An accountant is having difficulty sleeping and goes to see his doctor.

“Doctor, I just can’t get to sleep at night.”

“Have you tried counting sheep?”

“That’s the problem – I make a mistake and then spend three hours trying to find it.”

Just another accounting Joke!

Let me introduce you to the warriors who are battling accounting fraud. You will look at accounting differently and want to hug a good accountant.

- Your tour guide

- Our Knights, the Accountants

- The Closest I Got To An Accounting Scandal

- Understanding Accounting Misinformation – The Most Famous Accounting Fraud Case

- Traditional methods of detecting accounting fraud

- Data Science and Accounting Forensics – The Modern Knights

- An old idea updated – Benford’s Law

- The Beneish M-Score

- The Emergence of A.I. to Prevent Accounting Fraud

- Limiting the Performance Incentives for Mismanagement

- A word of caution – the long fight

- The coming battle for accounting integrity

- Details of The Beneish M-Score model

- FAQs

- For Video Lovers – The Enron Story

- Sources

- A Note on General Misinformation and Manipulation

Fraud is a significant global problem.

If we reduce fraud by 50%, the savings will exceed the cost of eliminating poverty.

A study by the National Bureau of Economic Research (NBER) says, “We estimate that 36% of federal income taxes unpaid are owed by the top 1% and that collecting all unpaid federal income tax from this group would increase federal revenues by about $175 billion annually.”

That $175 billion is more than enough to eliminate poverty in the USA.

And just as an aside, if they are accurate, the total unpaid federal income taxes each year is close to half a Trillion dollars.

Accounting fraud is a subset of fraud cases.

It is challenging to measure but may be even more important than the rest.

Every central policy or business decision rests on the assumptions of good economic data.

Investors, businesses, and governments all make decisions based on the assumption that the data has financial integrity.

We assume accounting fraud is negligible.

We must assume that because our entire economic system relies on that assumption.

In this piece, I will introduce you to some fearless warriors working to minimize accounting fraud.

When finished, you will want to hug a good accountant.

Read on to find out why.

Your tour guide

I have always valued accounting skills and the importance of integrity in the profession.

After all, my undergraduate degree was a BBA Major in Accounting, with minors in Computer Science and Mathematics, all Summa Cum Laude from Baruch College.

After that, I spent two years teaching accounting as an Associate Instructor at Indiana University in Bloomington while I completed my MBA.

Our Knights, the Accountants

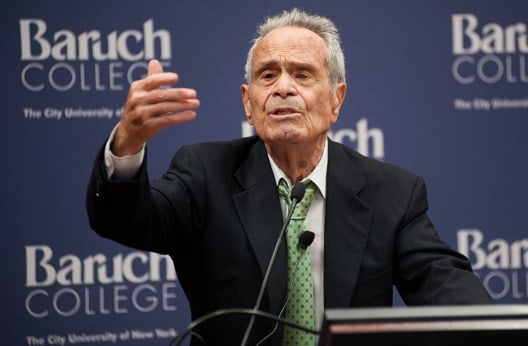

Professor Abe Briloff – Baruch College

The late Professor Abraham J. Briloff of Baruch College, a prominent accounting critic, was notorious for his writings when I started at Baruch.

Back in the 1960s, he had warned about the abusive use of “pooling of interest,” a creative accounting method used by acquirers to manipulate future earnings potentially.

The financial industry should have caught on to his brilliance immediately.

However, it wasn’t until 2001 that the Financial Accounting Standards Board changed the accounting standard, finally killing the pooling of interest accounting.

Despite the slow adoption of his ideas, he had a more instant impact as he wrote pieces on companies frequently published in the Barrons newspaper. His articles often caused stock prices to plunge, never to recover.

NY Times: Abe Briloff, an Accountant Who Saw Through the Games

Professor Seymour Eisenman – Baruch College

The late and great Professor Seymour Eisenman taught me my first introduction to accounting.

He was the first person to earn a Ph.D. in accountancy from CUNY under the supervision of legendary Professor Brilloff.

Professor Eisenman wanted his students to learn the craft profoundly. Most importantly, he cared about us deeply and wanted us to be good people.

It wasn’t easy to put into words his impact when he passed. Here is what I said:

“Yes, I learned accounting in his classroom, but he also taught me more, including an appreciation of a broad diversity of great music. He was a multidimensional mentor, and his lessons stayed with me. He changed my life.”

