You have probably seen the memes questioning the sense of Nike manufacturing in USA. Commentators presume Nike will be forced to do so because of the newly announced Tariffs. Are they right? Does US Policy end up taking jobs away from Asian factory workers? Let’s see if we can untangle the issues and shed some light on Nike’s likely strategy.

“Thinking is the hardest work there is, which is probably the reason why so few engage in it.”

Henry Ford

The recent tariff announcements have caught the world’s attention, and one story in particular has galvanized the negative response. It’s hard to miss the number of memes about manufacturing Nike shoes in the USA. Some have questioned the wisdom of a tariff strategy that forces Nike to move manufacturing to the USA.

Nike has received a variety of negative publicity as a result. After all, commenters point out that those Nike shoes sold at retail for $100 are built for $4 to $18. They imply that Nike is hugely profitable by abusing labor to supply its products. They question Nike’s profits.(1)

Commenters allege and are appalled that Nike uses slave labor. It’s a spurious claim that Nike continues to fight aggressively. They have vowed to stop Nike shoe purchases.

Others who see a return of manufacturing to the US as a patriotic call have heard that Nike has chosen not to do so despite the tariffs. They plan to avoid Nike products.

My international friends are aghast that America would put in place a strategy that imperils the jobs and families of poor factory workers in China and Asia. As a result, they think they will not buy Nike products.

Are these claims valid? Is the return of Nike manufacturing to the USA part of the Tariff strategy? Does the strategy announced force Nike to manufacture products in the USA? Are consumers right in boycotting Nike products?

The answer is an emphatic no!

Read on to get a reality check on Nike’s global supply chain and why tariffs won’t bring shoe manufacturing back to the USA.

First, let’s deal with the ugly accusations that directly harm Nike’s business before tackling the strategy question.

The Nike Cost Structure: Not What You Think

Nike is a $51B corporation headquartered in Oregon, USA. It sells athletic gear worldwide, and its largest segment is footwear. Nike does not have any manufacturing facilities. Instead, it uses contractors to manufacture its products around the world. Those contractors use materials from sources that Nike vets. Nike selects strategic suppliers directly.

Nike does not use slave labor.

In 2021, Nike published its supply chain statement on forced labor, human trafficking, and modern slavery. It outlines the methods its leadership team uses to select and review contractors and suppliers to meet sustainability and human rights expectations.(2)

Nike uses tools, systems, and audits to validate that suppliers follow their standards.

So, how do we explain those $4 shoes? They could only have been built on the backs of oppressed workers, right?

Wrong.

The popular narrative that Nike shoes cost $4-$18 to make while retailing for $100 is wildly inaccurate. These estimates, perpetuated by ill-informed reporting, reveal a fundamental misunderstanding of Nike’s supply chain and financial statements.

Nike’s financials reveal a different picture.

