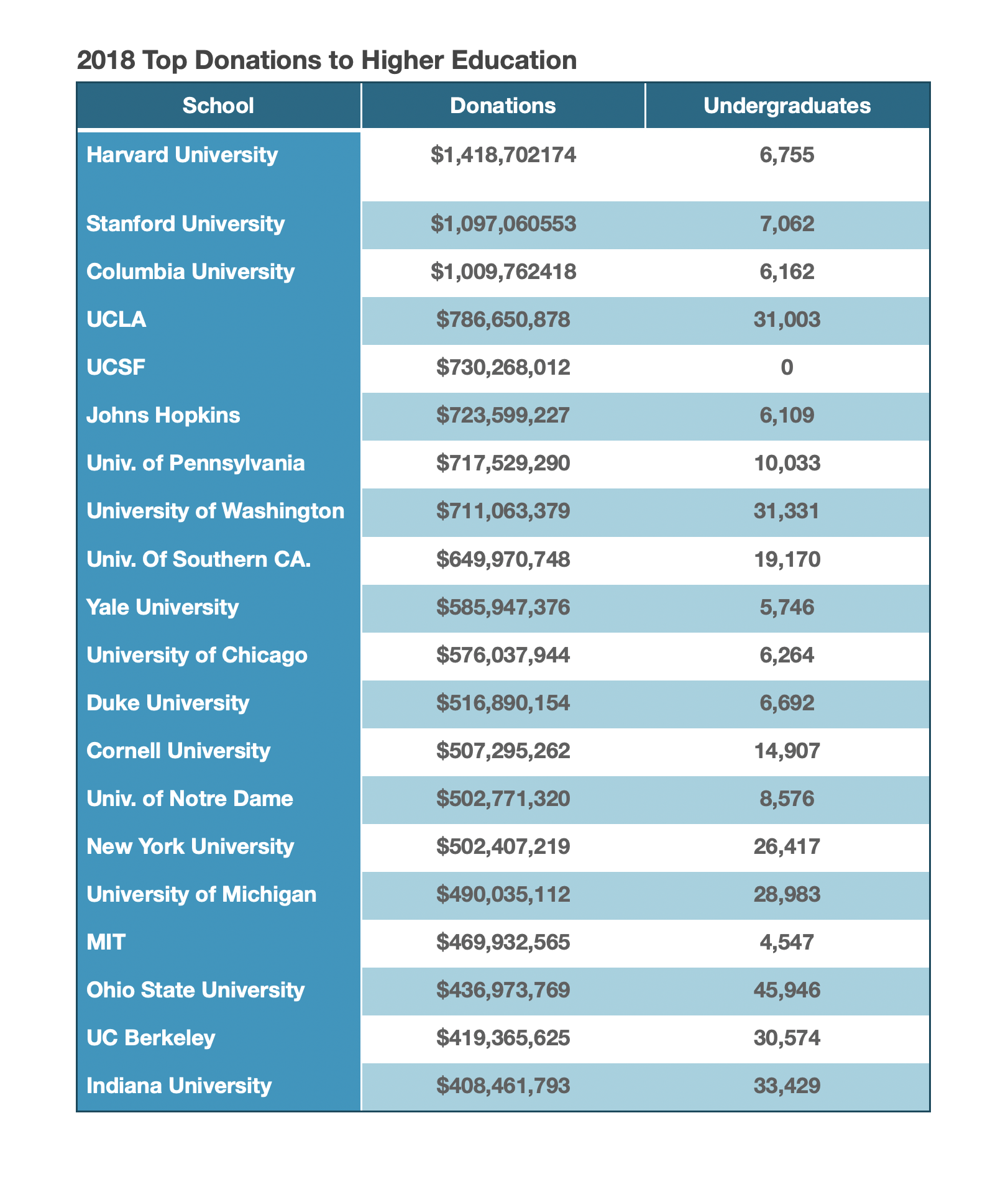

In 2018, a mere 20 institutions, serving just 1.6% of the nation’s students, secured a staggering 28% of the $47B in donations received that fiscal year.(1)

Here is why those investments make a lot of sense despite the donor motivation.

Model for Evaluating Donor Value

We have developed a comprehensive model that quantifies the potential social impact of college investments and provides a consistent and normalized approach for evaluation.