Baruch Alumni Magazine: In Memoriam: Tribute to Seymour Eisenman (MBA ’69, PhD ’75)

Professor A. Wayne Corcoran – Baruch College

The most challenging course I took during my college years, including the MBA program, was the course in Cost Accounting taught by Professor A. Wayne Corcoran.

On the first day of the class, I was one of 23 students there when he started by proceeding to solve a complex differential equation he had written on the board. There were only 18 in the next class, and we continued dwindling to the end of the semester.

The preface of the textbook Professor Corcoran had authored began:

“As much as anything, this is a book on philosophy.”

He went on to say:

“There is examination of conflicting theories and frank expression of opinion. Where my opinions are too outrageous, too out of keeping with established thought, or too naive, I have asked a colleague who is a supporter of a more prevalent or a more informed view in the particular area to expound on the opposing theory, so that you may better understand the controversy and form your own opinion.”

The course was an adventure in mathematics, operations research, philosophy, and many other mind-blowing topics.

He wanted us to think deeply about our work.

That textbook is still on my shelf, and I still pull it out occasionally.

My great Baruch accounting professors like Abe Briloff, Seymour Eisenman, and Dave Corcoran were my first introduction to the knights in the battle for accounting integrity.

The Closest I Got To An Accounting Scandal

Several years after graduating, I got an excellent first-person view of accounting misinformation while serving a client.

Nay, let’s call it what it was—blatant accounting manipulation.

They were making the company’s performance look better than it was to keep the stock valuation inflated.

Here is what happened.

This client was a fast-growing, high-tech company that had just hired a new President and was looking for faster growth through a strategic transformation.

We started working with him and the company, focusing on product management, engineering, design, and building.

Our work progressed quickly and so well that he offered me a lucrative role to join the company as an officer driving transformation.

We had yet to delve into the revenue side of the business. This area was not a priority as the company reported quarterly sales and income increases, beating the street expectations each quarter.

This business was an actual growth stock. On paper, anyway.

Before joining the company, I asked the President for some time to do my due diligence on the entire business.

He agreed.

The company had several divisions, with the fast-growing European business led by the Global Head of Sales.

I spent some time with him and his staff and visited the European operations to see how they were scaling so quickly.

I saw customer-designated/owned inventory in the company warehouse for the first time.

And the inventory was large and in every location.

Curious about why customers, all large multi-national companies with owned storage locations, were buying products for deployment but leaving them in our client warehouse, I got evasive answers.

Shortly after that, with a few discreet accounting requests for data, we were able to put together a sketch of what was happening.

We recognized the problem immediately.

Channel Stuffing is Financial Fraud

When sales were short of projections, the team would stuff the channel at the end of a quarter.

The selling business unit would make generous deals with friendly customers for orders sufficient to meet the shortfall.

These customers would return the products soon after the quarter ended.

In the early design of this process, they shipped products to customers.

But innovation soon took hold, and they figured out how to keep the products in the warehouse, saving the shipping and return costs but tracking them temporarily as customer-owned.

The end-of-quarter problem grew quarter by quarter as actual demand stayed flat.

When I met with the President to explain why I would not take the role, he learned for the first time about the problem.

He confronted the Chair and senior executives and, shortly after that, resigned from his role at the company.

The executive responsible for the manipulation became the new President.

Our team immediately disengaged from this client.

We were all subject to air-tight non-disclosures.

We moved on.

A few years later, a number of the company officers were indicted by the SEC for manipulation and securities fraud.

Understanding Accounting Misinformation – The Most Famous Accounting Fraud Case

Imagine a beautiful painting with a torn canvas beneath the surface.

This structural tear is the reality of accounting misinformation – a facade of financial health hiding a potential abyss of problems.

It’s a serious issue that can lead to catastrophic consequences for businesses and investors.

Financial Crime by Enron

Remember Enron?

Enron was one of the fastest-growing and supposedly most innovative companies in the United States in the 1990s., The entire edifice rested on massive accounting and corporate fraud. It eventually came to light, resulting in Enron declaring bankruptcy in December 2001.

Many of the Senior Executives faced criminal prosecution and were convicted.