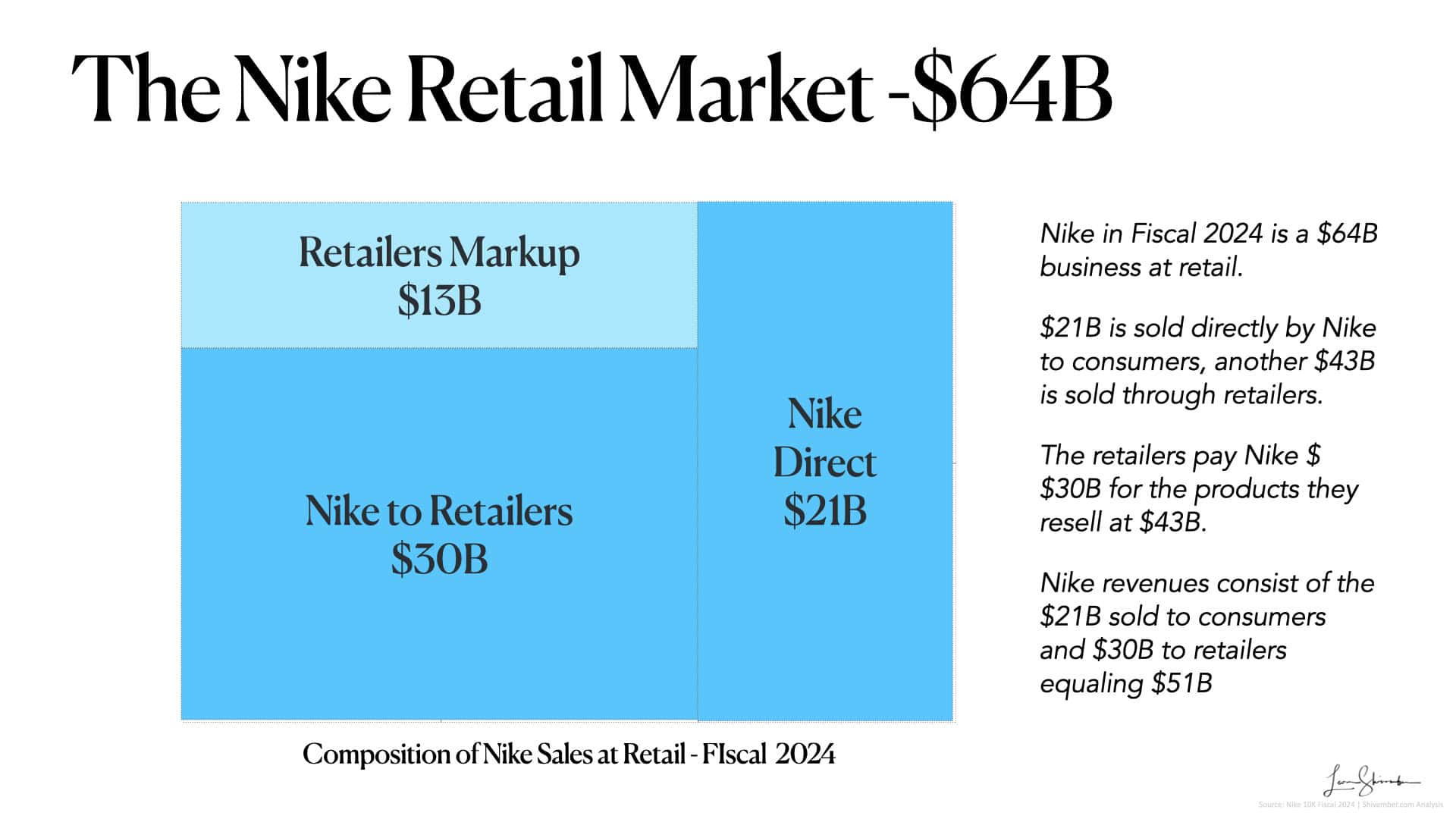

Nike sells its products directly to consumers (about $21B) and indirectly through wholesalers and retailers (~$30B). (3)

In both cases, the eventual consumer pays the same price, whether they bought the gear from Footlocker (a $7B retailer) or Nike Stores or Online.

Footlocker is typical of most retail Nike sales. They are a significant strategic partner, which Nike continues to support despite making more money selling directly. For the $30B of sales through retailers, Nike sells its product at a 30% discount. The retailer has to spend the majority of that margin to provide stores, employees, inventory, and other costs for the consumer to get the products. Retailing is a low-margin business, yielding about 3 to 5% of profits. Footlocker at $7B is barely profitable. The notion that retailers are wildly profitable even though they are involved in manufacturing a product is baloney.

Nike gets a lower margin in its wholesale business because it gets 70% of the retail price.

We estimate margins of 37%, meaning its goods cost 63% of its $30B sales. It does better in the direct business since it keeps its retail margin. However, Nike has to provide its own retail outlets and inventory operations. Margins are better at approximately 50%.

The Nike financial statements show a gross margin of 44.6%, which is based on $21B revenue at retail price and $30B at 70% of retail.