On the donor side, we assume a gift of $1 million to each institution. The effective cost to the donor after-tax benefits is typically $630k.

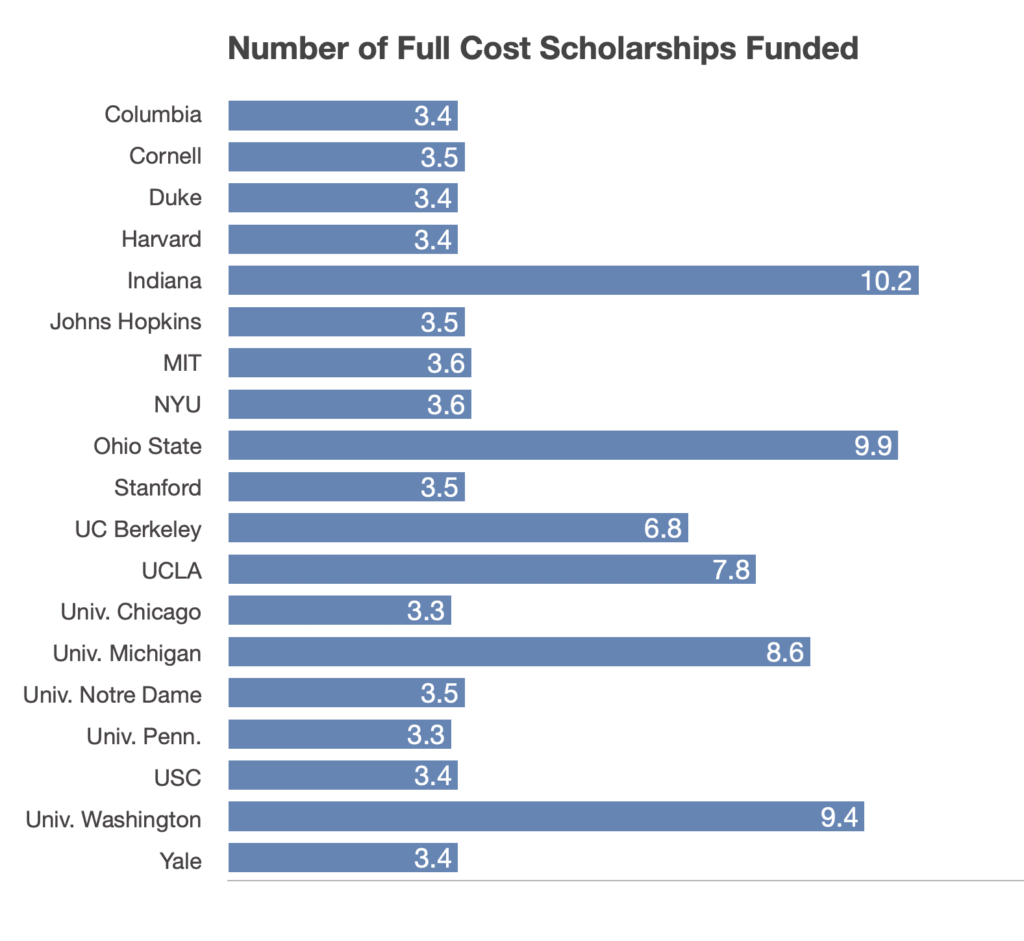

With the $1 million donation, we fund as many students as possible with four years of full-time attendance (assuming that is the time for graduation).

We can estimate the value of each student’s education at their respective institution by calculating the Net Present Value of their Lifetime Income after costs and taxes (NPVAT).

For social benefits, we can estimate the value accrued to the student and the taxes paid that accrue to society.

The donor’s gross social impact is the number of students funded times their total value created (to students and society).

The student could have graduated from high school and gone to work, so the marginal impact is the incremental difference between the value created by a high school graduate and this particular scholarship. In other words, it represents the additional value that the scholarship brings to the student and society, compared to the scenario where the student does not attend college.

The donor returns are the social value created and divided by the after-tax investment.

The Harvard Example:

The Harvard average total four-year costs are $353K, and the NPV is $293k, so the million-dollar donation funds 3.4 students.