Investors accused the SEC, credit rating agencies, and investment banks of negligence—and, in some cases, outright deception—that enabled the fraud.

Arthur Andersen was the accounting firm responsible for auditing Enron’s financial statements.

Instead of acting as a knight using their shield to protect investors from potential manipulation, they turned their shield to protect themselves from being thoroughly investigated for their role in the fraud.

The courts found the firm guilty of obstruction of justice for shredding documents related to Enron’s audit. As a result, with its reputation severely damaged, Arthur Andersen effectively dissolved its audit business.

Congress enacted the Sarbanes-Oxley Act to hold corporate executives more accountable for their company’s financial statements.

The FASB revised its accounting standards, tightening the responsibilities of the Chief Financial Officer, audit committees, the Board, and executives for accounting integrity.

The Enron/Andersen downfall is a stark reminder of the destructive power of accounting manipulation.

It also highlights the importance of genuine knights of honor in the fight against accounting manipulation. The few who worked on the dark side took down an entire firm with many honorable knights.

Traditional methods of detecting accounting fraud

For decades, complex accounting maneuvers have enabled corporations to bend the truth and manipulate profits and losses.

Our knights in the fight have historically worked as diligent data detectives using several traditional methods to identify these shady practices.

These methods included:

- Financial Statement Analysis: Analyze financial statements to identify inconsistencies or irregularities within the accounts or across different periods.

- Total Assets Comparison: Comparing the total assets of a company to industry benchmarks or previous periods can help identify discrepancies or potential fraud.

- Management Review: Review financial statements and reports critically for suspicious or unusual transactions or patterns.

- Tip Lines: Implementing anonymous tip lines or hotlines can encourage employees to report suspected fraud or misconduct.

- Regression Analysis: Regression analysis involves analyzing relationships between variables to identify abnormal patterns or outliers.

- Random Sampling: Traditional auditing techniques often use random-based selection methods to select a subset of transactions or records for closer examination.

It’s grueling, detailed, monotonous, and challenging work.

This gumshoe diligence is why there are so many jokes about accountants.

Before you go knocking accountant, you should remember the following studied or were working accountants before they became famous:

- Mick Jagger – studied finance and accounting at the London School of Economics

- Robert Plant – worked as an accountant before becoming a musician

- Bob Newhart – worked as an accountant before becoming a comedian

- John Grisham – worked as an accountant before becoming a lawyer and author

- Janet Jackson – worked as an accountant before becoming a musician

- Kenny G – worked as an accountant before becoming a musician

- John D. Rockefeller – worked as an accountant before becoming a businessman and philanthropist

Enough?

Data Science and Accounting Forensics – The Modern Knights

Technology and data analysis advancements have led to the development of more sophisticated methods for detecting accounting fraud.

Armed with cutting-edge statistical tools, our modern knights in the fight are rooting out anomalies and revealing the hard facts behind the financial smokescreens.

Enter forensic accounting, also known as accounting forensics or financial forensics.

This new specialty is a practice area within accounting that involves investigating financial reporting misconduct and financial crimes.

Forensic accountants utilize a combination of accounting, auditing, and investigative skills, like the traditional knights, but also leverage data science, artificial intelligence, and other technologies to determine whether there has been any financial reporting misconduct.

An old idea updated – Benford’s Law

In 1938, the American physicist Frank Benford published a paper called “The Law of Anomalous Numbers.”

The principle was first noted by Simon Newcomb, an American-Canadian astronomer and mathematician, in 1881.

From this work emerged what came to be known as Benford’s Law, or the Newcomb-Benford law.

Benford observed that the leading digit is more likely small in many real-life numerical data sets. For example, if you look at many expense reports, you would find more expenses where the first digit is a 1 (e.g., $19.95) than the first digit is a 9 (e.g., $9.95).

It was genius.

The application of Benford’s Law to detect accounting fraud emerged in an article published in 1972 by economist Hal Varian.

Humans who manipulate data can’t mimic the randomness of natural data.

Based on the plausible assumption that people who make up numbers tend to include all digits uniformly, simply comparing their first-digit frequency distribution with the expected distribution according to Benford’s Law should show inconsistencies.

Benford’s Law Analysis Drives Increasing Internal Control

While running a business in the Middle East with many drivers, we became concerned about the possibility of expense manipulation when a simple tally of total gas reimbursements exceeded multiples of fuel requirements if the drivers operated non-stop.