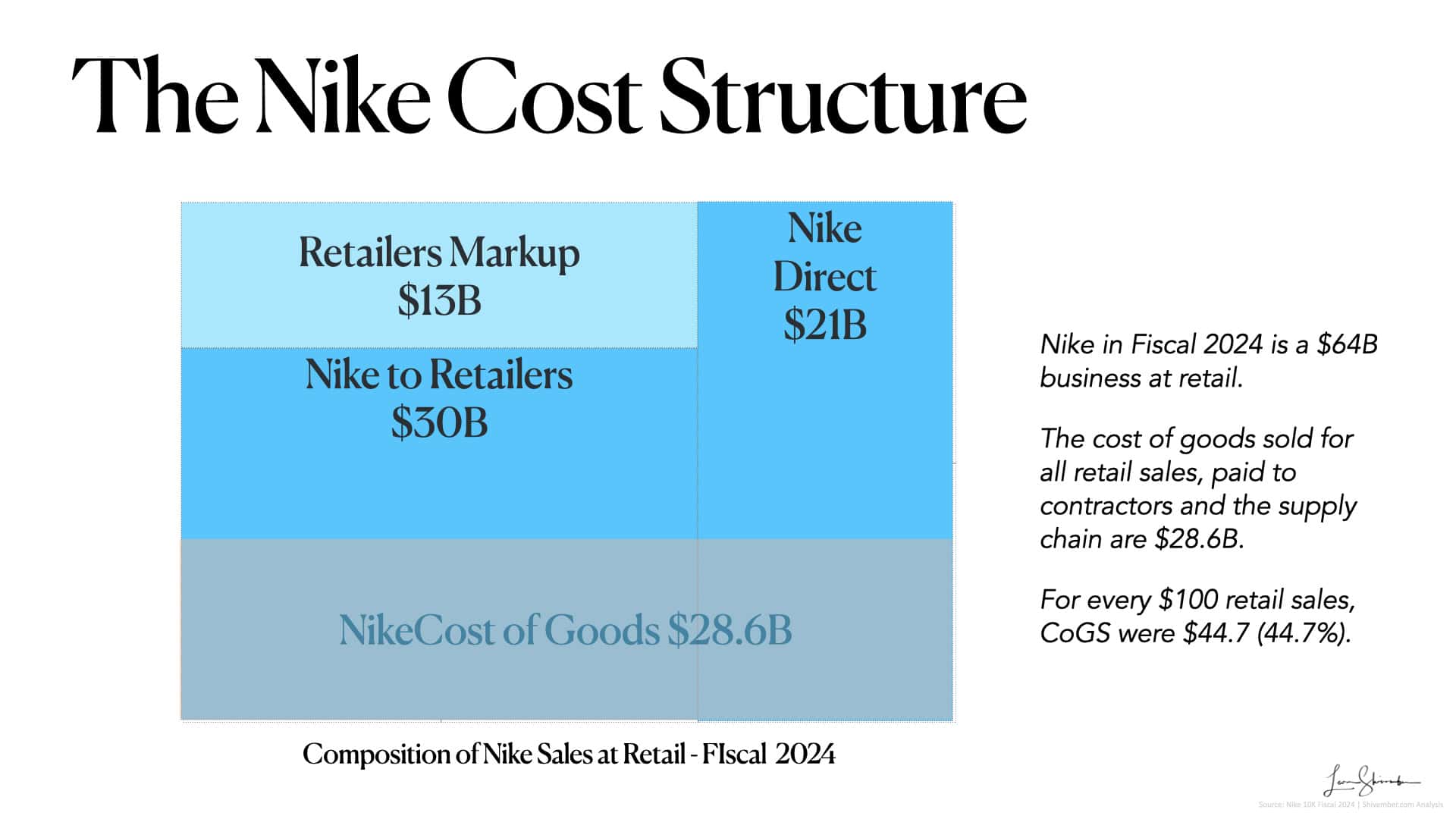

We want to express manufacturing costs in relation to the retail price, so we do some math and figure out that Nike’s retail business to consumers, including the markup received by retailers, amounts to approximately $64B in the athletic gear market.

The Cost of Goods Sold is $28.6B, equating to $45 for a $100 shoe. The cost will fluctuate depending on the nature of the product, but for every $100 the consumer pays, Nike has to spend $45 making those products.

Nike’s and all the retailers’ profits combined on the $64B revenue are approximately $6.3B (less than 10%). The perception of capitalists ripping off their customers or building their products with cheap slave labor doesn’t hold up in reality.

The next time you hear someone ripping on Nike about $4 shoes, slave labor, or fleecing their customers, you will know the truth. Please go out and buy Nike products; don’t boycott them.

The Nike supply chain is complex, risky, and difficult to coordinate globally. This reality alone makes the economics of US manufacturing challenging, but there are even more compelling reasons Nike won’t be rushing to open American factories.

Three Key Reasons Nike Will Remain Globally Manufactured

Our commentators presume that companies like Nike are supplying products from China to the USA and that, when the USA dramatically increases tariffs on goods from China, Nike would be forced to move manufacturing to the USA.

Those assumptions are flawed at best. I have argued elsewhere that the tariff strategy has two primary goals:

- First, rebuild skills in the United States that have withered due to offshoring, specifically those required for national security.

- Second, to create a level playing field for global trade and doing business worldwide (in China and with other major trading partners).

Neither of those goals implies Nike needs to do very much different from what it is doing. Let me explain.

Shoes Aren’t a National Security Concern

Unlike semiconductor chips or military equipment, athletic apparel and footwear don’t qualify as critical infrastructure. Nike operates a diversified manufacturing footprint across multiple countries.(4) They publish a site identifying all their contractors here: Nike Manufacturing Locations

In Footwear, Nike uses 169 Strategic Suppliers:

- Vietnam accounts for 50% of footwear production

- Indonesia contributes 27%

- China represents just 18%

For Apparel, Nike uses 285 factories:

- Vietnam accounts for 28% of apparel production

- Cambodia contributes 15%

- China represents 16%

This diversification does not demonstrate a dependency on China and provides robust supply chain resilience without the need for domestic production.