The Net Present Value of the Lifetime Income After Taxes and Costs for a median Harvard Graduate who did not pay any fees (full scholarship assumed) is $775k to the student and $223k to society (in taxes), totaling $998k per student.

The total gross value created for 3.4 students funded is $3.4 Million, with a remarkable gross return of 441% over the $630k invested by the donor.

A median high school graduate who does not attend college creates an NPVAT of $430k to the student and $75k in taxes. The combined total is $505k.

The incremental value created by each scholarship to Harvard is $493k per student.

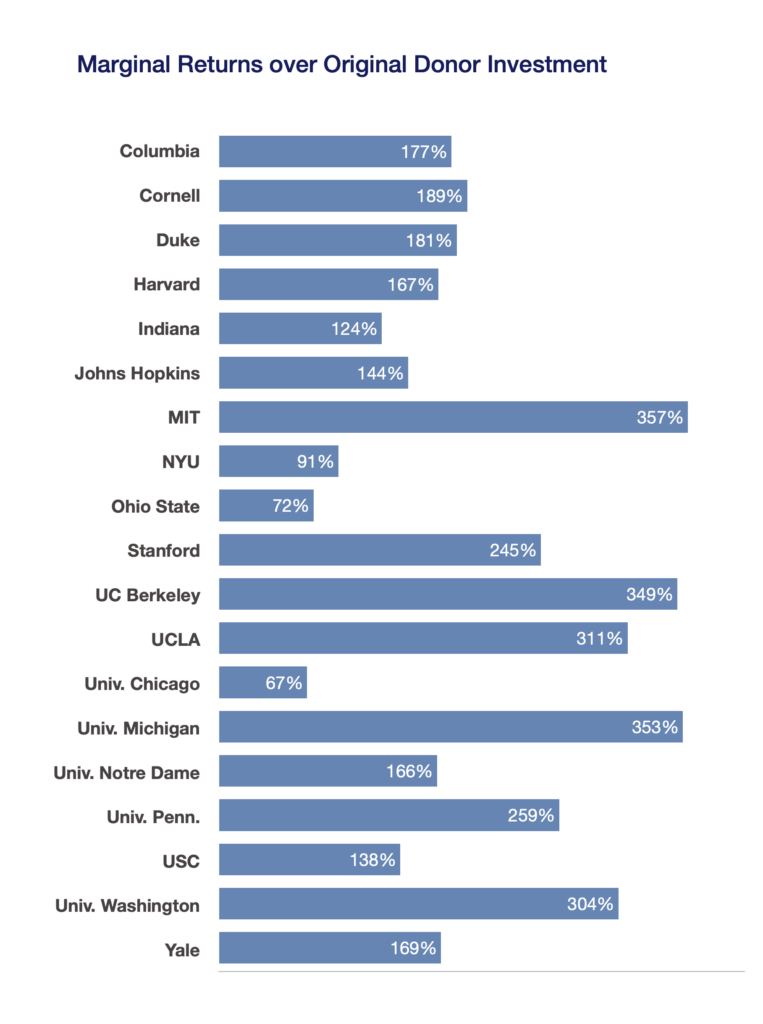

The total marginal value created for the 3.4 students funded is $1.68 million, which is a return of 167% over the $630k invested by the donor.

High Costs Limit the Benefit to Donors

These schools are treasured, and many are among the elite institutions of our nation. Their costs to attend reflect their prestige. The result is that, with few exceptions, donor funds can only provide full scholarships to a limited number of students with their million-dollar donation.

Returns generated by top schools

We have shown before that the Median College provides a negative return on investment compared to a median High School Graduate. The result for donors would be a stunning 55% shrinkage of the original donor investment.

The marginal returns from donor investments in the top schools vary from a low 67% from 3.3 scholarships at the University of Chicago to a high of 357% from 3.6 scholarships at MIT. These returns are over and above the return of the original investment.

The variability in donor returns reflects the cost affecting the number of scholarships funded, and the incremental value generated, which is affected by the salaries delivered for graduates versus the median high school graduate. Both schools have high costs to attend (3.3 versus 3.6 scholarships funded), but dramatically different incremental benefits to graduates and society.

Indiana’s costs are significantly lower, and the highest number of scholarships is funded (10.2), but the incremental benefit is also lower for each graduate. However, the combination still offers a respectable return to donors, well over the original investment.