While filling up my car at gas stations, I frequently observed drivers from other companies picking up discarded gas receipts.

Our CFO confirmed he was suspicious that the common disease of using discarded receipts as a valid expense might have infected our drivers.

Curious to see how pervasive the problem was, we used a Benford’s Law analysis of a subset of expenses and discovered the problem extended well beyond gas receipts.

Implementing a zero-tolerance approach to expense falsification would have led to the removal of a large chunk of foreign staff, all of whom would be deported back home to certain financial peril.

Our generous Chairman approved our recommended salary increase, which we announced along with a new Zero-tolerance policy for expense fraud.

A higher integrity culture set in, and suspicious expenses declined dramatically.

Benford’s law unleashed

Today, we can see Benford’s law at work in a wide variety of real-world applications:

- In Financial Auditing, to detect potential fraud or errors in financial statements, tax returns, and other financial data. If the leading digits of specific numbers deviate significantly from the expected distribution according to Benford’s Law, it may indicate fraudulent or manipulated data.

- In Forensic Accounting, to analyze financial data in legal investigations. By examining the leading digits of transaction amounts, they can identify suspicious patterns or irregularities that may require further investigation.

- In Election Fraud Detection, by analyzing the leading digits of vote counts. If the reported vote counts deviate significantly from the expected distribution, it may indicate irregularities or manipulation in the election results.

- In Scientific Data Analysis, to detect data fabrication or errors in research studies, environmental monitoring, and other scientific data sets.

- In Quality Control, identify anomalies or errors in manufacturing or production data. When analyzing the leading digits of measurements or quantities, it is possible to detect deviations from the expected distribution and investigate the underlying causes.

- Fraud Detection in Digital Transactions, is detecting anomalies and potential fraud, such as credit card transactions, wire fraud, insurance claims, and online transactions. It uncovers fictitious numbers in random data sets because it detects manual intervention in otherwise automated transaction records.

Benford’s law’s ability to identify irregularities and anomalies in numerical data makes it a valuable tool for every auditor in data analysis and fraud detection.

The modern accounting Knight, armed with data science tools and technology, uses Benford’s law to reduce the success rate of accounting fraud.

The Beneish M-Score

Professor Messod Daniel Beneish – Indiana University, Kelley School of Business

Professor Messod Daniel Beneish joined Indiana University in 1996, long after I had graduated.

His research interests included the areas of corporate governance, earnings management, fraud detection, and insider trading.

In June 1999, he published a report titled “The Detection of Earnings Manipulation.”

He hypothesized that companies with high sales growth, deteriorating gross margins, rising operating expenses, and rising leverage have considerable incentives to manipulate profits. Further, they likely manipulate profits by accelerating sales recognition, increasing cost deferrals, raising accruals, and reducing depreciation.