Nike’s China Operations Serve China

Contrary to popular belief, Nike’s Chinese manufacturing operations aren’t primarily serving American consumers. It is unlikely that very much of Nike’s production in China will ever arrive in the USA; thus, a 145% Tariff is unlikely to impact Nike or its consumers. Further, if there were any, it could quickly move production to a more favorable source. According to Nike’s financial statements:

- North America represents 43% of Nike’s $51.4 billion in sales ($21.4 billion)

- Greater China accounts for 15% of sales ($7.5 billion)

- Footwear manufacturing in China is 18% of total production

- Apparel manufacturing in China is 16% of total production

The numbers align neatly. China’s manufacturing capacity is proportionate to its market size, suggesting that Chinese factories primarily serve Chinese consumers. This means tariffs on Chinese imports have a limited impact on Nike’s US business.

Supply Chain Reality Is Complex

Nike’s supply chain isn’t simply about labor costs, it’s about an entire ecosystem of suppliers, materials, and expertise. From Nike’s 10K filing:

“The principal materials used in our footwear products, natural and synthetic rubber, plastic compounds, foam cushioning materials, natural and synthetic leather, nylon, polyester, and natural fiber textiles and polyurethane films, are locally available to manufacturers.”

This means Nike has developed sophisticated regional supply networks that would be enormously expensive and time-consuming to replicate in the United States. The company operates with:

- 169 strategic suppliers for footwear across multiple countries

- 285 factories in 33 countries for apparel production

Moving manufacturing to the US would require rebuilding this entire ecosystem from scratch.

What Are the Disproportionate Impacts of Tariffs?

The facts do not support the assumption that Nike supplies large portions of its US demand from China, and that those will face massive tariffs, forcing Nike to bring manufacturing back to the USA.

US demand is not supplied from China. The significant 145% China tariffs will not affect Nike. If they remain in place, the 10% base tariffs on other countries imply a $4 addition to the $44 cost. This increase will challenge Nike’s profitability and consumer demand, but it will be manageable without requiring major surgery on Nike’s supply chain.

Nike Has Better Options Than US Manufacturing

Nike has demonstrated its ability to adapt to trade pressures without compromising its business model. As stated in its 10K filing:

“Where trade protection measures are implemented, we believe we have the ability to develop, over a period of time, adequate alternative sources of supply for the products obtained from our present suppliers.”

The USA does not need Nike manufacturing for national security. Nike has no advantage by moving manufacturing to the USA.

The Nike Stories are mostly Political Rhetoric

While politicians may talk about bringing shoe manufacturing back to America, the numbers show why this does not make sense. The other side uses a fictional Nike cost structure and disparages the company. They do so to build an emotional case against Nike manufacturing in USA or the Tariffs that require that move. As we have pointed out, that argument is also false rhetoric.

Nike is a well-run company that is innovating in the athletic apparel market. It has a well-optimized supply chain and a good strategy to attack and win in China. It is not dependent on China to serve the US market.

Nike deserves the support of both sides, not the rhetoric that diminishes its ability to compete globally.

Time to Think Smarter About Trade

Rather than arguing about tariffs with assumptions and ideologies that fail to acknowledge supply chain realities, a more fact-based dialogue is needed. The current approach hurts our great companies, opening the door for competitors such as China’s Anta and Li Ning, and keeps us from progressing on a strategy that accomplishes our national interest.

Do not throw Nike under the bus.

As Nike notes in its 10K: “Changes in the U.S. government’s import and export policies, including trade restrictions, sanctions and countersanctions, increased tariffs or quotas, embargoes, safeguards or customs restrictions, could require us to change the way we conduct business and adversely affect our results of operations.”

The clever play isn’t forcing Nike’s manufacturing back to the USA, it’s developing trade policies that strengthen American competitiveness while recognizing the irreversibly global nature of modern supply chains. It’s more like Nike, not less.

Based on the announced tariff policies, don’t expect “Nike: Made in USA” tags to become the norm.

Reference Sources

(1) I have chosen not to link to stories underestimating Nike’s shoe manufacturing cost. They are misleading, and I prefer not to add to their publicity. A search can easily find them.

(2) https://about.nike.com/en/impact-resources/statement-on-forced-labor

(3) https://www.sec.gov/ix?doc=/Archives/edgar/data/0000320187/000032018724000044/nke-20240531.htm