Could other schools better balance costs while generating high student values, allowing comparably high donor investment returns?

A high-return hidden investment gem

For the Gross Returns and Marginal Returns to be high, the student must attend a college that is more affordable than those profiled and produce students whose value is also dramatically higher than that of the high school graduate.

One such institution that stands out is Baruch College, a part of the City University of New York System. With its low attendance fees and high median student returns, it presents a unique opportunity for high returns on donor investments.

Due to its relatively low cost and high returns to graduates, Baruch excels. The million dollars can fund 20.5 scholarships, and the marginal return is a whopping 684% over the original investment.

Yes, you read that right. The social impact return of donors’ investments in Baruch is almost double that of MIT and ten times that of the University of Chicago.

Baruch Donor Returns at 684% is among the best!

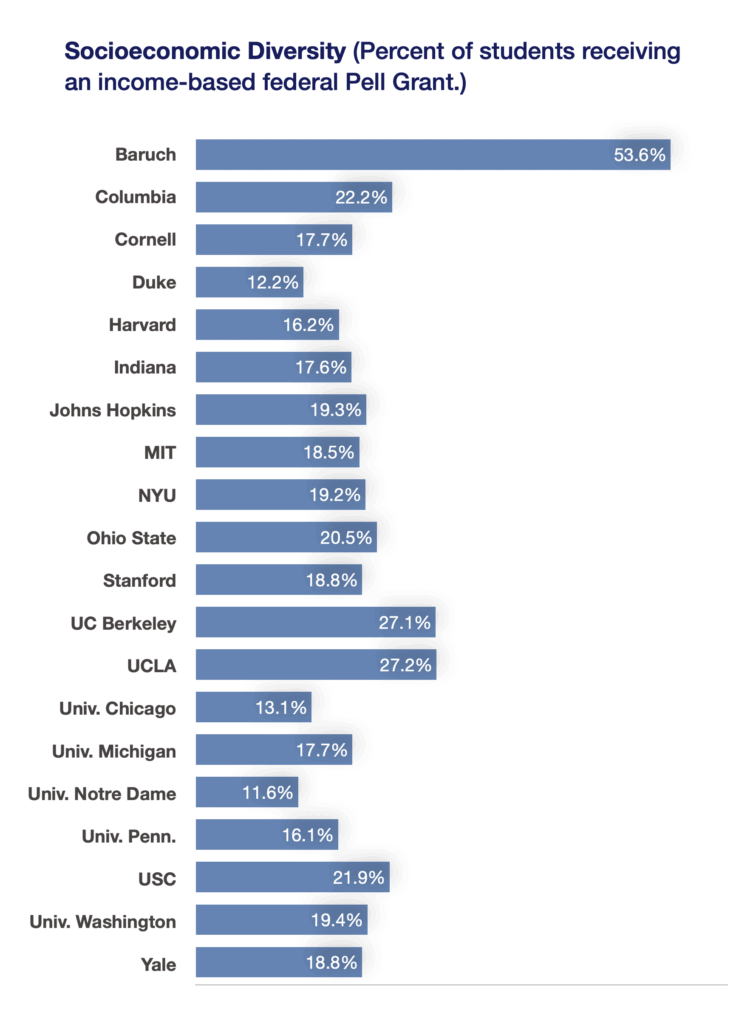

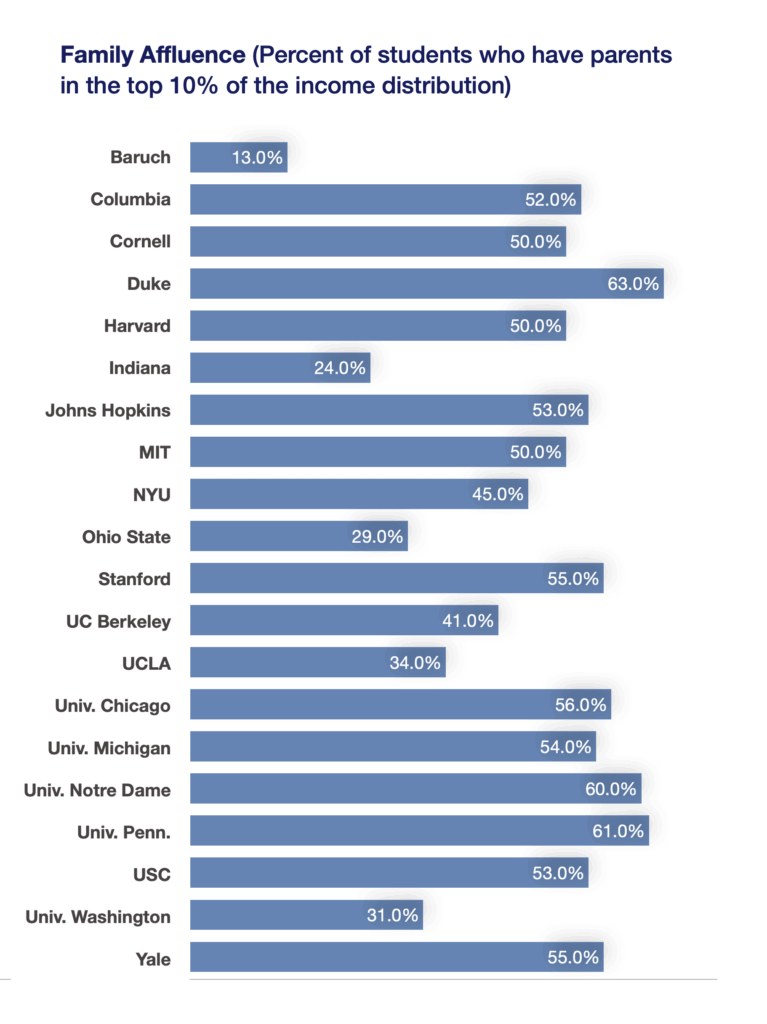

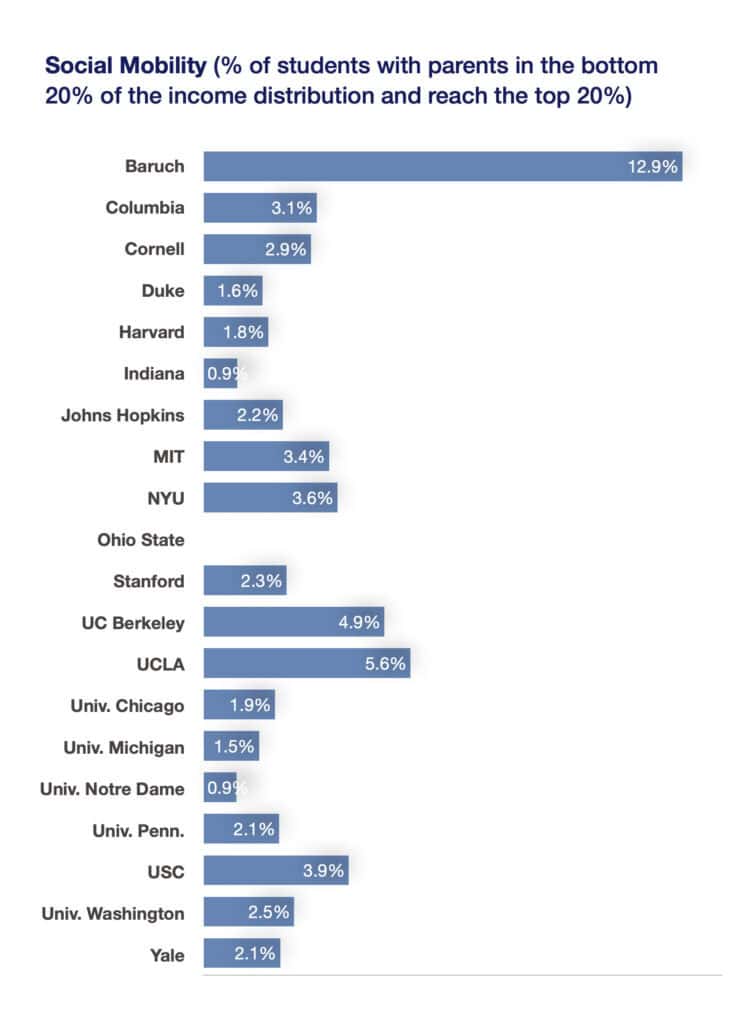

And if that’s not enough to convince big donors to look at Baruch for social impact investing, here are other reasons:

Conclusion

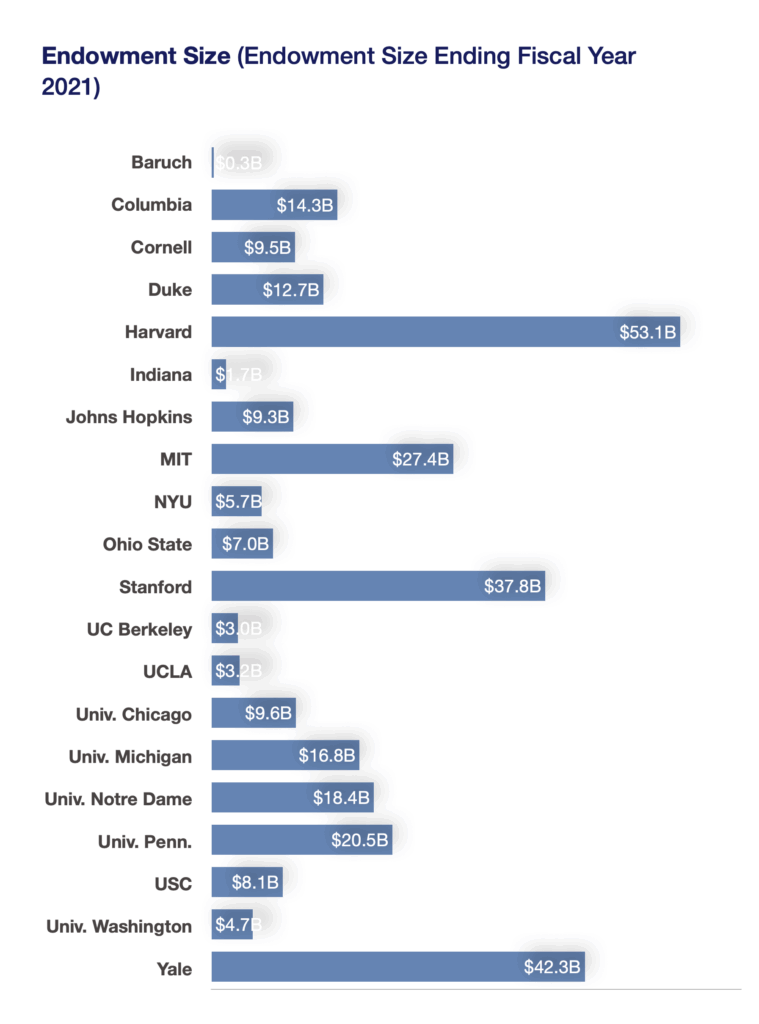

These 19 schools hold 33% of the $927.1 B in Postsecondary institution endowments. (2)

They are the donors’ favorites. Their returns to donors are well above those of the median college, which actually generates subpar returns.

It’s obvious why donors prefer these institutions. However, it should also be evident that the returns are dramatically different among these choices.

Most importantly, we have shown that Baruch College, one of the City University of New York colleges, delivers dramatically better financial returns! From a social impact perspective, it is delivering that performance while transforming the lives of the underserved.

One in eight Baruch students moved their family’s financial situation from the bottom 20% income distribution to the top 20%. This remarkable result was double the next highest in our elite group above.

Baruch is a social mobility engine.

Social investors would be hard-pressed to find a better four-year college investment!

Reference Sources

- Berman, Jillian. “20 Elite Universities Received 28% of College Donations Last Year – They Educate 1.6% of Undergraduates.” Marketwatch.Com. Marketwatch, February 20, 2019. https://www.marketwatch.com/story/these-20-colleges-took-in-28-of-donations-to-universities-last-year-they-educate-16-of-undergrads-2019-02-11.

- National Center for Education Statistics. ”Table 333.90. Endowment Funds of the 120 Degree-granting Postsecondary Institutions with the Largest Endowments, by Rank Order: Fiscal Year 2021.” Nces.Ed.Gov. Accessed July 12, 2024. https://nces.ed.gov/programs/digest/d22/tables/dt22_333.90.asp.