The Beneish M-Score – Applied To Corporate Financial Statements

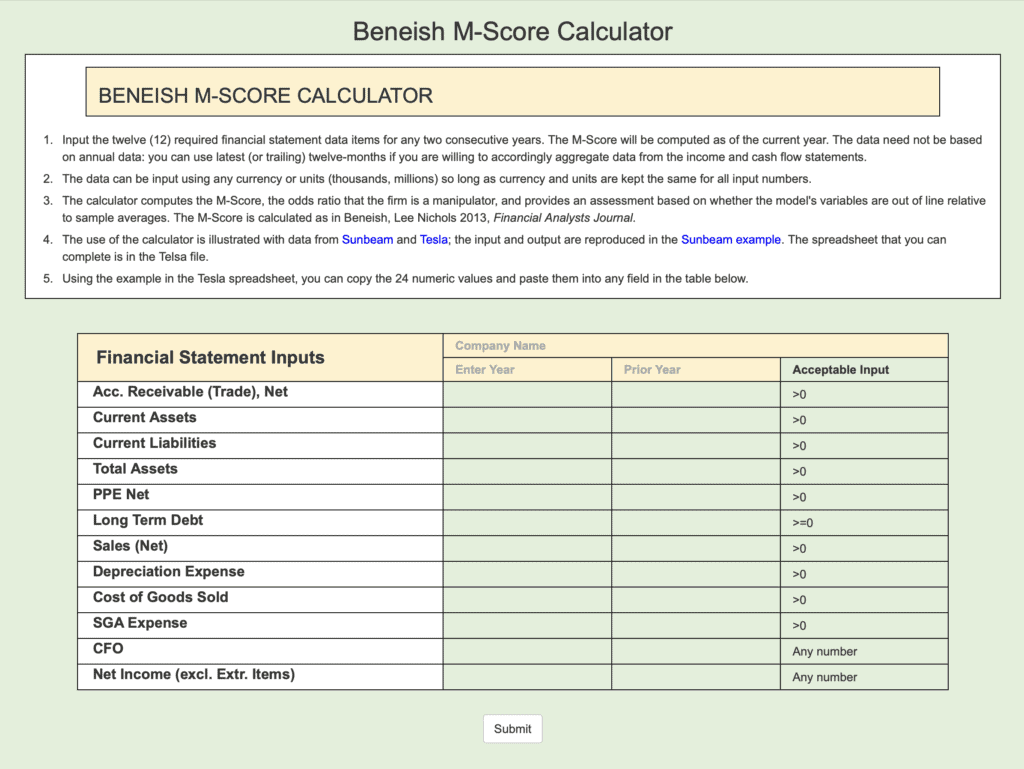

He introduced a model called the M-Score (the M stands for manipulation).

The M-Score combines eight ratios on a company’s balance sheet to assess its fraud risk. A higher M-Score means a company earnings manipulation is more likely.

The M-Score, he claimed, could correctly identify 76% of manipulators while only incorrectly identifying 17.5% of non-manipulators.

A 76% positive-positive score with only a 17.5% false-positive was a huge step forward in identifying manipulation.

A Cornell University Johnson Graduate School of Management team used the M-Score to identify potential problems with Enron in 1998, three years before it fell but discounted the clue.

From their report:

“The 8-variable Beneish model shows that that Enron may be manipulating its earnings. We get a M-score of -1.89 for Enron, which is greater than the standard M-score of -2.22 used to gauge the likelihood of manipulation. The most significant factor contributing to the M-score manipulation statistic is the SGI. After close examination we were not concerned by the fact they were growing too fast because the sales increase comes from the recent acquisition of PGE. Additionally, the GMI shows deteriorating margins, the AQI shows increasing amounts of ‘soft’ assets, DEPI shows depreciation expense slowing down, and LVGI indicate rapidly increasing leverage. However, further examination of these indicators showed no cause for concern.“

They were on to something, but the prevailing positive bias towards Enron and the fear of calling fraud on one of the largest and most successful companies at the time probably injected the caution shown there.

They did recommend selling the stock, though, a rare stance at the time.

Corporate Fraud At the Economy Level

In 2019, Professor Beneish expanded the M-Score, creating a new measure beyond individual companies to the economy as a whole.

He says, “This aggregate M-Score predicts recessions five to eight quarters ahead and is significantly associated with lower future growth in real GDP, real investment, consumption, and industrial production.”

In 2021 he and his co-authors David B. Farber of the Indiana University Kelley School of Business and Matthew Glendening and Kenneth W. Shaw of Trulaske College of Business, University of Missouri, published their paper “Aggregate Financial Misreporting and the Predictability of U.S. Recessions.”

A short while ago, in 2023, the aggregate M-Score was at its highest level in 40 years.

Here is what Matthew Glendening had to say about this ominous sign: “Accounting manipulation matters for the economy at large, Companies use other business’ earnings data to inform hiring, purchasing, and production decisions. What we are finding is that the level of aggregate misreporting is very similar to what we’ve observed in pre-recessionary periods.”

The Beneish M-Score is a trusty sword our knights use to detect earnings manipulation.

However, like any sword, it’s not infallible.

After all, Beneish expects there to be false positives. The point is that when risks are high, caution is reasonable. The M-Score helps us become more cautious.

Warren Buffet once said, “Only when the tide goes out do you discover who’s been swimming naked.”

The Beneish M-Score can sometimes miss those ‘swimming naked’ in the financial tide.

The Emergence of A.I. to Prevent Accounting Fraud

Artificial Intelligence (AI) is already pivotal in combating accounting fraud.

It’s like a vigilant sentinel, tirelessly scanning vast amounts of financial data to detect anomalies that could indicate fraudulent activities.

A.I. algorithms, particularly those based on machine learning, can learn from historical data, identify fraudulent behavior patterns, and then apply this knowledge to detect similar patterns in new data.

This ability to learn and adapt makes AI a potent tool in the fight against accounting fraud.

IBM provides a data science platform called Watson Studio that supports fraud detection and prediction. Their platform leverages A.I. technologies like deep learning and neural network frameworks to improve fraud detection and prevention. It integrates with traditional accounting software and works in the background to analyze mountains of data.

Many financial institutions have incorporated A.I. and machine learning into fraud prevention strategies. These organizations use A.I. algorithms to analyze large volumes of economic data, detect anomalies, and identify potential fraudulent activities.

In the future, we expect a more significant role of AI in combating accounting fraud.

For instance, A.I. will analyze numerical data and the text in financial reports and communications, using natural language processing to detect subtle hints of fraud.

Furthermore, AI could be integrated with blockchain technology to create immutable and transparent financial records, making it even harder for fraudsters to manipulate data.

Limiting the Performance Incentives for Mismanagement

One of the most significant drivers for accounting fraud is meeting short-term performance metrics.

Whether to build a reputation as a high-performer or to achieve results that deliver promotions, bonuses, higher stock-option value, or other compensation, the root cause is the same.

Poorly defined performance metrics leave much room for decisions outside the enterprise’s best interest or manipulation.

Salespeople with pricing responsibility, incented to increase sales, may do so without regard to new business profitability.

Inventory managers tasked with reducing the value held may do so without regard to lost sales.

The simple reality is that poorly thought-out performance measures that affect people’s earnings create incentives for bad decisions.

Simply changing the performance metrics or balancing decisions between multiple individuals led to better choices and reduced opportunities for manipulation.

Separating pricing from selling helped. Similarly, creating two metrics, sales and a profitability measure, for the executive brings balance to the decision-making.

An inventory turns metric combined with a service level or lost sales metric brings balance.

Professor Robert S. Kaplan – Harvard University

Professor Robert S. Kaplan is a senior fellow and the Marvin Bower Professor of Leadership Development, Emeritus at Harvard Business School.

He has taught there since 1984.

In 1985 he and his co-author Robin Cooper published an influential paper outlining the Activity Based Costing (ABC) concept and methodology. This helps popularize ABC in practice.

I remember using some components of this approach to recast the economics of client operations in the 80s. They were usually surprised to learn that where they were making money differed from what they originally thought. Their scaling assumptions, volume-based pricing, and many other management decisions changed to reshape performance fundamentally.

In the ’90s, he and his co-author David Norton pioneered and published “The Balanced Scorecard—Measures that Drive Performance.”

There are a few key reasons why I have always loved balanced scorecards and why they are considered necessary for many organizations:

- They provide a more comprehensive view of performance beyond just financial metrics. Focusing solely on financials can promote short-term thinking. The balanced scorecard helps managers see leading indicators across other perspectives (customers, processes, people) that drive future financial performance.

- They align activities with strategy. The scorecard makes the connection between longer-term strategic goals and day-to-day actions explicit. This linkage enables better strategic follow-through.

- They communicate the strategy across the organization. The scorecard methodology helps executives communicate strategic priorities and show how different units and teams contribute.

- They enable the measurement of intangible assets. Intellectual capital, brand, culture, and employee capabilities are intangible but vital to strategic success. The balanced scorecard provides a framework for tracking performance in these areas.

- They facilitate organizational change. Developing balanced scorecards requires cross-functional coordination and helps organizations identify and overcome barriers to change.

- They provide leading indicators. By monitoring non-financial metrics, managers can gain insight into future opportunities or problems before fully materializing in the financial statements.

Balanced scorecards are genius and critical to limiting short-term manipulative thinking.

A word of caution – the long fight

The forces on the other side are enormous, powerful, innovative, well funded, and have access to many of the tools our knights are using.

Our regulators are slow. And when they make changes, there are often unintended consequences not considered.

Even when our tools work as expected, a significant force built on positive biases toward the companies keeps many detectives from going public with their findings.

We need more Abe Briloffs.

He wasn’t afraid to publish.

We need more Eisenman, Corcoran, Benford, Beneish, Kaplan, and other heroes (you won’t like this article’s size if I covered them all).

The coming battle for accounting integrity

As we stand on the brink of this new era, the future of artificial intelligence and data science in accounting shines brightly.

It promises a world where accounting misinformation is a thing of the past, and where the integrity of financial information is as solid as a diamond.

But, like any journey, there will be challenges.

In the fight against accounting misinformation, AI and data science are not just allies; in the hands of our accounting knights, they are game-changers.

They are a beacon of hope, illuminating the path toward a future of integrity and transparency in accounting.

So, here’s to our knights and wizards, accountants, and data scientists, working together to safeguard the world of finance.

The world owes you its gratitude for your work!

Details of The Beneish M-Score model

The following are the eight ratios, how you calculate them, and how they relate to the possibility of manipulation:

- Days Sales in Receivables Index (DSRI): A significant increase in receivable days might suggest accelerated revenue recognition to inflate profits.

- Gross Margin Index (GMI): A deteriorating gross margin is a worrisome indicator of a firm’s prospects and creates an incentive to inflate profits.

- Asset Quality Index (AQI): An increase in long-term assets (for example, the capitalization of costs), other than property plant and equipment, relative to total assets indicates that a firm has potentially increased its involvement in cost deferral to inflate profits.

- Sales Growth Index (SGI): High sales growth does not imply manipulation, but high-growth companies are more likely to commit financial fraud to maintain the facade of growth and elevated valuations.

- Depreciation (DEPI): A falling level of depreciation relative to net fixed assets raises the possibility that a firm has revised the estimated useful life of assets upwards or adopted a new method that is income increasing.

- Sales, General, and Administrative Expenses (SGAI): Analysts might interpret a disproportionate increase in SG&A relative to sales as a negative signal about a firm’s prospects, incentivizing profit inflation.

- Leverage Index (LVGI): Leverage is total debt relative to total assets. An increase in leverage creates an incentive to manipulate profits to meet debt covenants.

- Total Accruals to Total Assets (TATA): Total accruals are the change in working capital (other than cash) less depreciation relative to total assets. Accruals, or a portion thereof, reflect the extent to which managers make discretionary accounting choices to alter earnings. Therefore, a higher level of accruals is associated with a higher likelihood of profit manipulation.

You calculate the M-Score using the eight variables according to the following formula:

Beneish M-Score = -4.84 + 0.92*DSRI + 0.528*GMI + 0.404*AQI + 0.892*SGI + 0.115*DEPI – 0.172*SGAI + 4.679*TATA – 0.327*LVGI

Beneish concluded that profit manipulation was likely if a company scored greater than -2.22 (i.e., a less negative or positive number).

Indiana University has a free version of the Beneish M-Score Calculator on its website.

FAQs

What is accounting fraud?

Accounting fraud is the deliberate and deceptive manipulation of financial statements by individuals or companies to misrepresent their financial performance or deceive investors, shareholders, or other stakeholders.

What are some examples of accounting fraud?

Some well-known examples of accounting scandals include the WorldCom fraud, Lehman Brothers’ collapse, and the Austal USA accounting scandal.

The WorldCom fraud case involved false accounting entries that inflated the company’s assets by approximately $11 billion. By misrepresenting the financial statements, the company hid its declining revenue and deceived investors.

Similarly, Lehman Brothers employed creative accounting techniques and manipulated their financial statements to make the company appear financially stable, leading to one of the largest bankruptcies in history.

In the Austal USA accounting scandal, executives at Austal USA LLC, a defense contractor, were accused of an elaborate accounting fraud scheme. They were indicted for allegedly manipulating accounting estimates and inflating expenses to deceive the government and investors about the cost of building naval vessels. The scheme involved a combination of creative accounting, fraudulent financial reporting, and misrepresentation of financial records. Craig Perciavalle, the former CEO of Austal USA, was eventually charged with wire fraud, financial statement fraud, and related offenses under 18 USC.

These examples highlight the importance of forensic accounting and the role of certified fraud examiners and forensic accountants in uncovering such fraudulent activities.

How does accounting fraud occur?

Accounting fraud occurs when a company intentionally manipulates its financial statements by overstating revenues, understating expenses, hiding liabilities, or engaging in other fraudulent activities to misrepresent its actual economic position.

Who is responsible for detecting accounting fraud?

Detecting accounting fraud is a collective effort involving various parties. External Auditors and Internal Auditors are crucial in identifying and reporting potential fraudulent activities. Still, shareholders, regulators, and government agencies such as the Securities and Exchange Commission (SEC) and the Department of Justice also play a part in detecting and investigating accounting fraud.

What are the consequences of accounting fraud?

The consequences of accounting fraud can be severe. Perpetrators can face legal consequences, including hefty fines, years in prison, and damage to their personal and professional reputations. In addition, companies involved in accounting fraud often suffer financial losses, lawsuits, and damage to their shareholder trust.

How can accounting fraud be prevented?

Preventing accounting fraud requires a combination of strong internal controls, ethical accounting practices, and a proactive approach to detecting and addressing any potential fraudulent activities. Regular audits, independent oversight, and a culture of transparency and accountability within organizations can help deter and prevent accounting fraud.

What should I do if I suspect accounting fraud?

You must report your concerns to the appropriate authorities if you suspect accounting fraud. This may include notifying your company’s management, the internal audit department, or regulatory agencies such as the SEC or the Department of Justice. Whistleblower protection laws are in place to safeguard individuals who report suspected fraudulent activities.

What role do accounting professionals play in preventing and detecting accounting fraud?

Accounting professionals, such as auditors, certified public accountants (CPA), and accountants, have a crucial role in ensuring the integrity of financial reporting. They are responsible for conducting thorough audits and reviews of accounting records, identifying red flags or potential irregularities, and reporting suspicious activities. By upholding professional standards and ethics, accounting professionals can help prevent and detect accounting fraud. A Forensic accountant, certified fraud examiner, and other specialized accountants can also help with fraud examination or prevention.

Is accounting fraud a common occurrence?

While accounting fraud is uncommon, several recent high-profile accounting scandals have highlighted the importance of strong financial oversight and ethical accounting practices. These scandals have had far-reaching consequences, underscoring the need for vigilance and transparency in financial reporting.

Why is it essential to have a good accountant?

Having a good accountant is essential for several reasons. A competent and ethical accountant can ensure accurate and reliable financial reporting, help businesses comply with complex accounting standards and regulations, provide valuable financial insights and advice, and play a vital role in preventing and detecting accounting fraud. A good accountant can help safeguard a company’s financial integrity and contribute to its long-term success.

For Video Lovers – The Enron Story

Sources

Note: I have embedded sources throughout the document as I find them easier to use. If I have missed any, please drop me a comment, and I will fix it.

A Note on General Misinformation and Manipulation

I have noticed a common theme in much of my writing.

It may be a reflection of my career in transformation.

In several cases, managers misinterpret readily available data about a company’s prospects. In others, misguided managers manipulate the data.

The results? Missed opportunities or, in some cases, dire performance requiring a turn-around.

Data manipulation is easy.

The meaning of data, even solid data, can be manipulated to misinform.

Our government, the media, and others we should trust have all contributed to the epidemic of misinformation and manipulation.

It’s everywhere in daily life.

Medical advertisements manipulate you to influence your doctor, who has far more information than you do about the effectiveness of any treatment.

Purdue Pharma persuaded the FDC to make their drug sound less addictive than opioids. They misled talented, well-meaning doctors.

Food products advertised to sound healthier for you. Food isn’t healthy. People are, or not. A food product can be nutritious.

Celebrities and famous politicians hock products that they have yet to try themselves. Or for which there is little scientific support for their effectiveness.

What about politics? The environment? Culture wars?

I can go on, but you get the gist.

I like tackling misinformation and manipulation on these pages by discussing topical examples.

I will always recommend data-based rather than opinion-based work.

Whenever available, I will go to credible data sources and illustrate the case as simply and neutrally as possible.

The rest is up to you.

Please read some of my articles listed below and limit the impact of misinformation and manipulation in your lives.

- The Truth About How Media Is Misleading With Facts

- Combating Coronavirus Misinformation

- We must have a conversation about policing and racism in America

- Can You Differentiate Smart From Nonsense?

- Is a College degree really worth it?

- Why Are Facts Irrelevant To Online Analysts?

- Why You Will Lose Money If You Follow That Analyst

- Down With Doom

- Do You See What You Believe?